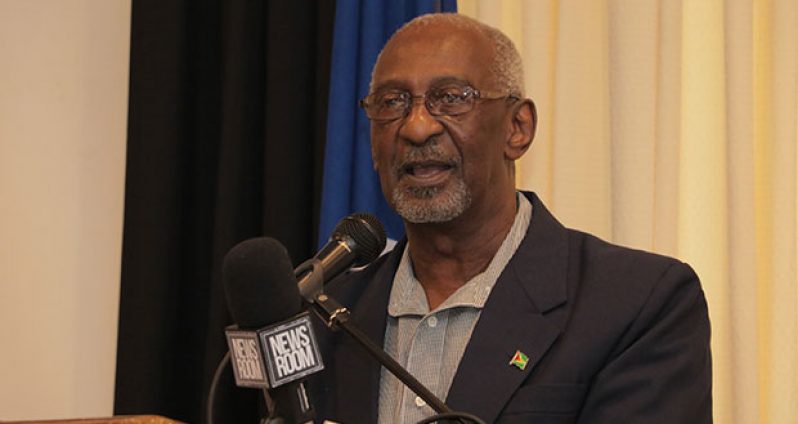

Keith Scott: Budget 2017 crafted to help capture tax cheats

MINISTER Keith Scott, the Minister within the Ministry of Social Protection, with responsibility for Labour, has praised the 2017 national budget as one which meets the scourge of tax evasion head-on through the introduction of tax reform and other measures in several areas.

The 2017 fiscal budget, to the tune of $250 billion, was presented on November 28 by Finance Minister Winston Jordan, in keeping with the theme “Building a diversified, green economy: delivering the good life to all Guyanese.” Critical reviews and debates started in the National Assembly on Monday, offering each Member of Parliament –- from both Government and Opposition parties — opportunities to comment.

Contributing to the debate, Minister Scott said tax evasion has been a major hindrance to economic development, and had become rampant under the Peoples Progressive Party/Civic regime in 2013. He said the budget this year introduces measures to curb the immoral trend and ensure, among other things, that more money is collected through taxation and more job creation.

Scott said the extent to which tax avoidance and tax evasion have impacted economic growth continues to inflict harm on the efficient management of the country, and the APNU+AFC Administration will no longer tolerated such.

EMPLOYMENT

The minister said Government is also not comfortable with the low rate of employment-creation realised this year, since underemployment leads to economic underperformance. “We are committed to sound economic planning, which must be driven by accurate and reliable data emanating from our statistical department, which, in conjunction with the Bureau of Statistics, has submitted that the unemployment level for the year is not comforting.

“Certainly, we are not proud of that, but more could have been achieved if the mischief of tax evasion and tax avoidance had not been so rampant,” Scott said.

Minister Scott said schemes and programmes have been deliberately concocted and initiated by some sectors of the local economy to prevent or limit employment-creation among youths in particular. Statistics prove the unemployment level to be discomforting, the minister said. He pointed out that his ministry, through its Central Recruitment and Manpower Agency (CRMA), has ensured employment for some 3122 persons, a figure reflecting 89% of the agency’s initial 2016 target of over 3500.

The budget also provides for a reduction in inequalities through a more even tax regime, and an increase in disposable income, which allows citizens to spend more and save more, Scott said. “In this regard, there is provision to increase the income tax threshold from $660,000 to $720,000 per annum. When we took office in 2015, that threshold was $600,000 per annum, but, within 18 months, we have effected a 20% increase,” Minister Scott said.

Scott said that while the provision releases more disposable income to employees, it also allows for the removal of 7600 persons from the tax register, giving them a greater opportunity to enjoy a good life.

Also, the budget reduces personal income tax by 2% for employees whose monthly earnings are below $180,000 or annual income below $2.16 million. Those employees will now pay personal income tax at a rate of 28% instead of 30%.

Minister Scott also praised the success of Finance Minister Winston Jordan in producing three national budgets in 18 months, setting a record in Guyana’s history and raising the monthly stipend for old age pensioners to $19,000, from $13,125; showing respect to the elderly with a 45% increase within 18 months. Another measure presented in the budget is the Restriction of Mortgage Interest Relief to loans up to $15 million, to relieve the burden of payment on mortgages for low-to-middle-income earners.

In the commercial sector, the prayers of manufacturers have been answered, Scott said, with the budget making possible a reduction in corporation tax from 30% to 27.5%. He said the 2.5% reduction now allows for manufacturers to become more competitive, pay better wages to their employees, and facilitate improved working condition.

“Mr. Speaker, it is projected that these measures will result in Government sacrificing a total of $752 million in tax, but it is a sacrifice we are prepared to make in favour of a good life,” Scott presented.

Scott also debated that new measures for tender compliance for Government contracts, where NIS and Income Tax certificates are prerequisites to participate in procurement processes, are intended to make more accessible the proverbial playing field, encouraging stakeholders to be more compliant with laws.

The introduction of these certificates, available at a cost of one thousand dollars ($1000.00), Scott said, indicates Government’s eagerness to do business. “The other compliance certificates, inclusive of the Trusted Trader Compliance Certificates and the Standard Income Tax and NIS Compliance Certificates, for relatively nominal fees, are intended to improve transparency and lead to a more equitable distribution of resources, as well as to make good corporate citizenship,” the Labour Minister said.

Minister Scott called the 2017 budget a “Christmas budget” with a lasting impact – one which offers joyful gifts to all sectors of society and all classes and ages of people. “It places the nation on the road to financial and economic prosperity in a clearly measurable and immediate way; but more so, its impact is one that will last for quite a long while in the future. It is a budget that will sustain,” Minister Scott said.