(Part 11)

PUBLIC DEBT ASSESSMENT

Sanzillo made the argument that despite the drawdown from the NRF Fund, Guyana’s public debt is climbing, and he further implies that the public debt levels will reach unsustainable levels.

Yet, in his ramblings and so called analysis, Sanzillo failed to demonstrate that he performed any thorough public debt sustainability analysis to support his wild and careless assertions. The below illustration which is an evidenced based analysis on Guyana’s total public debt, contradicts Sanzillo’s uninformed opinion on the state of Guyana’s public debt and debt management framework.

Total public debt stood at US$1.359 billion in 2012 which increased to US$3.127 billion by the end of 2021 representing an increase of 130% over this ten-year period, or an average annual growth rate of 13%. At the same time, real GDP moved from US$4 billion in 2012 to US$8.3 billion by the end of 2021 representing an increase of 115% over this period or an annual average growth rate of 11.5%.

During the period 2012 – 2021 the debt-to-GDP ratio was 34% in 2012 which further decreased below 30% in 2014 and remained below 30% up to 2018. During the period 2018 – 2020, the debt-to-GDP ratio reached its highest of 37%, 52% and 43%, respectively – higher than the period between 2013 – 2017, albeit below the 60% benchmark.

However, by the end of 2021 the debt-to-GDP ratio declined from its highest level of 52% in 2019 to 36%. In 2022 the debt-to-GDP ratio is forecast to reduce further from 36% to 28%. This is reflective of prudent debt management coupled with the expansion of the economy driven by the oil economy and the draw down from the NRF thereby reducing the level of borrowing.

Moreover, this outturn is indicative of the fiscal space available to support the economy’s aggressive development and expansionary agenda within the framework of a sustainable development model.

Furthermore, an examination of external debt-to-GDP ratio – that is, the foreign denominated public debt exclusive of domestic debt, represented 34% of GDP in 2012, which consistently reduced over the years relative to the growth of GDP, and is now forecasted at 12% of GDP for the fiscal year 2022 based on the projected GDP growth rate of 47% and external borrowings. This is the lowest external debt-to-GDP ratio in eleven years, and among the lowest in Latin America and the Caribbean region, if not the lowest in the world.

It is important to note that when performing assessment of the national debt, one cannot look at a single variable in isolation of others, for example, as Sanzillo did in his analysis, he only looked at the growth in national debt. This, however, does not tell the true story on whether the level of public debt is sustainable. The other macroeconomic variables that need to be considered in the analysis are the level of GDP growth, revenue, and debt service ratio.

The table below illustrates the level of growth of the abovementioned variables for the period 2011 – 2022(F), eleven years. The result tells a starkly contrasting story to Sanzillo’s.

Having examined the growth of the above indicators for the past eleven years (2012-2022F), though the figures for the fiscal year 2022 are the forecasted figures according to the National Budget, 2022; the average annual growth in total public debt is 15%, external debt 1%, GDP 20%, and revenue 18%. Clearly, the level of growth in revenue and GDP are greater than the average annual growth rates for total public debt and external debt.

With this in mind, given the low debt-to-GDP ratio as shown in the previous section, Guyana’s total public debt is well below the minimum sustainable benchmark. For example, the benchmark for the debt-to-GDP ratio is 60% which is considered fiscally sustainable, and this ratio for 2022 is less than 30%.

FISCAL DEFICIT

Sanzillo contended that the fiscal deficit should be closed according to some IMF report and he religiously used this report in his argument suggesting that the fiscal deficit is an adverse macroeconomic condition for Guyana. However, again, Sanzillo failed to perform any sound analysis on the country’s fiscal deficit position. To this end, in a developing economy context, like Guyana – moderate levels of fiscal deficit is a positive indicator and is necessary provided that it is to finance infrastructure development that will accommodate and boost future growth. This is especially the case for Guyana against the backdrop of Guyana’s immense development needs – where Guyana is considered a highly under-developed country owing to its historic, political and economic challenges.

With that in mind, the graph below highlights Guyana’s fiscal deficit position as a percentage of GDP for the period 2012– 2022.

According to the IMF standard, moderate levels of fiscal deficit relative to GDP are in the region of 3%-10% of GDP. Evidently, Guyana’s fiscal deficit position for the period 2012 – 2022(F) is well within this range. For the year 2022 fiscal deficit is forecasted at 3.7% of GDP. The highest fiscal deficit during this period were in the fiscal years 2020 and 2021 of 6.04% and 6.74% respectively, still below the 10% benchmark, and was due to the impact of the COVID-19 pandemic. As such, budgets 2020 and 2021 allocated substantial resources to help cushion the impact and revamp the economy. Therefore, in this situation, this level of fiscal deficit was very necessary and well justified in the circumstance – while remaining, nonetheless, below 10% of GDP.

Having said that, if one were to look at countries like the United States, China and India, these countries also are managed on fiscal deficits. In 2020, the United States fiscal deficit stood at 15.2% of GDP, the highest level since 1945, China’s 2022 fiscal deficit is projected at 2.8% and India is projected at 6.9% in 2022, and the United States is projected at 4.2% of GDP for 2022.

It is worthwhile to note, too, that the average fiscal deficit for the Latin America and the Caribbean in 2020, even before the crisis, was 9% of GDP, according to an Inter-American Development Bank (IADB) report. Moreover, the median fiscal deficit forecast for the fiscal year 2022 for the Latin America and the Caribbean region is around 4.6% of GDP. Hence, it is important to highlight that Guyana’s fiscal deficit forecast for 2022 is well below the regional average and well within the minimum sustainable benchmark.

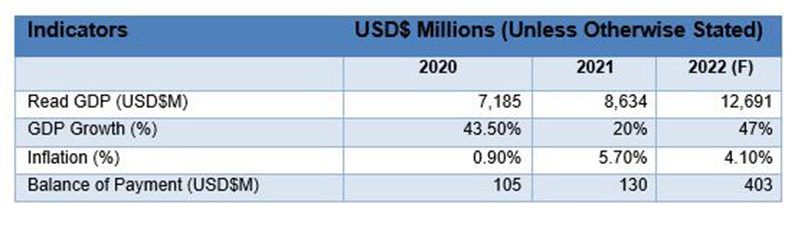

KEY MACROECONOMIC INDICATORS

The key macroeconomic indicators highlighted in the table above demonstrates a relatively strong and stable macro-economic environment, a prerequisite condition conducive to attract and stimulate increased levels of investments within the economy.

CONCLUDING REMARKS

The findings of the analysis contained herein quite evidently debunked the contentions put forward by Tom Sanzillo of the IEEFA. Clearly, Sanzillo does not appreciate the need to perform robust evidenced based analyses to inform his opinion. The analysis therein (by Tom Sanzillo) is, therefore, highly misleading.

Furthermore, Guyana’s national debt and fiscal deficit positions are at its strongest levels and considered sound from a macroeconomic stability standpoint.

In terms of saving oil revenues in the NRF fund for future generation, it is imperative, given Guyana’s economic development needs: the need to accelerate development, that a significant portion of the resource are invested at the very outset. Thus, as production levels are ramped up and development cost recovered, the NRF Fund balance will grow substantially and towards the end of the decade there will be sufficient sums available to save for future generations. At this point, the country needs to invest in the infrastructure development among many other development needs for the future generation as well.

.jpg)