Eco (Atlantic) Oil & Gas Ltd. (Eco Atlantic) has raised its oil estimate in the Orinduik block offshore Guyana to over 5.1 million barrels of oil equivalent, representing a 29 per cent increase in Gross Prospective Resources.

In a new Competent Persons Resource report on the block released on Monday, Co-founder and Chief Operating Officer (COO) of Eco Atlantic, Colin Kinley said that this is due to momentum gained from recent discoveries. The company’s previous estimate in March 2019 stood at 3.9 million barrels of oil equivalent (MMBOE).

Meanwhile, 22 prospects have been identified on Orinduik Block including 11 leads in the Upper Cretaceous horizon. Two targets in the Cretaceous horizon — Amaila/Kumaka and Iatuk-D —- are identified as having in excess of 725 MMBOE each. Eco Atlantic stated that the majority of the project leads have over a 30 per cent or better chance of success, enhanced by the recent discovery of light oil on the Kanuku block to the south of Orinduik.

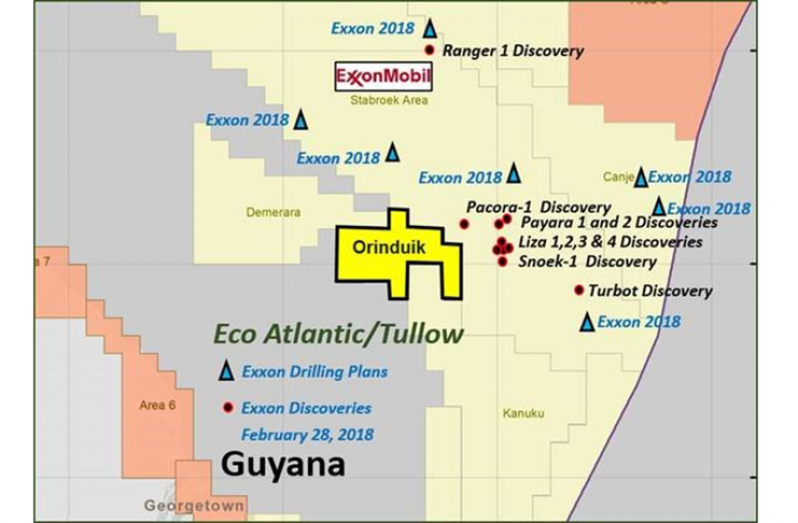

Kinley said that the positive outlook has also been driven by the discoveries of over 8 billion barrels of oil immediately East of the block by ExxonMobil. “The Cretaceous pathway of lighter weight oils from the source kitchen to the north, through the Liza sands and through the recent discovery of light oil in Carapa-1 to the south confirms our theory and interpretation of transmission of high-quality oil across the Cretaceous sand channels and traps within the Orinduik Block,” Kinley said.

“Significant exploration potential is what brought us into Guyana before the first barrel was discovered by ExxonMobil. The elements are all here. We know that the geology and the geography support us and we have a great team to fine tune the next drilling targets.”

The joint venture partners in the Orinduik Block are Eco Atlantic with a 15 per cent working interest; Tullow Guyana B.V., the Operator, with a 60 per cent working interest and Total E&P Guyana B.V. with a 25 per cent working interest. Kinley stated that as it defines its targets with its partners on the block, options will be considered to drill as soon as “practically possible.”

Eco Atlantic itself reported that it has a robust cash position with over US $20 million cash and cash equivalents as at 30th September 2019, and is fully funded for its share of further appraisal and exploration drilling at Orinduik of up to US$120m (gross). Back in November 2019, initial analysis of the oil discovered in the Jethro-1 well and the Joe-1 well in the Orinduik block found that the finds are heavy crude with high sulphur content unlike the preferred light, low sulfur crude found in the Liza field.

However, Kinley explained: “Heavy oil is more challenging to produce than conventional lighter oils, but remains a marketable hydrocarbon with increasing demand world-wide, as other heavy oil resources have dropped offline. Interpretation of this pay has continued and has seen material growth in the interpreted resources. The Company is conducting in-depth evaluation of the economics of this play, with independent third party economic advisory support.”

Tullow, Total and Eco Atlantic have an Operations Committee meeting scheduled in early February 2020 to evaluate recent drilling results, define drilling targets, and consider the budgets and dates for future drilling.

.jpg)