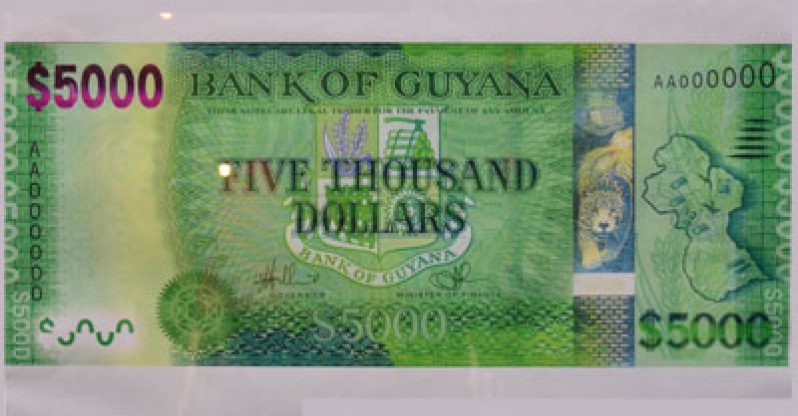

– The new $5,000 bill goes into circulation on December 9

THE introduction of the $5,000 bill is not expected to fuel inflation or higher prices but the law should be amended to cater for the minimum transaction using the new bill.These were the views of the Georgetown Chamber of Commerce and Industry (GCCI) which indicated in a statement that the Chamber does not envisage inflationary pressures or increases as a result of the introduction of the new denomination.

The new $5,000 bill goes into circulation on December 9.

While the GCCI acknowledged that the $5,000 bill would help with large transactions by companies and individuals, it however wants the law activated or amended to state the minimum transaction for which the note should be accepted.

The body noted that the only inconvenience envisaged is the use of the $5,000 notes to carry out small transactions that would require vendors offering a good or service to provide many smaller notes in return as “change.”

And as expected minibus conductors and vendors are expressing concern about the burden that the new note would bring to their business.

The GCCI is suggesting that the Central Bank issue an advisory, if permitted by law, on a minimum amount during a transaction where a $5,000 note can be tendered.

On the issue of inflation, the GCCI has informed that they are relying on assurances by Bank of Guyana Governor Lawrence Williams back in 2012 that the new note was not intended to increase Guyana’s money supply but rather shift the dependency from the $1,000 note to the new, larger $5,000 denomination.

The Chamber recalled that Williams had informed that international standards and principles usually dictate that the highest currency denomination usually account for around 20 per cent of total currency notes or 60 per cent of the total value of money in circulation.

In Guyana’s case, the $1,000 note at the time accounted for 59 per cent of the quantity of currency notes in circulation and around 94 per cent of the total value of money in circulation.

Also, on that occasion, Mr. Williams posited that from an historical context inflation decreased when larger notes were introduced into the economy.

LOWER PRINTING COSTS

The Governor, the Chamber noted, had also advised that significant savings will accrue as a result of lower printing costs for notes. According to the Governor, it costs the Central Bank between $600 million and $700 million to print current notes and the new $5,000 would reduce the volume of notes being printed.

.jpg)