– Set sights on new discoveries, development

PRESIDENT of ExxonMobil Guyana Limited, Alistair Routledge, has announced that the company has recovered US$19 billion out of its US$29 billion spent on the Stabroek Block so far.

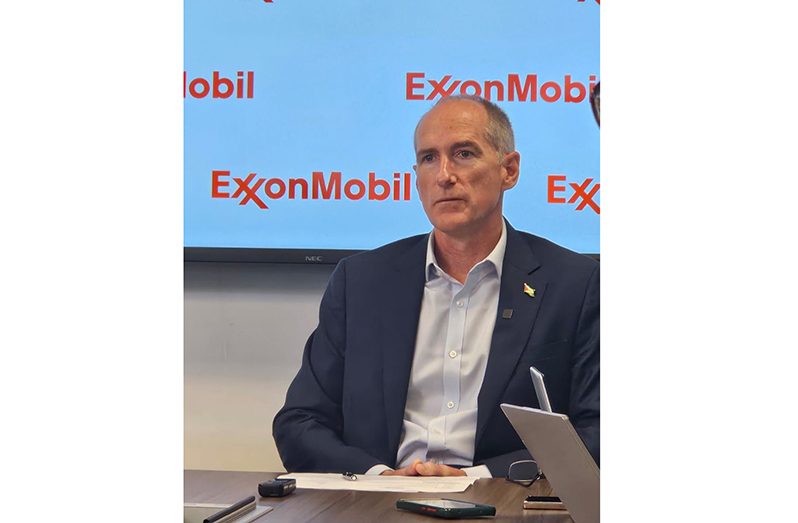

During a press conference at the company’s Georgetown headquarters, on Tuesday, Routledge provided a comprehensive update on the company’s financial commitments and future plans in Guyana.

Under the terms of the Production Sharing Agreements with ExxonMobil Hess, Guyana receives a 2 per cent royalty on pre-cost revenues and 50 per cent of profits, with a 75 per cent cap on revenues used for cost recovery.

This arrangement has allowed Guyana to earn over US$1 billion so far. While costs are still being recovered, Guyana’s government typically sees about 52 per cent of profits, equivalent to 14.5 per cent of total revenues.

As cost recovery completes, Guyana’s share of revenues will increase from 14.5 per cent to nearly 52%, significantly boosting the country’s income from its oil resources.

Since beginning operations in 2018, ExxonMobil and HESS have made a substantial investment in the country, with Routledge detailing the figures involved.

“To date, on a total basis, we [ExxonMobil & Hess] have invested US$29 billion,” he stated, emphasising the combined efforts of ExxonMobil and Hess in financing this venture.

This investment, he explained, encompasses not only the capital expenditures but also the operational costs of running their facilities daily.

Out of the $29 billion invested, the company has recouped approximately $19 billion, leaving an outstanding cost of $10 billion.

“So, the amount of money that we’re still financing we’ve made available in order to run these operations and grow the business here. The outstanding amount is $10 Billion US,” Routledge explained, highlighting the scale of the investment relative to Guyana’s national budget, which nearly doubles.

He further commented on the commitment this represents from the company to the country’s economic development.

Routledge also discussed the factors influencing the pace of cost recovery, which includes the revenue from increasing production levels and the unpredictable nature of oil prices.

Despite the uncertainties, he projected optimism about the company’s financial trajectory.

“In a reasonable range of prices, even as early as 2026 to 2027, we will no longer need the full 75 per cent of that limit; we will no longer be cost recovering… And so more and more of the revenue from crude sales will go back to profit,” he remarked, indicating a significant shift towards profitability in the near future.

This financial overview comes as ExxonMobil Guyana Limited continues to exceed expectations in oil production.

With a current daily output of 645,000 barrels of oil, the company has surpassed its initial targets.

The operations are spread across three floating, production, storage, and offloading (FPSO) facilities – Liza Destiny, Liza Unity, and Prosperity – all of which are operating beyond their nameplate capacities.

The year-end goal is to reach a total cumulative output of 500 million barrels, marking a major milestone for Guyana since the start-up in the Stabroek Block five years ago.

Also on the front burner, ExxonMobil is gearing up this year for an ambitious exploration and appraisal campaign in the offshore Stabroek Block, with plans to drill at least seven wells this year.t

Routledge explained that the focus is not only on expanding oil discoveries but also on understanding the natural gas potential within the block, especially in areas west of the Essequibo River.

These exploration efforts would include drilling two wells in the less-explored western portion of the Stabroek Block, named the Redmouth and Trumpetfish wells.

This initiative, part of what the company describes as “anchor hunting,” aims to uncover new commercially viable resources.

Routledge emphasised the company’s strategic plan to explore potential new reserves, noting that if these wells yield commercially viable resources, it could prompt the drilling of more wells in the vicinity.

The majority of ExxonMobil’s discoveries in the Stabroek Block have been in the central and eastern areas, with significant projects like Liza and Payara drawing close proximity.

However, this year’s exploration and appraisal focus is twofold, with five of the seven wells intended to assess the quantity and usability of natural gas reserves found towards the eastern part of the block, extending towards Suriname.

Routledge detailed the exploration goals, mentioning from memory that the plan involves drilling approximately five wells this year, covering both exploration and appraisal.

The aim is to identify potential resource locations and gather dynamic data from the reservoirs to assess their productivity.

This exploration push comes as the government expresses a keen interest in rapidly developing and monetizing the country’s natural gas assets.

Plans are already underway to transport approximately 50 million standard cubic feet of gas per day from the Liza project to power a plant at the Wales gas-to-energy project, which is expected to significantly reduce electricity costs across Guyana.

Routledge updated on the progress of the infrastructure required to support this vision, noting that about 40 per cent of the onshore pipeline laying is complete, with the offshore portion approximately 55 per cent finished.

He anticipates the entire pipeline being ready to introduce gas onshore by the end of the year, pending coordination with Guyanese officials for the connection of onshore facilities to the pipeline

.jpg)