Key Highlights…

BY and large, the IMF country report on Guyana presented an accurate assessment of the macroeconomic conditions of the country, considering the political landscape in 2020, the fiscal and monetary policy framework administered by the current Government, and the favourable outcomes obtained as a result.

More so, the assessment is largely consistent with previous assessments conducted over the past two years, and more recently on the mid-year performance for 2022 by this author/SPHEREX Analytics.

FISCAL POLICY

The report noted that the “fiscal policy in 2022 has been appropriately supporting growth, while considerably reducing the fiscal deficit”. The report also highlighted the notable reduction in current expenditure relative to non-oil GDP compared to 2021.”

SPHEREX ANALYTICS’ COMMENTS

In the Budget 2022 review and analysis conducted and published by this author, a trend analysis of the allocation of public expenditure (current and capital relative to total expenditure) was performed. The results showed the substantial increases in current expenditure by the previous Administration during the period 2015 – 2019 and reduction in capital expenditure. This manner of misallocation of public finances that increased expenditure on non-productive areas would have necessitated an unsustainable fiscal framework and laid the foundation for an economic disaster. Budgets 2020, 2021 and 2022, however, were then reoriented by the current Administration to its pre-2015 trend where more resources were expended on capital projects that would ultimately create more value for the economy and its people in the long term. Additionally, during the period 2015 – 2019, budget allocations towards the economic sectors declined by 10.32 per cent in 2016 and 27 per cent in 2019, thus, resulting in the underperformance of some of the major economic sectors during this period. This trend changed in 2020 where allocations towards the economic sectors increased by 24.46 per cent in 2020, 25.31 per cent in 2021 and 27 per cent in 2022.

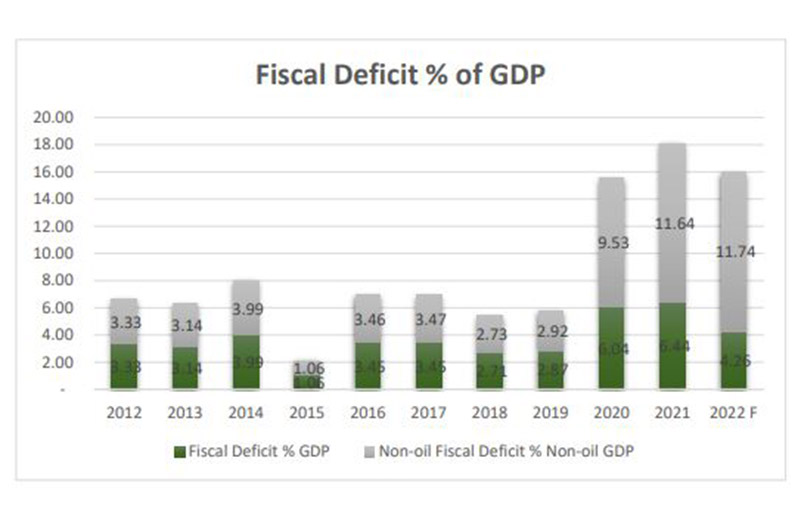

The overall fiscal deficit from 2012 through 2019 remained below four per cent and increased to just over six per cent in 2020 and 2021. This level of increase was necessary owing to the COVID-19 pandemic where the government had to roll out a comprehensive rescue package to confront the economic impact therefrom to avoid any major adverse impact and further decline in economic activity.

The fiscal deficit position is forecast to improve by the end of 2022 by 2.18 percentage points to 4.26 per cent of GDP. As a rule of thumb, a fiscal deficit of around 10 per cent of GDP is considered moderate, and as shown in the analysis, Guyana’s overall fiscal deficit is well below this benchmark. The non-oil fiscal deficit is just over 11 per cent in 2021 and 2022 which will improve in the medium term. Again, this outcome was as a result of the measures in response to the rising cost of living and rescue packages implemented by the government to address the effects of the COVID-19 pandemic, to both the household level and firms.

In these respects, the estimated impact of the cost-of-living measures and interventions implemented by the government is almost equivalent to 100 per cent of the oil revenues in profit and royalties earned as of July 2022. Using conservative estimates in an attempt to quantify the impact of the cost of living (COL) measures and interventions by the government on the economy, cumulatively for the period 2021 – 2022, amounted to approximately $226 billion, representing 96 per cent of the total NRF balance to date from the inception of oil production.

The report noted that “Guyana’s debt sustainability analysis (DSA) indicates that risk of external debt distress remains moderate, with debt dynamics improving significantly with incoming oil revenues, with debt dynamics improving significantly with incoming oil revenues. Guyana’s debt carrying capacity, for both overall public debt and public external debt, has been downgraded from ‘moderate’ to ‘weak,’ reflecting a relatively low international reserves-to-imports cover in 2022 that is driven by a sharp increase in oil-related imports. Nevertheless, Guyana still has substantial space to absorb shocks, reflecting the current low level of external debt, a rapid expected increase in international reserves, and accumulation of savings in the NRF over the medium term. Furthermore, Guyana’s level of international reserves is expected to remain above adequate levels in terms of short-term debt, broad money, and non-oil related imports.”

SPHEREX ANALYTICS’ COMMENTS

In the review and analysis of the mid-year performance for 2022 report conducted and published by this author and published in early September 2022, it was shown that the level of public debt is within sustainable levels with low to moderate default risk. The debt-to GDP ratio is an estimated 29 per cent for the first half of FY 2022 and the non-oil debt to GDP ratio is an estimated 63 per cent for the period. Both of these ratios indicate that the level of public debt is relatively low to moderate in terms of the risk of default and that the level of public debt is within sustainable levels. The Government must be commended for this type of prudent public debt management by restricting the temptation to borrow excessively against future oil revenue. The external debtto-GDP ratio remained low at 16 per cent as of the end of 2021 and based on the 2022 forecast, an estimated 10 per cent by the end of 2022.

The IMF also recognized the unreported overdraft balances at the Bank of Guyana during the period 2015 – 2020 where the previous Administration racked up an overdraft of about $100 billion in the government deposit accounts that was never part of the official stock of domestic debt. The current Administration has since corrected this situation where the overdraft balances were cleared and added to the stock of domestic debt. Hence, should this overdraft amount be excluded from the stock of debt of $100 billion, the non-oil debt to GDP ratio would have been around 54 per cent and overall debt to GDP ratio below 29 per cent.

MONETARY AND EXCHANGE RATE POLICY

The IMF noted that “given the expected continued tightening of the U.S. monetary policy, monetary policy in Guyana also needs to be tightened, to maintain exchange rate stability. In addition, monetary policy will need to contain inflationary pressures due to elevated international commodity prices, the recovery in domestic economic activity, and higher government spending. Staff suggested deploying a combination of instruments to curb the growth of monetary aggregates, including raising the reserve requirement rate and expanding the sale of Treasury bills to contain excess liquidity.” In addition, “the exchange rate should continue to serve as the nominal anchor, along with increased efforts to deepen the domestic financial markets.”

SPHEREX ANALYTICS’ COMMENTS

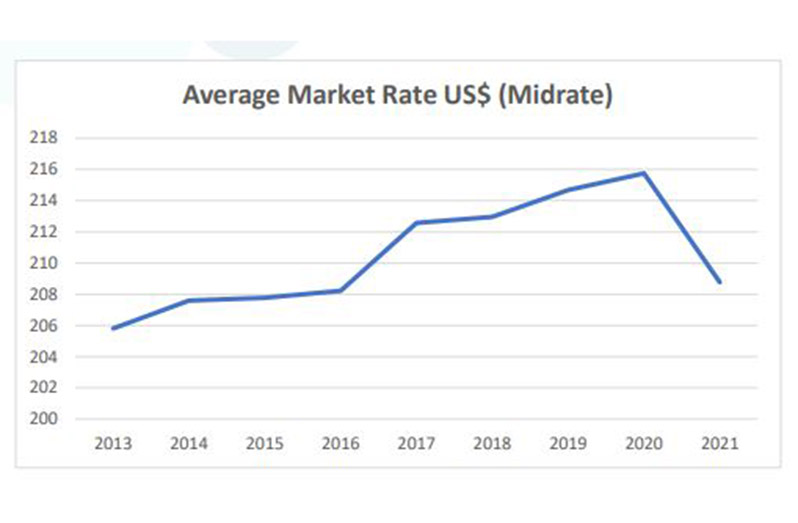

The exchange rate appreciated marginally by 0.91 per cent from $208.8 for the first half year period in FY 2021 to $206.9 for the first half year period FY 2022. The Bank of Guyana foreign exchange (FX) reserve balance which stood at US$711 million for the period ended January – June 2022, represented 2.46 months import cover. The FX reserve weakened steadily during the period 2015 through 2020 in terms of its equivalency relative to the minimum requirement of import cover – that is, three months’ worth of import cover. In 2009 the FX reserve represented 5.79 months of import cover, six months import cover in 2010, five months import cover in 2011 – 2013, more than four months import cover in 2014 and close to five months import cover up to 2016. From 2017 – 2020 the FX reserve started to weaken below 4.5 months of import cover down to 3.4 months import cover in 2018, 1.7 months import cover in 2019 and 2.2 months import cover in 2020.

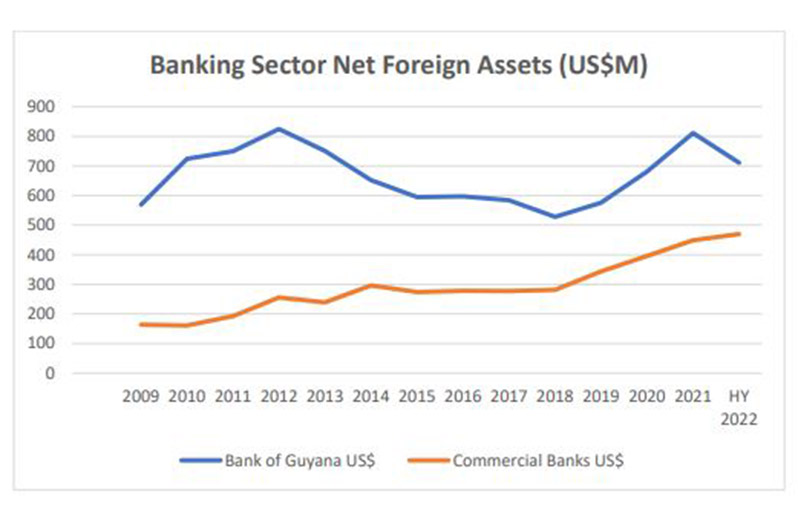

Despite this, the exchange rate remained stable because fortunately, the net foreign assets (NFA) of the commercial banks (which are the dominant players in the FX market) experienced dramatic increases during the twelve years’ period spanning 2009 to 2021 and thus remained strong. In this respect, while the Bank of Guyana FX reserves increased by 43 per cent over this period from its 2009 position of US$569 million to US$811 million by the end of 2021; the commercial banks NFA increased by 174 per cent from US$164 million in 2009 to US$449 million by the end of 2021. This outturn is largely due to increased foreign direct investments, growth in the private sector FX balances, and growth in overseas investments by the local financial institutions.

Moreover, it is noteworthy to mention that owing to the poor economic management of the economy and bad policies during the period 2015 – 2019, have resulted in the cumulative loss of productive output in the sugar, forestry, fishing, bauxite, manufacturing and wholesale and retail trade subsectors together with the cumulative loss of export earnings of a number of key commodities (as shown the midyear review and analysis report by this author), during the period 2009 – 2014 relative to the corresponding period 2015 – 2020, amounted to a whopping $238.7 billion or US$1.14 billion. Put differently, under the stewardship of the previous Administration, a number of key productive sectors and export earnings declined by US$1.14 billion cumulatively. This amount represents 36 per cent of the total stock of public debt, 1.5 times the Bank of Guyana FX reserves and more than one year’s equivalent of oil revenue in both profit oil and royalties. Evidently, this situation is the primary cause for the weakened position of the FX reserve relative to the import cover, otherwise, the FX reserve would have remained above 3-4 months import cover.

OUTLOOK AND RISKS

The IMF is of the view that: –

Guyana’s medium-term outlook is very favorable, with increasing oil production having the potential to transform profoundly Guyana’s economy; public investment spending is expected to increase in the medium term, to close infrastructure gaps and to support development needs, helping growth in the non-oil economy; the external outlook is expected to recover strongly, with revenues from oil production providing substantial buffers; Guyana’s debt-sustainability analysis (DSA) indicates that the risk of external debt distress remains moderate; and Guyana’s medium-term outlook is subject to both downside and upside risks. On the downside, highly volatile oil prices, the slowing global economy, and the war in Ukraine (which could result in escalating sanctions and other disruptions, leading to even higher commodity prices) could adversely affect growth and fiscal performance, especially if the global economy enters a recession, leading to a reduction in oil demand and oil prices. New outbreaks of Covid could weaken growth. An excessively rapid increase in government spending could subject Guyana to appreciation pressures on the real exchange rate and an eventual loss in reserves, and possible governance concerns. At the same time, further oil discoveries and production could significantly improve Guyana’s long-term economic prospects.

SPHEREX ANALYTICS’ COMMENTS

The IMF’s medium-term outlook is consistent with the development trajectory of the country given the ambitious development agenda of the Government. At the same time, the government has adopted a prudent fiscal policy approach in its pursuit of the development goals set out over the medium to long term. To this end, there is more than adequate fiscal space to support the government’s economic development and diversification programme at the current pace of development, while maintaining a prudential macroeconomic stability framework. With respect to the downside risks, the government has so far taken a hands-on approach to proactively manage and contain these risks from spiraling out of control, for example, investing heavily in the non-oil sectors, thereby avoiding the Dutch disease phenomenon, and a sharp appreciation of the domestic currency against the U.S dollar. In addition, the authorities have managed to keep inflationary pressures contained, in the mid-single digits range, while the rest of the world in some cases have been experiencing double digit inflation.

THE IMF’S KEY POLICY RECOMMENDATIONS

1) Implement a feasible and moderate increase in capital spending to address social development needs and infrastructure gaps and avoid macroeconomic imbalances. 2) Set budgets within a fiscal framework that, over the medium term, maintains zero overall fiscal balance to anchor fiscal policy in a sustainable way. 3) Develop and deepen the markets needed to support a move towards greater exchange rate flexibility over the medium to long term. 4) Structural reforms to support inclusive growth – including through labour market reforms– and strengthen climate change policy framework.

SPHEREX ANALYTICS’ COMMENTS

1)While budget 2022 represented an increase of 109 per cent towards capital expenditure compared to 2021, this was necessary for three major reasons as follows: a) Budget 2022 is first budget the Administration sought to drawdown the first set of funds from the NRF to finance the government’s development programme. b) The budget had to be reoriented as explained earlier, wherein, the country was deprived of adequate investment in capital projects for the preceding five years period (2015 – 2020). c) Owing to the inherent challenges in the political landscape since 2011 – 2020, Guyana has largely been deprived of major developments, thus, there is more than a decade of economic development setback. This, coupled with the impact of the externalities stemming from a series of global turmoil currently on the domestic and regional economy, it has become more urgent than ever before, for the country to accelerate its development needs while solving the many development challenges that have been largely unresolved for more than two decades.

Notwithstanding (c) above, the government is on a path of rebuilding the macroeconomic fundamentals and in view of the IMF’s and this author’s assessment of the macroeconomic conditions, there is sufficient fiscal space while maintaining other stable macroeconomic indicators to pursue these (development) goals.

More so, with these in mind, future budgets are unlikely to have substantial increases of over 100% towards capital projects as has been the case with the 2022 budget, which was necessary and well justified in the circumstance.

2) In view of the explanations outlined in 1 (a) – (d) above, the current fiscal deficit is well below the minimum benchmark and while it is prudent to ensure a tight fiscal policy framework is maintained, for the reasons stated above, it is also critical to ensure that there is room for flexibility in the fiscal policy framework to be able to respond to external shocks while balancing the development needs and creating prosperity of the country and its people. Therefore, there is no need for a zero overall fiscal balance as proposed by the IMF at this time neither will this auger well for the country in the medium term. The government needs to maintain the current fiscal trend albeit gradually strengthening while leaving room for “fiscal policy flexibility”.

3) There is need for capital market deepening which would necessitate certain amendments to the legal and regulatory framework, and the development of secondary market. These changes, however, which are inevitable need to be followed by a simultaneous paradigm shift in the market behavior.

4) The structural reforms proposed by the IMF are already being undertaken by the government, inter alia, an updated labour market study, the examination of an immigration policy framework, accessibility and affordability of education (scholarships and free tertiary education by 2025) as well as curriculum review etc., and the updated Low Carbon Development Strategy (LCDS) among others.

References

https://www.imf.org/en/Publications/CR/Issues/2022/09/27/Guyana-2022-Article-IV-Consultation-Press-Release-Staff-Report-and-Statement-by-the-523930.

Review and Analysis of the Mid-Year 2022 Economic Performance:

Review and Analysis of the Mid-Year 2022 Economic Performance:

Review and Analysis of the Mid-Year 2022 Economic Performance…

Budget 2022 lays the foundation to avoid the paradoxical resource curse and the Dutch disease

https://www.linkedin.com/posts/joel-bhagwandin-57481470_budget-2022-review-analysis-activity-6897627254843670528-rFyW?utm_source=share&utm_medium=member_desktop

.jpg)