A Contextual Analysis of the Public Sector Wage Increase

Growth/Expansionary Philosophies of the Tax Base: Vertical Versus Horizontal Growth

SINCE Independence, Guyana has only had two governments. Both governments have fundamentally different political ideologies and economic philosophies altogether. The economic philosophy of the Administration of the day, essentially serves as the guiding principle of the economic policies that it implements.

To this end, the economic philosophy of the current Administration is quite clear wherein the regime pride itself as a business-friendly government, while the other (previous) regime, is the opposite.

This is where the author describes these two different philosophies in terms of the growth/expansion of the tax base (current revenue), as one being the vertical approach and the other, the horizontal approach. In the vertical approach, which is the non-business friendly policies (increased level of taxation, increasing the tax burden not only for the business sector but also the household), is economically detrimental in the long term, while the horizontal approach (more business-friendly policies, less tax burden) is the economically sustainable option to grow the organic tax/revenue base of the government.

These assertions are evidenced by Guyana’s own political and economic history where, in the pre-1992 era, under the previous regime (vertical approach) Guyana moved from one of the most thriving economies in the region to a bankrupt State. This was followed by the implementation of the IMF’s economic reform programme, the birth of the private sector in 1992, and with significant debt forgiveness / debt write-offs brokered under the current Vice President during his tenure as Finance Minister and President, in the early and mid-90s, have significantly contributed to where Guyana is today, economically. Guyana graduated from a less than US$200 million economy from the early 90s era and a per capita income of less than US$200–to GDP of US$4 billion by the end of 2019 (pre-oil production), representing 1900% GDP growth and over 2000% growth in per capita income in just over two decades (the horizontal growth approach).

The above discussion points to historic evidence to support the argument put forward by the author on the vertical growth method versus the horizontal approach.

Further, let’s examine some other empirical evidence, drawing from data in the banking sector for the period 2007–2020, the past thirteen years.

The author is contending that in the previous regime’s economic philosophy, described as the vertical approach in which the tax burden on companies and households are heavily increased, eventually another 10 – 15 years of this continued approach would have eventually resulted in the detriment of the private sector or all enterprises operating within the productive sectors of the economy.

The State, in turn, would not be able to collect sufficient taxes to service its national debt, pay wages, cover other recurrent expenditure and capital expenditure on developmental projects. To test this theory further, an examination of the private sector deposits in the banking sector was conducted and the empirical evidence are as follows:

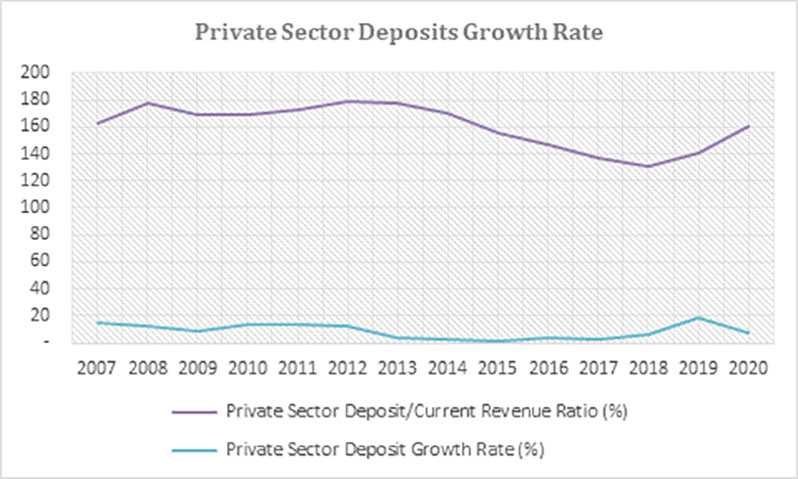

The author performed an analysis of the private sector deposit to current revenue ratio and the growth rate of private sector deposits in the banking sector over a period of time. The reason for selecting this ratio is because, normally, companies pay corporation taxes in quarterly installments, PAYE is also remitted to the tax authorities on a monthly basis and the other taxes incurred on transactions such as customs duty etc., are paid within the fiscal year. As such, it is safe to use the deposits held in the banking sector which would be reflective of cash in the bank after most of the companies’ tax liabilities have been paid over to the tax authorities for the fiscal year.

The story that the private sector deposits to current revenue ratio tells is essentially how much cash/profit companies have left after paying their tax liabilities. From looking at this ratio for the period 2007-2014, the ratio averages 1.72 or 172% while for the period 2015 -2019, the ratio averaged 1.42 or 142%, 30 percentage points lower. Notably, however, in 2020, with the immediate fiscal measures implemented in budget 2020, this ratio went up back to 1.6 or 160%.

A simple way to interpret the findings of this ratio is: for the period 2007-2017 where the ratio averaged 1.72, it means that on every dollar of taxes paid by the private sector, private sector firms had 1.72 or close to $2 remaining. So, for the period 2014-2019, the lowest ratio of 137% means that on every dollar of taxes paid by firms, they had $1.3 remaining, less than the $2 dollar in the period that experienced horizontal growth versus vertical growth.

Additionally, looking at the growth rate of private sector deposits in the banking system, it tells virtually the same story. From looking at the graph, private sector deposit growth rate for the period 2007-2014 (horizontal growth) averages 14% while in the period 2015-2019 (vertical growth) averaged a low of 3%. As such, this is another piece of empirical evidence that validates the argument that vertical growth is detrimental in the long term – and can potentially lead to bankruptcy of the State, while horizontal is more broad-based, sustainable, and viable in the long term– and can result ultimately in greater prosperity of the country, for its people, private enterprises, and the overall economy.

Interestingly, just for comparison, the author conducted similar analysis for the same period for Trinidad & Tobago, and it was found that in Trinidad, every dollar of taxes paid by firms, companies had $4 dollars remaining. That means Trinidad & Tobago private sector deposit to current revenue ratio averaged around 400%. Put differently, it can be said that the average Trinidadian company is four times richer than the average Guyanese company. Hence, the higher this ratio, lesser the tax burden on firms, thus firms having more capital at their disposal for expansion of their existing operations and new investments. In the process of doing so, more employment is created by the private sector, firms declare more profits and in turn pay more taxes generally (PAYE, corporate income taxes, VAT & Excise etc.).

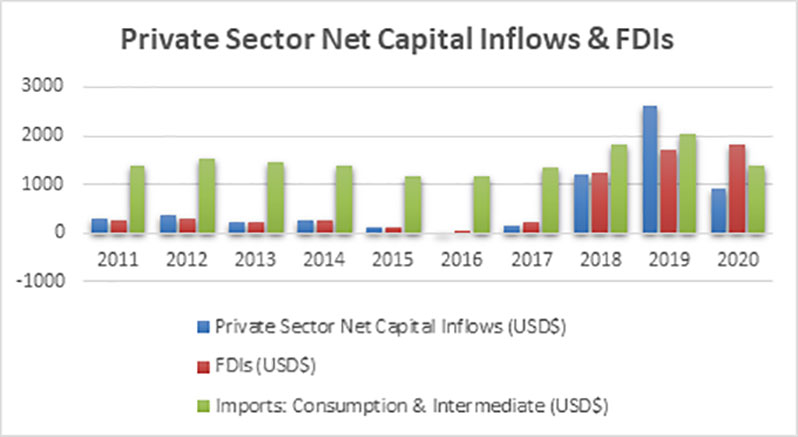

The counter argument that opponents may want to put forward is that this selected ratio is perhaps not 100% accurate because there is a notion that private sector deposits in the bank is not reflective of their deposits in offshore banks or out of the jurisdiction. However, the evidence would quickly dismantle such an argument because if one were to look at the balance of payment account for the period 2007-2020 there has been no substantial capital outflows by the private sector. In fact, the net capital flow position of the private sector exclusive of FDIs is a net inflow position. Which means, the local private sector, during this period would have obtained financing from external sources – that is outside of the local capital market.

Another counter argument that the former finance minister could contend, which he usually boasts of, is the fact that during his tenure as finance minister in the period 2015-2020, the previous regime reduced the corporate tax from 30% to 27.5% or by 2.5 percentage points. Yet, during the same period, the previous regime added 14% VAT on water and electricity (two items that never attracted VAT previously).

Effectively, these two items would amount to 28% additional tax burden on the operating cost for companies despite the reduction by 2.5 percentage points in corporate tax. For example, a manufacturing company like Banks DIH with an electricity cost of about $4 billion would have incurred an additional $560 million in operating cost.

The same would be the outcome for the water rates of that company, hence, the 2.5 percentage points reduction by the previous regime was counter productive and in fact resulted in companies having to incur billions more in operating cost thus inhibiting their competitiveness and deterring future investments.

To be continued

.jpg)