PUBLIC SERVICE WAGE PER CENT OF GDP

Public Service wages represents close to nine per cent of non-oil GDP, while other countries average between 10 per cent-12 per cent of GDP. Here again, using this indicator, Guyana is just one percentage points below the average of other countries which also indicates that public servants’ wages in Guyana is within the highest range countries can afford to pay that is financially and fiscally sustainable.

The size of the public service relative to the population would also have a bearing on the net effect of wages an individual employee would receive–that is, the smaller the public service, the greater the individual wage and the larger the public service, the smaller the individual wage (theoretically). For this reason, the modernisation of the public sector, vis-à-vis, digital transformation of the public service over time, is critical. In so doing, this would enhance the efficiency and quality of service and also enable a leaner public service.

It is important to note though that (1) achieving a leaner public service would take about 10-15 years assuming that the public service transitions through a digitisation strategy as early as FY 2022; and (2) a leaner public service can be achieved through this method without having a single public servant becoming redundant.

This can be achieved easily in the following manner: As senior career public servants or public servants’ veterans reach the age of retirement, there will be no need to have those persons rehired which will effectively create the opportunity for the younger and mid-level public servants to advance to senior levels.

Thus, with this strategy over a period of 10-15 years coupled with the simultaneous transition to digitisation, upskilling and continuous training and development of the public service, a leaner and more efficient public service workforce can be achieved within 10-15 years, easily.

This is unlike the case of GuySuCo under the previous regime with the abrupt termination of 7000+ sugar workers which impacted the livelihood of about 50,000 households directly and indirectly under the pretext of right sizing the industry.

THE MACROPRUDENTIAL CONTEXT

The Potential Inflationary Impact and Sustainable Public Financial Management

There was a strong view by one of the trade unions that public servants should have gotten 20 per cent increase.

While from the discussion and analysis so far, a 20 per cent increase cannot be accommodated from a financially sustainable position at this time, lets nonetheless test the theory to ascertain what might be the impact on inflation should a 20 per cent increase be granted.

Twenty per cent increase in public servants’ wages would result in an additional $16 billion for public servants, thereby increasing the total employment cost from $80.3 billion to $96.3 billion, representing 53 per cent of current revenue.

Fifty three percent employment cost of current revenue is way above the prudential benchmark of 30 per cent, bearing in mind, that 30 per cent of revenue goes towards debt service and – a 30 per cent debt service-to-revenue ratio is in line with prudential financial practice. Even at the individual level where a person seeking to obtain a loan from a commercial bank, for example, the banker would tell you that your loan installment (debt service = principal + interest) should not be greater than 30 per cent of your income.

This is after considering other regular household expenses. And if in the individual case, when the banker calculates the individual’s household and other expenses and add what the installment of the proposed loan amount would be and it exceeds 30 per cent of the income earned and/or the surplus remaining is not sufficient to cover the installment, then that person would not be qualified for the loan. The same principle is applied in public financial management.

Turning now to the likely inflationary impact of a 20 per cent increase within the current financial and macro context, the public servants represent about 15 per cent of the employed labour force which means any substantial wage increase could have a relatively material (inflationary) impact on the economy.

Inflation is typically tied to the country’s imports simply because most of the goods consumed domestically are imported.

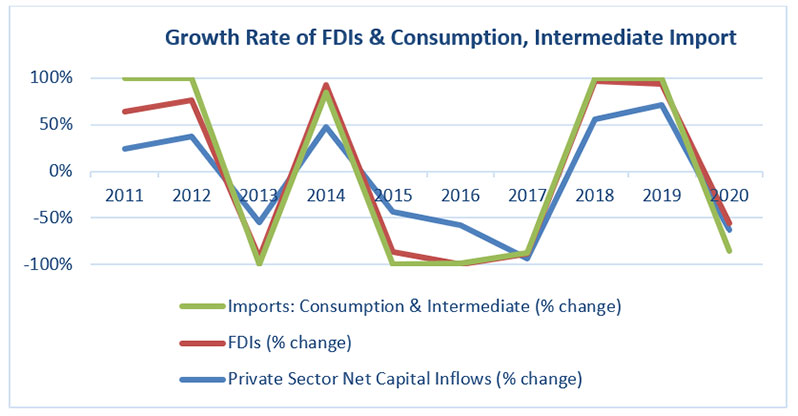

With this in mind, the average annual growth rate for importation of consumption and intermediate goods (pre-oil production) is below five per cent.

So, having established that 15 per cent of the employed labour force is relatively material in terms of increased spending power, should an additional $16 billion or US$77 million is spent on consumption, imports on this category of goods can increase by 4.5 times the current growth rate, and therefore using 4.5 times as the multiplier of the current inflation rate, the potential rate of inflation, as a result of this, could reach 25 per cent. Contrary to this argument, the counter argument is supposing the increase is not used in this manner and rather used productively to invest in other entrepreneurial endeavors, the result is likely to be the same as even in business, most businesses are in the business of supplying consumption goods and services. The only way this theory will not hold true is if the extra money is put towards savings in the bank, rather than spending on consumption items.

Now, there are two important points to note from the above scenario type argument–that is:

1. The call for a 20 per cent increase cannot be accommodated simply because total employment cost of above 30 per cent and in this case above 50 per cent is not financially and fiscally sustainable, even in the richest countries in the world.

And, not just governments but the richest companies in the world, the fortune 500 companies such as the ExxonMobil of the world, Apple, Google, Microsoft, etc., do not allow their employment costs to be more than 15%-30 per cent of revenue. Therefore, 50 per cent is simply not sustainable; and

2. Even if, in the current situation, provided that all things being equal, the 20 per cent wage increase for public servants could potentially result in 25 per cent inflation which will have effectively diminish the purchasing power of the currency by 25 per cent. In a different perspective, the 20 per cent increase would not have been a sensible fiscal policy decision in the long run, if it potentially takes away 25 per cent of the purchasing power of the currency.

Understanding the Source of Central Government’s Current Revenue in the context of the Economic Policy Philosophy

In the discussion and analyses so far, the author explored a variety of different dimensional contexts of sustainable public financial management practices and policy implications.

In this section, the author seizes the opportunity to dedicate this section in response to the argument put forward on the wage increase by the Shadow Finance Minister. Where in a letter to the editor, the shadow Minister of Finance argued that the policies of the government of the day are private sector focused and thus it was implied that the working class and public servants are treated with less importance or ignoring their plight altogether.

This contention, though interesting, begs the question: where do public servants wages come from? Or what is the composition of central government’s current revenue and how can the government expand its revenue base – or effectively, its tax base.

The answer to these questions is simple, logical, and quite obvious. The current revenue composition of the State is made up of taxes paid by the private sector. In fact, 90 per cent of current revenue is made up of taxes paid by the private sector. These include PAYE, corporate income taxes, VAT and excise taxes, customs, and trade taxes, etc.

It therefore means that in order for the government to be in a position to pay the public servants better wages and salaries, over time, it needs to focus heavily on improving national competitiveness of the business environment so that businesses and the private sector as a whole can thrive, attract more foreign direct investments, stimulate, and enable the business environment for increased investments by the private sector. By doing so, the private sector create more employment opportunities, generate more wealth and ultimately pay more taxes.

To be continued