– Central Bank zeroes in on non-cambio businesses trading in USD

GUYANA is likely to lose foreign exchange entering the official market if local stores do not abide by the Bank of Guyana (BoG) Act 1998, which states that all monetary obligations or transactions in Guyana must be settled in Guyana dollars.

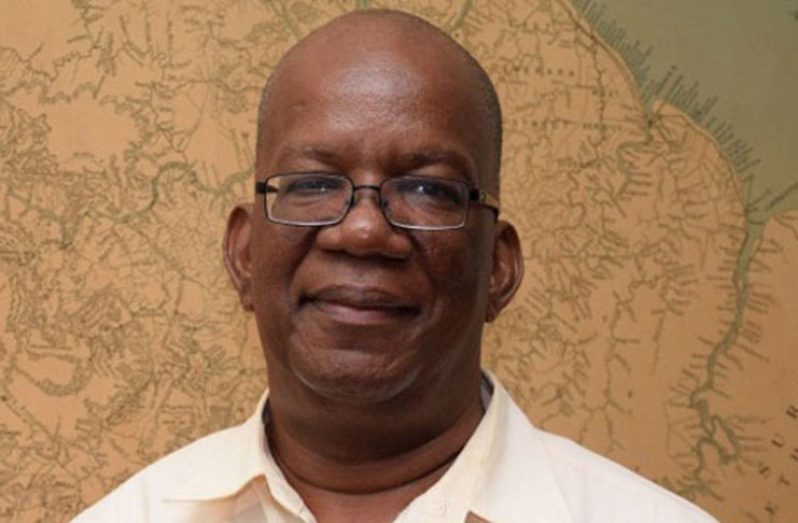

In fact, Governor of the BoG, Dr Gobind Ganga, told the Guyana Chronicle on Saturday that all transactions are to be conducted in Guyana dollars. He said the bank is not so much worried about one-off transactions done in foreign currencies.

“What is happening here is there are a lot of traders coming in… we appreciate the traders… they shop largely at the Chinese stores and the Chinese stores are even putting their prices in US dollars. This is not a one-off thing. These stores are catering to collect US dollars… even Guyanese are faced with prices in US dollars,” Dr Ganga explained.

Last week, the BoG by way of a notice published in the daily media warned against this practice. The notice said, “The Bank of Guyana notes with concern that some businesses are accepting foreign currency for the purpose of settling payments for transactions, instead of Guyana dollars.

“The bank wishes to advise that pursuant to section (20) of the Bank of Guyana Act, 1998, all monetary obligations or transactions in Guyana shall be settled in Guyana dollars.”

The bank said too that only banks and licensed cambios are authorised to conduct buying and selling of foreign currency. The Bank of Guyana Act 1998 and the Dealers in Foreign Currency (Licensing) Act 1989 provide penalties for violations which include fines and imprisonment, the BoG stated.

“The bank warns that any person contravening the Bank of Guyana Act 1998 and the Dealers in Foreign Currency (Licensing) Act 1989 will be prosecuted,” the foreign transaction note stated.

According to Dr Ganga, such practices make it difficult to trace the foreign currency spent here. For example, the BoG official said it is unclear what is done with the US dollars collected by the Chinese stores. “We don’t know if they are taking to the cambios, bank and non-bank cambios.”

The official made it clear that traders are to change their foreign currency at licensed cambios, bank or non-bank. Over the past two years, there has been an influx of Cuban traders here and they purchase goods mostly from Chinese stores in central Georgetown.

While all transactions are to be done in Guyana dollars, Dr Ganga explained that a customer can enter a supermarket for example and make a purchase using US dollars, as those items purchased at the supermarket are not being exported. He described such purchases as one-off purchases.

However, where items are being purchased to be exported there is a difference. The rules are to be applied strictly in such cases.

“One-off is if you don’t have Guyana dollars, but when the goods are being purchased with US dollars and are being exported… the least you require from them is that money goes back into the system,” said the governor.

COMPLAINTS

Several complaints have been filed by citizens about the practice of the Chinese stores in particular; and Dr Ganga said once the relevant authorities are in possession of evidence to substantiate the complaints, the police would be informed and take charge of the matter.

“This thing is of concern to us; it is becoming a big practice,” he stated, while noting that the publication of the foreign currency transaction note is to serve as a deterrent to those who are culpable.

The Guyana Chronicle understands that in one instance, a Chinese store had printed their exchange rates and was operating like a cambio.

“People are reporting these things and we have to take action,” the governor stated, while noting that the Bank of Guyana is not targeting any specific set of traders.

He made it clear that despite public statements being made about the bank’s notice and its relevance to Cubans, Dr Ganga said, “We benefit significantly from the Cubans trading, but they need to go to the cambios and change their money so that it is in the system.”

The Guyana Chronicle was reliably informed that one store owner has been placed before the courts for violating the Bank of Guyana Act. This publication was unable to ascertain the facts and outcome of the said case.

Meanwhile, the publication of the notice by the BoG has resulted in some persons, in particular business persons, voicing their concerns on social media. One such person is businessman Terrence Campbell.

Campbell, who owns the Church’s Chicken franchise, said on his Facebook page: “Oh boy! The Cubans have kept commerce afloat and now we want to make life difficult for them. How does forcing them to the cambio help? The only benefit here is better statistics! Maybe we want to help local bandits identify those who change large sums. Haven’t businesses been through enough? Slow economy since 2014, red tape from the City Council, blackouts from GPL and now they must endure raids from Bank of Guyana?”

Campbell called on Dr Ganga to “please issue four new banking licences and help reduce the spread between interest rates on loans and those on deposits.”

He posited that monetary policy does not work in Guyana. “When things are tough, the banks don’t lower their rates. In fact, I suspect they try to raise them to maintain their profits. Have you tried a little moral suasion on them? This would be better use of your time. Please leave the Cubans alone.”

LAW IS THE LAW

But on Saturday, when questioned about the situation, Finance Minister Winston Jordan maintained that “the law is the law and we should be enforcing the law.”

“If there are to be changes to the law, then we must do that, but until we change the law we should be enforcing the law. The law says only licensed dealers in foreign currency should be trading foreign currency and those licensed dealers pay a hefty fee every year,” declared Jordan.

He said he too has observed social media comments on the matter, but posited that “sometimes it is not thought out.”

“Those dealers pay a hefty fee and it must hurt them to see unlicensed dealers accepting foreign currency and the authorities are not doing anything while they have to comply with the law. I have no problem with what the Bank of Guyana is doing, in fact, I asked him [Dr Ganga] to a similar thing last year when we were having issues to do with foreign currency in 2017,” said the finance minister.

Jordan noted too that the government and the Central Bank believe in suasion, after which, if wrongdoers do not abide by the law, the law would be enforced.

“I hope Dr. Ganga has the backing of what he has said. Since the last time I was telling him if you allow things to develop from small they would become uncontrollable.”

The minister said too that since 2016 reports were made that “certain activities were being done by certain nationals in Guyana”.

“I hope that we will see some actions in terms of deterring this. I don’t want people to be locked up, but we want to run educational programmes to let people, especially non-English speaking people, to let them know there are lots of cambios available around the country.”

Additionally, the finance minister dismissed claims that people get robbed when they enter cambios.

“I do not buy the thing about robberies when you go into cambios, many other people are going in to change or buy money,” he stated.

Lending his voice to the situation, Chairman of the Georgetown Chamber of Commerce (GCCI), Deodat Indar, told the Guyana Chronicle on Saturday on the sidelines of a business summit held at the Pegasus Hotel that while he cannot speak to those businesses breaking the law, but he said making the conduct of commerce difficult will be counterproductive.

He pointed to persons having to change foreign currency at nights and the possibility of being targeted.

“If you go to a cambio and people target you, that would be an issue for people who are going to change their money,” said Indar, who made it clear that he intends to communicate with the BoG to find out clearly what the issues are.

“I guess they would have information of such businesses and I don’t have that information. We need to work as government and private sector– work towards the ease of commerce rather than what is going on,” he maintained.

The GCCI president said there must be no hindrance to commerce here as businesses in the hospitality sector interact on a daily basis with foreigners and would receive money in foreign currency.

“They collect that money and give them at an exchange rate. That is how business is conducted. This is a matter that I would take up with the BoG to find out what is going on before I come up with an official statement from the Chambers of Commerce,” he told the Guyana Chronicle.

Indar said that with the influx of Cubans here to do business, the country ought to be grateful. “My information from walking Regent Street and Robb Street- 20 per cent of their business comes from Cubans and that is a significant thing—why would you go trouble with that — it baffles me. I believe that this commerce is helpful to our local business community.”

He said with the number of Cubans entering Guyana weekly, locals in several businesses are benefiting significantly.