Global banking giant eyes local foothold amid rapid transformation

GLOBAL banking giant Citibank has described Guyana as “a compelling opportunity,” as the global financial powerhouse announced plans to establish a representative office in Georgetown, pending regulatory approval from the Bank of Guyana.

The move underscores Citi’s growing confidence in Guyana’s explosive economic trajectory, fuelled by record-breaking growth in the oil and gas sector, infrastructural expansion, and increased export financing.

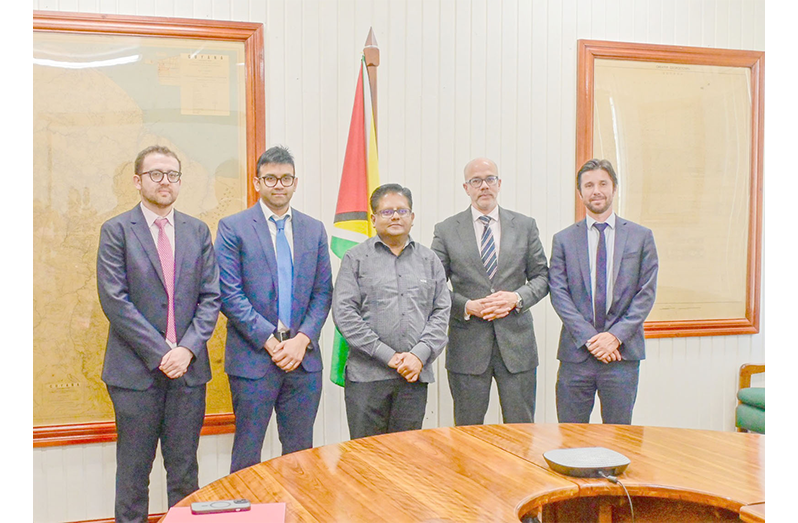

Pablo del Valle, Citi’s Head for Central America and the Caribbean, said the country’s transformation offers unmatched potential for international investors and financial partners.

“We are very excited about the prospect of establishing a presence through a representative office in Guyana,” del Valle stated. “Guyana’s growth trajectory and vibrant investment landscape present a compelling opportunity for Citi and further complement our unmatched global network.”

Citi, which operates in more than 90 countries, said its planned office will help connect Guyana to global markets, facilitating cross-border financing and investment partnerships.

The institution added that it looks forward to collaborating closely with the Bank of Guyana and other stakeholders as it positions itself to play a strategic role in supporting the nation’s development and deepening its financial infrastructure.

Senior Minister in the Office of the President with Responsibility for Finance, Dr. Ashni Singh, welcomed the announcement adding that, “this move by one of the world’s largest financial institutions is a clear testament to the rapidly expanding opportunities in Guyana and the strong international confidence in the country’s economic trajectory.”

“The attraction of major global companies like Citi is a direct result of the strong leadership of His Excellency President Dr Mohamed Irfaan Ali in positioning Guyana as a premier and stable destination for international investment. This development also underscores the PPP/C’s Government’s efforts to engage with the global community and build a resilient, modern, and diversified economy,” a release from the Ministry of Finance said.

Previously, President Dr Irfaan Ali and Vice-President Dr Bharrat Jagdeo announced that the PPP/C administration will catalyse growth in small and medium enterprises (SMEs) through various programmes such as a Development Bank, which will be a state initiative.

“That is why we’re trying to drag it out of the stone ages into an environment that is appropriate to support the expansion in the real sector,” he said.

The banking and financial sector is an important sector, which the government has been placing specific focus on to empower citizens to benefit from the massive economic transformation taking place across the country.

Access to financing is a main pillar for the establishment, growth and success of both small- and large-scale businesses, as well as the economic empowerment of individuals and

households.

Under the stewardship of the PPP/C Government, Guyana’s financial sector has shown significant improvements in recent years in key performance indicators, reflecting a strengthening economy and robust regulatory oversight.

The establishment of Citi’s representative office is also a direct result of the tabling and successful piloting of the Financial Institutions (Amendment) Bill 2024.

This amendment allows for the establishment of representative office by foreign financial institutions and is in keeping with Government’s broad agenda to build and strengthen the legal framework and modernise the country’s banking sector.

“This new development will provide immense benefits for the Guyanese economy. It will help facilitate greater access to global financial markets for Guyanese businesses, and introduce new, sophisticated financial products and services to Guyana’s market. This new presence will bolster Guyana’s financial infrastructure and contribute significantly to the country’s ongoing development,” Finance Minister said.

.jpg)