-claims were incoherent, prolix and obscure

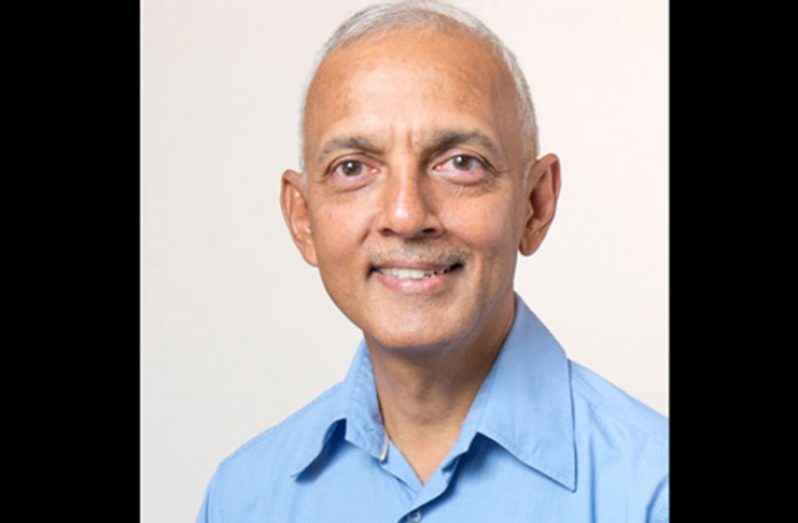

A $90M lawsuit filed by former Minster of Communities, Ronald Bulkan, and his brother, Rustum Bulkan, against the Bank of Guyana and its Governor, Dr. Gobind Ganga, was, on Monday, dismissed by Justice Priya Sewnarine-Beharry in the Demerara High Court.

Justice Sewnarine-Beharry said, in her ruling, that the lawsuit was an abuse of the court process and was statute barred.

The Bulkans, who are shareholders in Precision Woodworking Limited, brought legal proceedings against the Bank of Guyana for failing to probe the unauthorised deposit of $82M into their company’s Republic Bank (Guyana) Limited bank account.

The Judge in her ruling explained that an action for the recovery of damages must be brought within 3 years of the cause of action arising.

Against this backdrop, she stressed that the brothers’ Statement of Claim does not disclose a cause of action against the Bank of Guyana and Dr. Ganga.

“The Statement of Claim averse to potential harm and not any real harm, loss or damage and at best is speculative,” Justice Sewnarine-Beharry said.

Further, the Judge ruled that Dr. Ganga was improperly sued in his personal capacity.

According to her, Section 4 (1) of the Bank of Guyana Act provides that it shall be a body corporate; while Section 11 provides that the Governor shall be the Chief Executive Officer and shall be responsible for the management of the Bank. Section 38 of the Act, the Judge said provides that the Bank of Guyana shall have exclusive responsibility for the supervision and regulation of licensed financial institutions under that Act and the Financial Institutions Act.

Lastly, the Judge said that Statement of Claim was incoherent, prolix, lacked precision and was obscure.

Costs

As a consequence of her ruling, Justice Sewnarine-Beharry ordered that the brothers pay $250,000 in court costs to the Respondents on or before October 30, 2020.

It was further ordered that counsel for the brothers personally pay costs in the sum of $75,000 to the Respondents on or before October 30, 2020, for prolixity of pleadings. The court further ordered that costs awarded shall be paid before any further steps are taken in the proceedings.

The lawsuit was filed in December 2019 by their attorneys–at-law, Maxwell Edwards and Patrice Henry.

In February 2020, Dr. Ganga and the Bank of Guyana’s lawyer Pauline Chase filed a Notice of Application for the lawsuit to be dismissed.

The Bulkan brothers were awarded receivership of Precision Woodworking Limited and are the only authorised signatories to the company’s bank account.

Claims

The brothers claim that the Bank of Guyana neglected its statutory duty when it failed to launch an investigation into the deposit of $82, 068,617 into the company’s Republic Bank (Guyana) Limited bank account which has been on hold since 2011.

In 2013 and 2017, the brothers wrote to Dr. Ganga, Republic Bank, then Minister of Finance, Winston Jordan, and Attorney General raising concerns over the unauthorised and suspicious deposit.

Dr. Ganga, according to the brothers, ignored their letter and plea for an investigation to be conducted by the Bank of Guyana with the view of prosecution in relation to the $82M deposit.

The brothers claim that Central Bank continues to “arbitrary and whimsically deny the deposit being made.”

The siblings said that they were “gravely concerned and disturbed that the deposit was a breach of the Anti-Money Laundering and Countering of Financial Terrorism Act by an individual identifiable by name.”

“[We] are acutely aware of the international financial jeopardy that Guyana endured as a result of the Financial Task Force blacklisting Guyana prior to 2015; and of the government’s post 2015 zero tolerance for money laundering,” the brothers said in their claim.

They also noted that at all material times they were well aware and cognizant of the draconian and ruinous effects of the penalties of fines ranging from $220M to $520M, and/or imprisonment prescribed under the Anti-money Laundering and Countering of Financial Terrorism Act.

They also argued that Dr. Ganga continues to fraudulently misrepresent that no such deposit was ever made into the company’s bank account. The claimants, in their documents stated that the Central Bank intended to mislead, deceive, induce and trick them into believing that the deposit was not made for them to abandon their relentless good faith pursuit of an investigation into the truth about the matter.

Also, the claimants said that they have been induced by the Central Bank’s repeated false, and in bad faith, denials or recklessly, not caring whether their denials were true, or not, into a belief, and entertaining of some doubt about the veracity of the very serious imputations of criminality against Republic Bank, probably the largest commercial bank in Guyana, tending to an appearance that they are mischievous and malicious.

In the circumstances, each of them sued Dr. Ganga for, in excess of $10M in damages and the Bank of Guyana for breach of statutory duty and sought in excess of $50M in damages.

The brothers also asked the court to award them exemplary damages for the potential harm, distress and unease caused by Dr. Ganga’s action, substantial costs and or any other order as the court deems just.