By Dr Amit Telang, High Commissioner of India to Guyana

ON August 15, 2025, Hon’ble Prime Minister Narendra Modi announced that India would undertake far-reaching reforms in India’s Goods & Services Tax (GST) aimed at further simplifying the taxation system with significant, positive impact on India’s foreign trade, especially in sectors such as pharmaceuticals, medical equipment, agricultural commodities and equipment, textile and apparel and other commodities with major shares in India’s exports.

These reforms would come into effect from September 22, 2025, coinciding with the festive season in India. The new GST reforms envisage revamp of the GST structure by rolling out GST 2.0 based on three core pillars: structural changes, rate rationalisation, and procedural simplification.

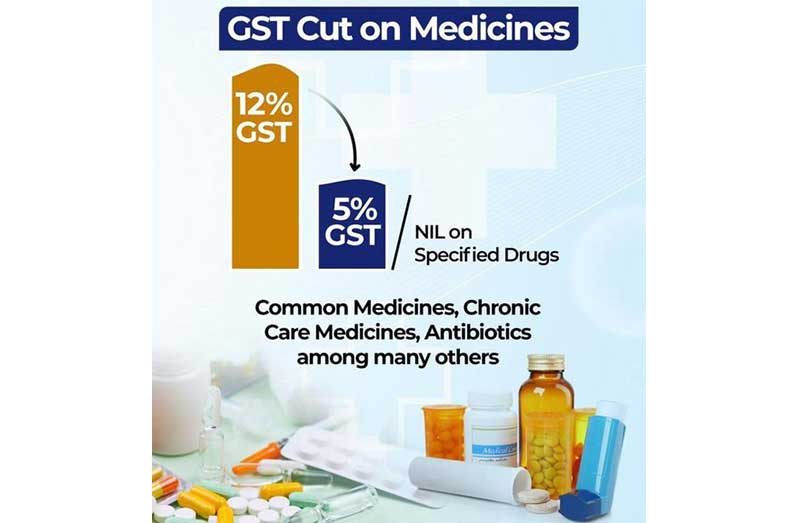

The new GST regime seeks to streamline the system into two main slabs: five per cent and 18 per cent, besides a new 40 per cent rate for luxury and “sin” goods. The previous four-tier GST system, which commenced in 2017 and included higher 12 per cent and 28 per cent slabs, stands abolished. This rationalisation is undoubtedly a bold step in tax reforms, reinforcing India’s intent to emerge as a major exporter of commodities, including pharmaceuticals, medical equipment, agricultural commodities and equipment, textile and apparel. India has proven expertise and strengths in these sectors. The new reforms would facilitate new investment and growth, sustaining India’s impressive growth trajectory. It also signals to global markets that India has a predictable investor-friendly tax environment.

India’s GST 2.0 reform, under Prime Minister Narendra Modi, is seen as a significant step in tax policy, aiming to remove complications and establish a robust and reliable investor-friendly tax climate. The reform aims to simplify the GST system into two main tiers: five per cent and 18 per cent, with a new 40 per cent rate exclusively for luxury items. The GST system, which commenced in 2017, aims to create a more straightforward, equitable, and growth-focused tax system, enhancing the quality of life for citizens, facilitating business operations, and boosting economic development.

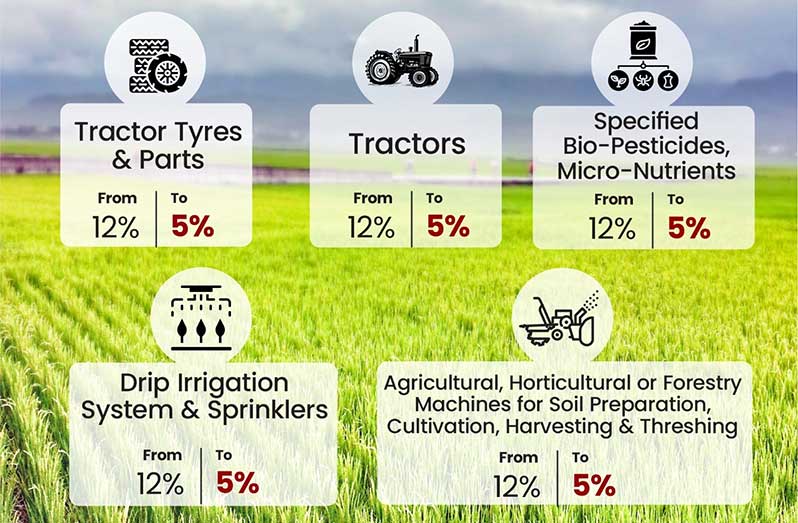

GST 2.0 also aims to make basic necessities more budget-friendly, enhancing accessibility to healthcare, social security, medicines, and agricultural requirements. The reforms have reduced GST on tractors, farming equipment, and fertiliser components, directly benefitting household finances and promoting economic growth. Stock markets reflected the positive sentiment among businesses and industry. GST 2.0 would foster growth, attract fresh investments, ensure compliance, and contribute towards Viksit Bharat by 2047, enhancing India’s heft in the global economy.

GST 2.0 is part of India’s broader push to simplify trade and boost global competitiveness, and as a growth enabler, it seeks to deepen trade ties with our reliable partners from the Global South, including Guyana and other CARICOM member states.

These reforms would create newer opportunities for trade and commerce with Guyana- India’s most important partner in the region. Guyana’s impressive economic growth trajectory and phenomenal developmental transformation have created new opportunities to intensify our trade and commerce. The tax simplification as part of GST 2.0 would boost competitiveness of Indian goods and services in Guyana, reducing transaction costs and avoiding supply-chain delays.

In particular, GST 2.0 would benefit export of tractors, harvesters, composters and fertilisers, which are crucial to implementing ambitious reforms and plans in developing Guyana as the food basket in the Caribbean region. It will also complement Guyana’s vision of emerging as one of the important global players in agriculture and food-processing sector. India, given our time-tested partnership, is looking at untapped potential to further intensify our engagement through exploring joint ventures or technology transfers in agriculture and food-processing industry.

Textile and apparel are among major sectors benefitting from GST 2.0. Importers would get quality products at affordable prices, boosting the ongoing trade in this sector. There is considerable demand for ethnic Indian garments and sustainable products including natural fibres and high-end textiles and apparel products among fashion-conscious people in Guyana, which would receive further impetus as part of GST 2.0. Pharmaceuticals and medical equipment sectors also significantly contribute to our bilateral trade with Guyana. These sectors, too, would greatly benefit from GST 2.0.

As President Irfaan Ali’s new government assumes office, India is looking forward to a productive and mutually beneficial engagement with Indian and Guyanese businesses and industries, intensifying our bilateral trade and commerce. We are confident that it would provide further impetus to our historical, people-centric, future-oriented partnership. India stands ready to join hands with Guyana as the new government embarks on a fascinating journey towards a brighter, inclusive, promising and sustainable future, based on the vision of One Guyana.

India, too, has made impressive strides in our transformational journey, under the leadership of Prime Minister Modi, emerging as one of the fastest-growing major economies with a strong foundation of an equitable, inclusive, progressive and sustainable society. I am confident that given our historically strong partnership and shared vision, India and Guyana are poised to begin an interesting journey of development and societal transformation, energised by the new reforms in the form of GST 2.0, as well as the vision shared by Prime Minister Modi and President Ali for a strong, sustainable and people-centric India-Guyana partnership.

.jpg)