– urges stronger judicial training to boost AML convictions

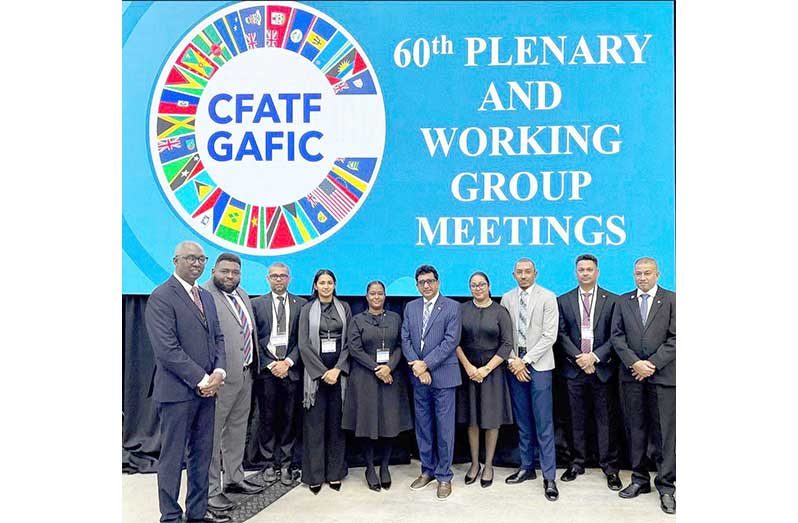

ATTORNEY GENERAL (AG) and Minister of Legal Affairs, Anil Nandlall, is currently leading Guyana’s delegation at the 60th Plenary of the Caribbean Financial Action Task Force (CFATF), being held in Trinidad and Tobago from May 25 to 30, 2025.

The bi-annual CFATF Plenary brings together member states to deliberate on critical issues related to anti-money laundering (AML), countering the financing of terrorism (CFT), and counter-proliferation financing (CPF). This year’s event is chaired by Jamaica’s Minister of Finance and Public Service, Hon. Fayval Williams.

Guyana’s robust delegation includes key national stakeholders from the financial, law enforcement, legal, and regulatory sectors. Among them are: Dr. Gobind Ganga, Governor of the Bank of Guyana; Mr. Matthew Langevine, Director of the Financial Intelligence Unit; Mr. Navindra Datt Prashad, Deputy Commissioner, Guyana Revenue Authority; Deputy Commissioner of Police, Fazil Karimbaksh, Head of the Special Organised Crime Unit; Mr. Rommel St. Hill, AML/CFT Officer, Ministry of Legal Affairs; Mr. Jimmy Reece, Deputy Commissioner, Guyana Geology and Mines Commission; Mrs. Diana O’Brien and Ms. Natasha Backer, Assistant

Directors of Public Prosecutions; Ms. Alanna Lall, General Counsel, Guyana Securities Council; Mr. Victor Herbert, Compliance Officer, Gaming Authority; and Mr. Visal Satram, Legal Officer, Ministry of Natural Resources.

In his remarks to the Plenary, Attorney General Nandlall emphasised the urgent need for enhanced training for all stakeholders in the AML/CFT/CPF framework. He particularly advocated for judicial training to strengthen

legislative enforcement and improve conviction rates under what he described as “sui generis” legislation—laws that are by nature invasive and more stringent than ordinary criminal statutes.

“This legislative reality is not yet fully appreciated by those charged with interpreting and applying it. One may have strong investigations and robust prosecutions, but still fail to secure the desired results due to a tribunal’s approach,” Nandlall explained. He called for a structured, Caribbean-wide training programme guided by judicial experts from jurisdictions with strong track records, such as the UK, Netherlands, and the US.

A major highlight of the Plenary is the mutual evaluation of Curaçao and Sint Maarten—marking the final evaluations under the Fourth Round of Assessments. Guyana’s own Mrs. Diana O’Brien has been appointed as a Legal Assessor for Curaçao’s evaluation, a significant achievement for the country.

The Plenary also includes reviews of follow-up reports from Grenada and Saint Vincent and the Grenadines. Guyana is scheduled to report on its own progress at the 61st CFATF Plenary, set for the fourth quarter of 2025 in Barbados.

Additionally, Guyana received formal recognition at the recent CFATF Risk Trends and Methods Group (CRTMG) meeting for its contributions to the project on “Money Laundering Vulnerabilities in the Financial

Arrangements of Non-Traditional Designated Non-Financial Businesses and Professions (DNFBPs).” The initiative was led by the Guyana Revenue Authority (GRA) through Mrs. Rajni Boodhoo Moore. The final report is expected to be published on the CFATF website.

Looking ahead, the Fifth Round of Mutual Evaluations will begin in 2026, with Trinidad and Tobago and Jamaica slated to be the first jurisdictions assessed.

.jpg)