GOVERNMENT has extended the submission deadline for 14 offshore oil exploration blocks to July 15, 2023, due to industry feedback and regulatory framework modernisation to support the country’s first competitive offshore oil- and-gas licensing round.

On Wednesday, the Ministry of Natural Resources announced the extension of the Guyana 2022 Licensing Round’s bid submission deadline.

“Industry feedback and the advanced pace of modernising the oil-and-gas regulatory framework underscore the extended bidding period for the nation’s first competitive offshore oil-and-gas licensing round. The round, officially launched on December 9, 2022, continues to receive strong global interest and the government has benefitted from insightful feedback during the consultation periods of the indicative terms and guidelines and the draft model production sharing agreements (PSAs),” the Natural Resources Ministry noted in a press statement.

The government recognises the need for a modern regulatory framework to govern the new oil-and-gas development era. They have been working on finalising the model production sharing agreements and overhauling the 1986 Petroleum (Exploration and Production) Act, as promised in their manifesto.

Additionally, agreements have been concluded with PGS Exploration (UK) Limited and CGG Data Services to reprocess 2D seismic data relevant to the blocks for tender. Participants in the licensing round can benefit from this additional seismic data, which can be licensed to inform their bids better.

“The Government of Guyana remains committed to the successful execution of the Guyana 2022 Licensing Round and the strengthening of the nation’s fiscal and legal petroleum management frameworks,” the release said.

Thus far, Guyana’s upcoming auction of oil blocks has lured at least 10 companies, including Shell, Petrobras, and Chevron, to consider the decade’s hottest oil region.

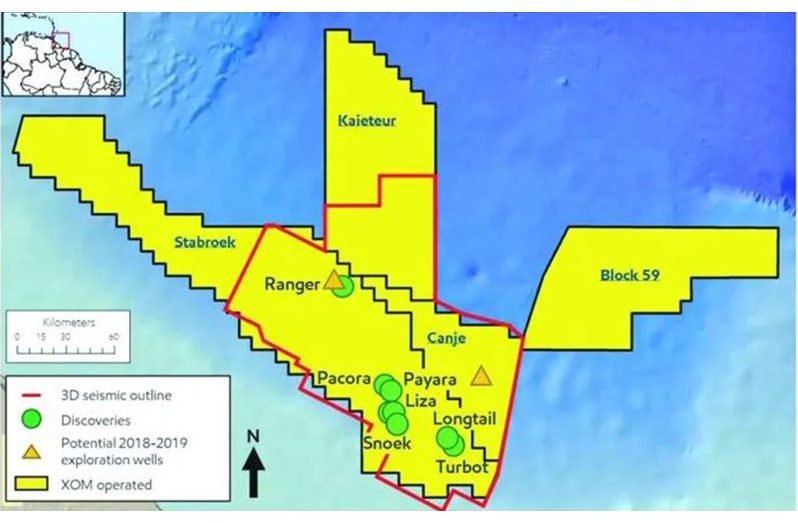

The Stabroek Block is 6.6 million acres (26,800 square kilometres), with its gross recoverable resource now estimated to be more than 11 billion oil-equivalent barrels, including Liza and other successful exploration wells.

President, Dr Irfaan Ali last year announced that the government hopes to award the contracts by the end of May. Guyana is among 65 countries that will launch the auction of oil blocks.

The blocks being put up for auction range in acreages from 1,000 sq. km to 3,000 sq. km, with 11 in shallow water, and the other three in deep water.

The bidders’ work programmes, financial offers, and local-content commitments will be evaluated.

There won’t be any restrictions on the number of bids a company can submit, but a successful bidder will be limited to an award of no more than three blocks.

There is a participation fee of US$20,000 for the bidding process for each block.

The winning bidders of the shallow-water exploration blocks must pay a minimum of US$10 million signing bonus and twice that amount for the deep-water blocks.

Bidders will also be required to provide a development plan and financial bids for consideration.

Under the new fiscal terms and other conditions for future Production Sharing Agreements (PSAs), successful companies will be subjected to 50 per cent profit sharing, a royalty rate of 10 per cent, and corporate tax of 10 per cent, among other things.

President Ali had previously said that Guyana’s offshore basin had captured the attention of global oil market participants and has been called a gateway to the world’s fastest-growing super basin over the last few years.

“Guyana’s offshore [fields] are estimated to have potential resources of in excess of 25 billion barrels, and estimated reserves of in excess of 11 billion barrels,” President Ali had said.

.jpg)