Dear Editor,

REFERENCE is made to the so-called economics professor, Kenrick Hunte’s letter to the editor that appeared in Kaieteur News edition of March 9, 2023. The author argued that the average cost per barrel of oil produced by ExxonMobil is questionable and unacceptable.

Readers would recall that around July–August of last year, Hunte and this author were engaged in an extensive debate in the media on oil and gas issues to the extent that the quality of Hunte’s analyses in response to this author (the challenger) began to diminish. He then vanished for a few months before recently re-appearing with another series of flawed/bogus analyses in the local media.

While the learned economist admitted that he hadn’t access to EEPGL’s, HESS and CNOOC’s financial statements to perform a more accurate analysis, he has incorrectly asserted or believed that the financial statements are not publicly available.

Contrary to Hunte’s belief in this regard, the financial statements are filed with the Deeds Registry, and anyone can obtain copies of same from the registry. In fact, all of the media houses are in possession of the financial statements and have published several reports accordingly. So, Hunte is either oblivious of this fact or he is being disingenuous.

Consequently, the author mistakenly presumed that the 75 per cent cost recovery ceiling is the total cost from which he derived an average cost per barrel of crude of US$52.86 using data reported on crude oil production in the Bank of Guyana report for 2021.

The correct [average] cost per barrel of crude oil, however, using the financial information reported in the 2021 financials for EEPGL, Hess and CNOOC, and based on the total crude oil produced in 2021 which was 42.213 million?would in fact work out to US$22.28 per barrel.

This is in line with the average cost per barrel of crude in the United Kingdom, Brazil, and Venezuela, according to the comparative data presented by the author?as well as in line with the average cost for the U.S Non-Shale.

Having said that, I wish to, for the benefit of the readers, reveal some important historical facts in relation to the author that most readers may not be aware of about him?that is, his professional track record in Guyana.

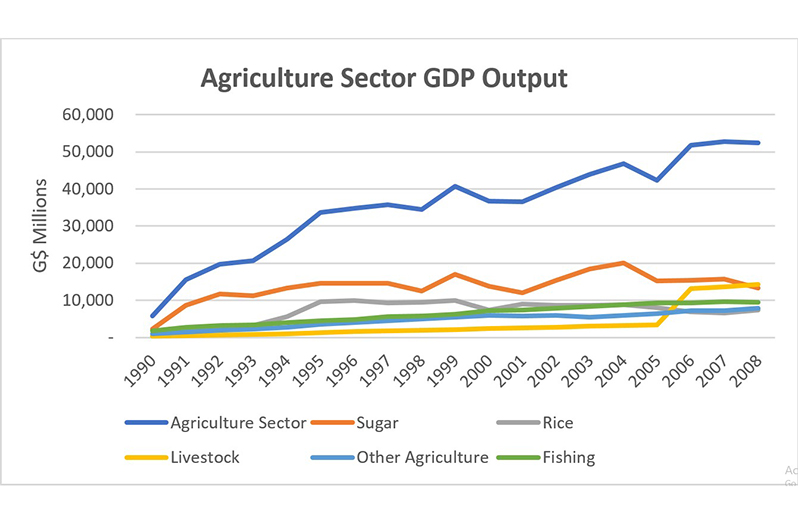

First, the learned economist has a proven track record of producing mediocre analyses. To this end, in a letter published in Stabroek News on December 22, 2009, the economist made an assertion which he claimed to have cited from the Bank of Guyana’s annual report of 2008 that the agriculture sector’s output has been declining over the decade which spanned 1999–2008. But if one were to peruse the agriculture sector’s output for this period as reported in the Bank of Guyana reports during these periods, one would derive the findings outlined in the graph.

As illustrated in the chart above, the agriculture sector grew steadily during the period 1990– 2008. Though there were few years in which the overall output declined, the sector rebound in the following years to levels above where the sector was prior to several periods of decline.

The most notable period of significant decline was in 2004–2005, when more than half of the population was affected by the most severe flood in our history. One would recall that a national emergency was declared. The then Finance Minister reported in the 2006 national budget speech that following an economic impact assessment of the flood, the estimated economic loss from the flood was $93 billion, the equivalent of 60 per cent of GDP. In addition, it was predicted (then) that the production of sugar and rice, two of the largest contributors to the agriculture GDP, would fall precipitately.

Notwithstanding, the learned economist failed to acknowledge that the other agricultural subsectors?namely, livestock and other agriculture, experienced uninterrupted growth from 1990–2008, and that the only subsectors that experienced periods of interrupted growth due largely to the 2005 natural disaster, were the sugar and rice subsectors, and in other cases inclement weather among other factors at the time that were unrelated to the policies of the government and allocation of financial resources in the sector.

Second, and most notably, in the same letter of December 22, 2009, Hunte disclosed that he served as the former General Manager of the Guyana Agricultural and Industrial Development Bank (GAIBANK)? a development bank established in 1973, which went bankrupt and was liquidated in the mid-90s.

According to Hunte, he was employed at GAIBANK from 1980-1993 in various technical positions before advancing to the General Manager in 1985–1993. The economist was responding to someone at the time who accused him of mismanagement of the said institution under his tenure which largely led to it having to be liquidated.

He then sought to deny this allegation and absolve himself of any mismanagement of the institution and claimed that if the government had implemented the Auditor General’s recommendation at the time in relation to some foreign exchange losses that he claimed was a government liability, then the true profit of the entity would have been reflected.

In this regard, the author cited the Auditor General’s recommendation which stated that it was proposed by the Auditor General to invoke the laws of Guyana to deal with the foreign exchange losses, section 50 (2) of the Co-operative Financial Institutions Act, Chapter 75:01. He claimed how the PPP government ignored the advice of the Auditor General. However, a perusal of the referenced section of the Act states that:

“If the reserve fund is in any given year insufficient to cover any net loss of the financial institution recorded in its Profit and Loss Account, an amount equivalent to the deficiency is hereby charged on the Consolidated Fund”.

Again, it would appear that the former General Manager of GAIBANK was not entirely truthful in his missive. Because a perusal of the 2001 Bank of Guyana Annual Report, Table 5-V contained a statement of asset and liabilities of GAIBANK. The table showed that as of June 1991, the accumulated deficit of GAIBANK was $397.6 million, which was cleared, resulting in a surplus position of $23.5 million by December 1991 and remained in a surplus position of $2 billion as of May 1995.

There is another column in the table that shows government contributions on the liability side of the statement which could only mean that the deficit balance was cleared by way of a charge on the Consolidated Fund.

Moreover, the core business of the development bank was lending and therefore, the true performance of the institution under Hunte’s tenure would have been reflected in the quality of the loan portfolio and not the foreign exchange gains/losses.

In this respect, it must be highlighted that in the former General Manager’s letter of December 2009, he was careful to stay completely away from speaking to the portfolio’s performance under his tenure. As such, to give him the benefit of the doubt, here are a few questions he should provide answers to in response to this article:

a) What was the status of the loan portfolio in 1985 when he took over as General Manager and where did he leave it in 1993?

b) How many loans were approved and disbursed during this period?

c) How many were repaid?

d) What percentage of the portfolio was non-performing?

e) How much bad debt was written off during his tenure?

The answers to these questions will prove or disprove whether the former General Manager was indeed culpable of mismanagement and whether indeed he was responsible for the ultimate failure of the institution.

It is worth noting that at the time of writing this article, the author did not have access to GAIBANK’s financials and audit reports for the period 1985–1993 to confirm the numbers/answers to the questions posed above. But these can be and will be easily obtained from the Parliament’s library which will be done during the course of the week. For now, Hunte is given a fair chance to come clean with his management performance of GAIBANK.

Yours respectfully,

Joel Bhagwandin

.jpg)