FIVE countries in Latin America — Brazil, Colombia, Guyana, Mexico and Venezuela – are looking to boost oil production in 2023, but the lion’s share will come from developments in exploration hotspots Brazil and Guyana.

This is according to Hart Energy, the global energy industry’s comprehensive source for news, data and analysis.

The company, in an article on its website, said that Latin America may not be the solution to Europe’s energy crisis, but it will add significant new production volumes next year and beyond.

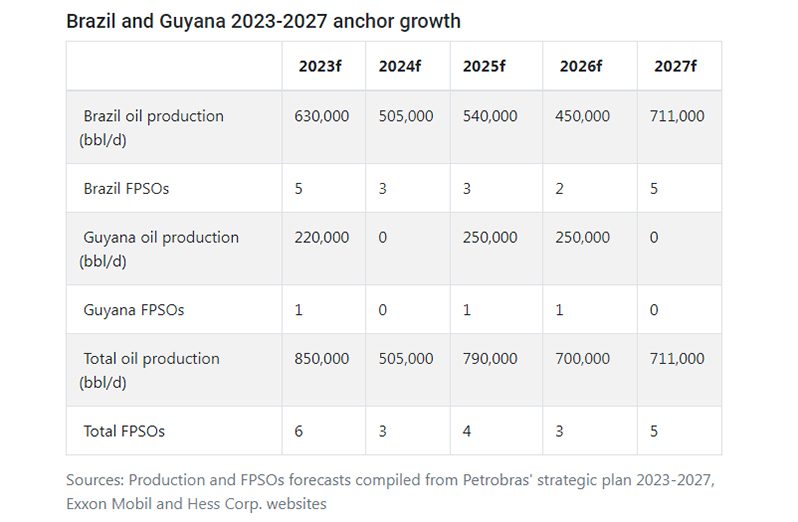

“The region’s two exploration hotspots, Brazil and Guyana, will anchor production growth in 2023, and could add 3.6 million bbl/d [barrel per day] between 2023-2027,” the company said. It reached this conclusion based on the data it had compiled.

According to Hart Energy, this growth will come from the installation of six new floating production storage and offloading (FPSO) units next year, and 15 more over the following four years.

New production from the two emerging countries, among others, will provide some assistance to a global energy market still rattling from the loss of Russian supply, sanctioned after its invasion of Ukraine in early 2022.

Notwithstanding, Latin America will continue to encounter formidable headwinds, such as rising energy costs, despite an abundance of resources due to a high dependency on imports from LNG to refined petroleum products, which will continue to stoke inflation, the article said.

“While Brazil and Guyana will garner the most investor attention and capital spend, other Latin American countries such as Colombia, Mexico and Venezuela could also boost production over the near-term, if above-ground risks mainly related to political uncertainties are kept to a minimum,” it added.

Guyana was described as a “newcomer” to the Latin America oil production and exporting club.

“Guyana continues to ride a wave of successful exploration in its prolific offshore Stabroek Block. There, an Exxon Mobil-led consortium that includes Hess Corp. and China’s CNOOC has found gross recoverable resources estimated at around 11 Bboe [billions of barrels of oil equivalent]. The three companies will continue with exploration efforts in Stabroek while other integrated oil companies (IOCs) explore other blocks. A recently announced offshore bid round for 14 blocks is likely to attract old and new IOCs and national oil companies (NOCs) seeking to replicate Exxon’s feats in Stabroek,” the article said.

It added that currently, Exxon’s first two developments in Stabroek, Liza I and Liza II, are producing around 360,000 bbl/d from the Liza Destiny FPSO (140,000 bbl/d) and Liza Unity FPSO (220,000 bbl/d), respectively.

New production forecast for late 2023 will come from incorporation of the 220,000 bbl/d capacity Prosperity FPSO, which corresponds to the third development Payara. Two additional FPSO units (with 250,000 bbl/d capacity each) are forecast for 2025 and 2026 corresponding to the fourth and fifth developments of Yellowtail and Uaru, respectively, it added.

.jpg)