–company says sustainability more integral in its operations

WAVERING amid challenges and uncertainty in the local economy last year was not an option for local cigarette distributor, the Demerara Tobacco Company Limited (DEMTOCO), as it was able to adjust its operations to close 2020 with a profit after tax of $1.7 billion.

“In this environment and despite the challenges and uncertainty, we did not waver in our commitment to deliver superior value across the total portfolio.

‘The strength of our brands, coupled with innovative strategies that allowed us to quickly pivot and adapt to the changing realities, resulted in positive outcomes for our distributors, customers and shareholders,” Chairperson of DEMTOCO, Kathryn Anne Abdulla, was quoted as saying in the company’s annual report for 2020.

The company managed to work throughout 2020 without reducing its staff complement or utilising any government schemes (or subsidies). In doing this, Demerara Tobacco has shown great resilience, demonstrating capabilities which have showcased that they can recover quickly from difficulties and setbacks.

The company’s profit for last year, when compared to the $1.6 billion recorded in 2019, reflects an increase of 8.7 per cent. Abdulla said: “Overall, we saw growth in revenue of 1.3 per cent, with a favourable movement in operating profit of 7.9 per cent, mainly driven by increased operating costs versus prior year.”

The company’s Managing Director Vijay Singh, in his report, said that with each fiscal year, new challenges arise, but the Demerara Tobacco Company successfully rises to overcome those hurdles by navigating an increasingly complex operating environment.

“While no one had the blueprint for this particular challenge, we were able to dig deep and draw on our resilience to get us through,” Singh related.

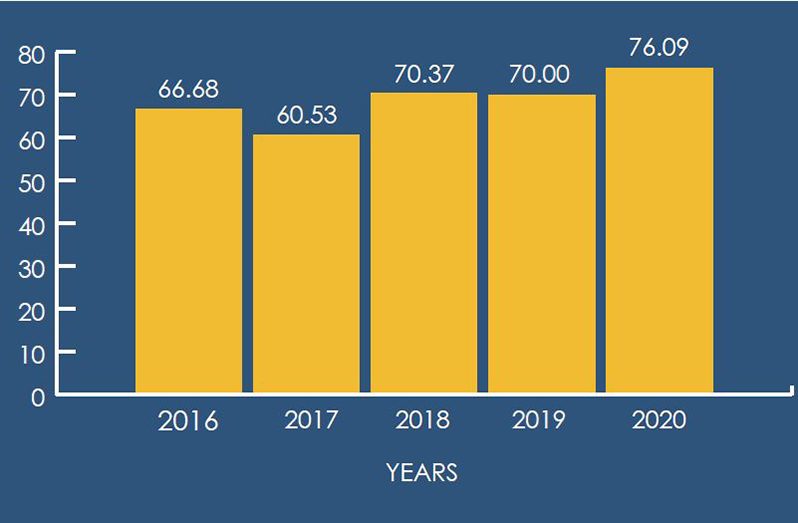

Operating revenues, he said, increased by 1.3 per cent, while operating costs decreased by 5.5 per cent. Additionally, earnings per share increased by 8.7 per cent; this represents the highest growth in the past five years.

It is noteworthy that the company’s share price remained resolute in the face of increased economic pressure at $975 per ordinary share, demonstrating effective management through difficult times and the persisting threat of illicit trade.

The company, in addition to navigating turbulence in the economy, experienced a proliferation of illegal cigarettes, both without tax stamps and the legally required graphic health warnings based on the Tobacco Control Act, with high levels of non-compliance and in some instances, breaches in the form of promotions.

Although this was the case, the company managed to maintain growth by being customer-focused and diligent, Singh said.

Owing to its performance last year, the company delivered earnings per share of $76.09 versus $70.00 in 2019, and a dividend per share totalling $1.6 billion, was distributed for 2020.

“The ability of the organisation to deliver consistent shareholder value is rooted in our prioritisation of cutting-edge practices,” Abdulla related.

But given the new realities presented by the global pandemic, like many other businesses, Demerara Tobacco adapted and transitioned into a new way of working.

In speaking about the company’s transition, Abdulla said: “We transformed our vision of the future with agility, while displaying steadfast commitment to our corporate values and the health and safety of our employees. It is a year where [sic] we rebranded, changed our motto to ‘A Better Tomorrow’ and introduced our Ethos – Bold, Fast, Empowered, Diverse, Responsible.

“We were forced to reflect on what sustainability means to us as part of this new journey and as such, we are moving from a business where sustainability has always been important, to one where it is front and centre in all we do.”

The company, she said, will continue to navigate the challenges and impacts of COVID-19, with effective crisis management and risk- management processes which are already in place. It also intends to demonstrate that it remains a financially resilient business.

“The company remains financially robust, demonstrating the confidence in our ability to continue to navigate COVID-19 with the associated macro and socioeconomic challenges and uncertainty this international crisis brings,” Abdulla said.

Clarity around the full impact of the pandemic, and for life to return to some semblance of ‘normalcy,’ will take time. So, the duration of the short-term impact on the performance of the business will depend on the nature and timing of the subsequent economic recovery, but the company believes that they are well-positioned to emerge as a stronger entity.

.png)