—Dr Singh urges banks to utilise flexible collateral options, cites supporting legislation

SENIOR Minister in the Office of the President with responsibility for Finance and the Public Service, Dr Ashni Singh, is calling on Guyana’s banking sector to modernise its approach to lending by taking full advantage of legal reforms that permit the use of movable assets as collateral.

Speaking recently on the matter of diversifying collateral to better support private sector growth, Dr. Singh described the issue as “a very topical conversation in Guyana right now,” adding that while the financial sector has played a stabilising role over the years, it is time for banks to evolve.

“The banking sector has historically been conservative, erring on the side of caution, which is not necessarily a bad thing,” Dr Singh stated. “We want strong banks and strong balance sheets. We want them to maintain good-quality portfolios. But there is room, I believe, for the banking sector to be more aggressive in providing financing to the Guyanese private sector.”

He noted that this shift in approach is critical, especially in a rapidly growing economy where access to finance remains a constraint for many entrepreneurs and small businesses.

“One of the conversations that we’ve been having with [the banking sector] is what they can do, and what we need to do, for them to be more aggressive,” Dr Singh explained.

“There are some things we [the government] can do on the policy side.”

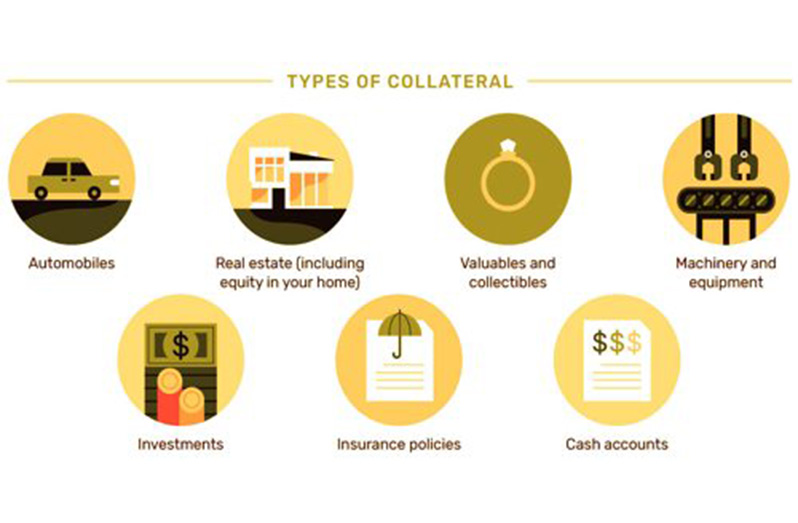

In that regard, the minister highlighted the government’s efforts to create an enabling environment, including legislative reform. He pointed specifically to the enactment of legislation that allows for the use of movable collateral, such as machinery, vehicles, receivables, and inventory, to secure loans.

“We enacted that legislation. It’s in force,” Dr Singh affirmed. “We’ve also been working with the sector to enable them to do more, such as accepting more financial assets, like receivables that can be pledged, and invoices that can be factored or discounted, which is standard technology in the most sophisticated market systems.”

The finance minister acknowledged that some banks have already begun to adopt these mechanisms, responding to both the legislative framework and the broader economic context. However, he stressed that the pace of adoption has not been fast enough.

“So, we’ve made sure to develop laws,” he said. “We want to see more take-off of this. The legal framework is in place. Banks now need to respond to that legal and regulatory framework and step out a little bit from their historic comfort zone, which is almost a risk-free lending model secured by real estate.”

According to Dr Singh, this transformation is not optional if the banking sector wants to remain relevant in an economy that is becoming increasingly dynamic and diversified.

“It’s happening,” he said of the shift toward accepting alternative collateral types. “But it’s not happening as quickly as we would like to see it happen.” He further indicated that the government is monitoring the situation closely and is prepared to escalate its efforts to ensure banks become more inclusive and innovative in their lending practices.

“It’s something that we have on the radar to be elevated in our recent priorities in the next five years,” Dr Singh noted. “But the frameworks are there in place already and it’s really a question of how banks respond to it.”

The minister’s comments reflect a broader push by the government to improve access to finance, particularly for small and medium-sized enterprises (SMEs), as Guyana continues to experience sustained economic expansion driven by both traditional and emerging industries.

In Guyana, recent legislation aims to improve access to credit by allowing movable property to be used as collateral. The Moveable Property Security Act, which was enacted in 2024, establishes a comprehensive framework for secured transactions involving movable assets, such as equipment, inventory, crops, intellectual property, and receivables, as collateral.

In addition, the government has established an Electronic Collateral Registry, housed at the Commercial Registry to facilitate the implementation of the Act. President Dr. Irfaan Ali has made a strong call to the banking sector, demanding greater innovation, proactivity, and adaptation to Guyana’s dynamic economic environment.

The Head of State also underscored the importance of banks seeking out new opportunities, understanding economic trends, and creating ecosystems that support the country’s growth trajectory.

“The role of the bank is not to take deposits and to lend in a low-risk environment. The role of the bank is also seeking the opportunity to understand where the economy is going, to create an ecosystem to support where the economy is going and to build upon what is happening in the country,” he previously explained.

.jpg)