–predicts 360 per cent surge by 2042

THE International Monetary Fund (IMF), in its 2025 Article IV Consultation Report, has commended Guyana’s careful and rules-based management of its Natural Resource Fund (NRF), calling it a key pillar of the country’s long-term economic strategy.

The IMF noted that “fiscal policy follows self-imposed limits, ensuring an accumulation of substantial savings in the NRF.”

These savings, it noted, are governed by a fiscal framework that includes “rules on withdrawals from the NRF to the budget (approved by parliament) and statutory debt limits.”

In a major policy update, it said the government raised the ceiling for NRF withdrawals in 2024. According to the IMF, this adjustment “would allow for maintaining high capital spending while closing the overall fiscal deficit over the medium term as oil revenues increase.”

Rising oil production and falling investment costs are expected to further strengthen this position.

The report outlined a forward-looking scenario in which NRF withdrawals, subject to the higher ceiling, are used to fund capital expenditure, while the non-oil primary deficit gradually shrinks.

Under these conditions, the IMF projects that “NRF assets will peak at about 360 percent of non-oil GDP in 2042.”

This outlook, the IMF emphasised, supports the government’s “ambitious investment goals while preserving fiscal sustainability and macroeconomic stability.” The Natural Resource Fund’s assessment signals growing confidence in Guyana’s ability to manage its resource wealth responsibly.

The IMF’s endorsement affirms that the NRF is not just a savings tool but a strategic engine powering Guyana’s transformation. The Natural Resource Fund (NRF) Act of 2021 in Guyana established the NRF, a fund designed to manage the country’s natural resource wealth.

The Act outlines the framework for handling oil revenues, ensuring transparent and accountable management for the benefit of current and future generations. The Bank of Guyana is responsible for the operational management of the Fund.

Guyana’s NRF received a total of US$605.5 million in deposits during the first quarter of 2025.

This is according to an NRF Receipts report published in the Official Gazette on April 5, 2025, which detailed all petroleum-related inflows between January 1 and March 31, 2025.

All of Guyana’s oil production originates from the offshore Stabroek Block, a prolific deepwater basin. The block is operated by U.S. oil giant ExxonMobil, which holds a 45 per cent stake.

Its partners include American firm Hess Corporation with 30 per cent, and China’s CNOOC with the remaining 25 per cent.

Since the discovery of oil in 2015, three major projects—Liza 1, Liza 2, and Payara—are collectively producing over 600,000 barrels of oil per day in the Stabroek Block.

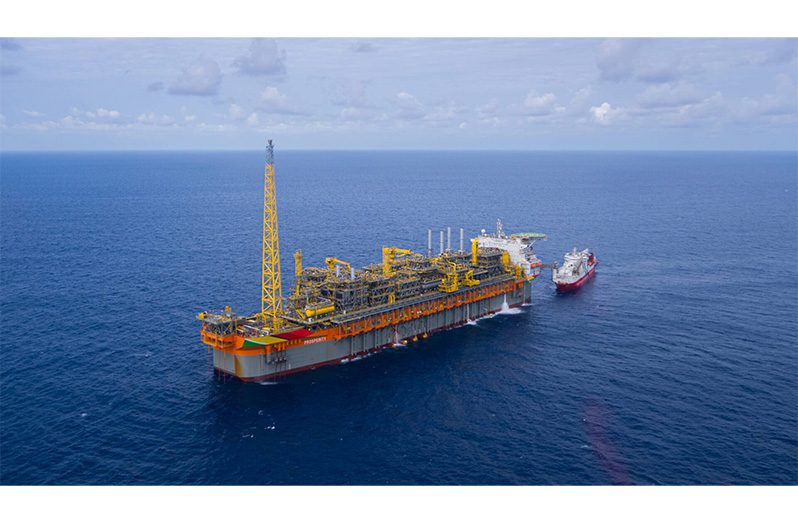

This production is supported by three Floating Production Storage and Offloading vessels: Liza Destiny, Liza Unity, and Prosperity. Three other development projects in this block—Yellowtail, Uaru and Whiptail—are set to begin production in 2025, 2026, and 2027, respectively.

Each project is estimated to generate 250,000 barrels per day, bringing the total offshore oil output in Guyana to more than 1.3 million barrels per day. The prolific Stabroek Block has solidified Guyana’s position as a major player in the global oil industry and the fastest-growing economy in the world.

.jpg)