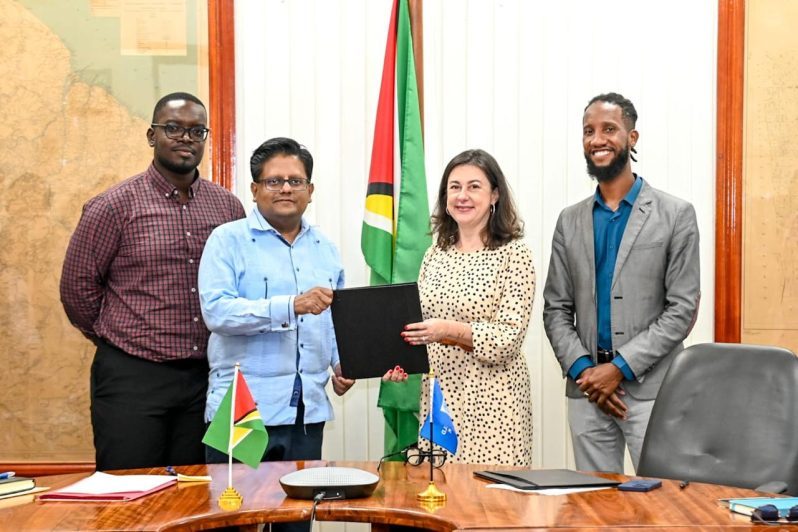

–as Finance Minister signs Climate Resilience Debt Clause, Rapid Response Option agreements with World Bank

THE government continues to manage Guyana’s debt in a prudent and sustainable manner while also ramping up efforts to improve and build the country’s resilience to climate change.

As efforts are made to proceed further in this direction, Senior Minister in the Office of the President with Responsibility for Finance and the Public Service, Dr. Ashni Singh signed a Climate Resilient Debt Clause (CRDC) Agreement with the World Bank at the Ministry of Finance along with an agreement for the activation of the World Bank’s Rapid Response Option (RRO).

The CRDC is a debt management tool that allows for the deferral of debt payments for up to two years should Guyana experience a natural disaster such as flooding.

Guyana is the first country in the Region to sign the updated CRDC and this has now taken place following intense lobbying by Government for the bank to include appropriate climate change phenomena such as floods, droughts and public health emergencies unique to this country’s circumstances.

Should the country experience such a disaster and once the CRDC is activated, it will also reduce the burden on government resources to finance disaster response and recovery efforts.

The second agreement signed with the World Bank is the Rapid Response Option (RRO) which, if activated, would see existing resources quickly repurposed for emergency response should there be a crisis such as a natural disaster, health shock or conflict event.

Guyana, in such a situation, can repurpose up to ten percent of its undisbursed balances in its Investment Project Financing and Program for Results (PforR) operations per year for quick disbursement.

During the signing, Dr. Singh explained that ‘notwithstanding Guyana’s improved economic circumstances in recent years, we continue to be a country that is extremely vulnerable to climate and other potentially catastrophic events,’ as he recalled that the country has overtime experienced multiple episodes of flooding including in 2005, noting that the floods devastated Guyana’s economy and posed damages in excess of 60 percent of GDP.

The Senior Minister added, “the bank has been partnering with us on building our resilience to natural disasters and to catastrophic events and not least ofcourse is the support for the Flood Risk Management Project, amongst others. But increasingly too, the international community as well has recognised the importance of instruments that can respond more effectively to exogenous shocks, extreme climatic events or other natural disasters and catastrophes.”

Signing on behalf of the Bank was World Bank Group Representative to Guyana Ms. Diletta Doretti who underscored the significance of the signing as she lauded the finance minister for his intense lobbying efforts and for pointing out when he perused the agreement months before, that the CRDC needed to include natural disasters relevant to Guyana as it only catered for hurricanes and earthquakes.

It can be recalled that in July this year as well Dr. Singh presented to Parliament two amendatory loan agreements, including one which amended the Export Finance Facility Agreement dated June 14, 2022, between the Co-operative Republic of Guyana, represented by the Ministry of Finance as the Borrower and UK Export Finance as the Lender, and the UniCredit Bank Austria AG as the Agent and Arranger, for an amount of EUR 161,016,949.15 for the Guyana Paediatric and Maternal Hospital Project. This Amendatory Agreement facilitated the inclusion of a Climate Resilient Debt Clause into the original Agreement with Guyana being one of the first countries to adopt the CRDCs directly as part of its loan agreement with the UK Export Finance.

This Government’s effective debt management practices over the past years have contributed to a large decline in the country’s debt ratios over a sustained period. It can be recalled that Guyana’s debt-to-GDP ratio declined from over 600 percent in 1991 to 27 percent in 2023 while in 1992, about 90 cents of every dollar of revenue earned was used to make debt service payments. Today, this has been significantly reduced to about 6 cents of every dollar.

Noteworthy for the country, has been the International Monetary Fund’s (IMF) 2023 Article IV Report for Guyana which placed the country in a positive light, indicating that the risk of (overall and external) debt distress remains moderate, with debt dynamics improving significantly with incoming oil revenues.

The IMF also commended the Government’s commitment to maintain debt sustainability and a balanced growth path through moderating fiscal impulses over the medium-term, while continuing to address development needs. (Ministry of Finance)

.jpg)