The Case for a National Oil Company

Background

Since the public statement by the Vice President, Dr. Bharat Jagdeo in one of his press conferences, that the Government is considering whether to auction off the remaining oil blocks or set up a National Oil Company (NOC) with a strategic investor, critics hasten to posit that a national oil company would be bad for Guyana.

The justifications for this assertion by all of the opponents including one international institution, namely the International Monetary Fund (IMF), however, are arguably weak.

Discussion and Analysis

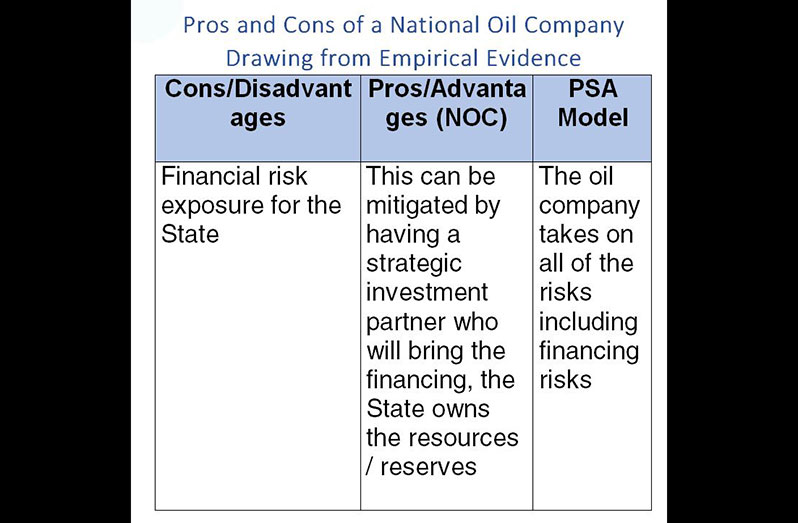

Pros and Cons of a National Oil Company Drawing from Empirical Evidence

Cons/Disadvantages

Pros/Advantages (NOC) PSA Model Financial risk exposure for the State This can be mitigated by having a strategic investment partner who will bring the financing, the State owns the resources / reserves

(Higher the risk, higher the reward) The oil company takes on all of the risks including financing risks

(Higher the risk, higher the reward) The oil company takes on all of the risks including financing risks

Fiscal terms, net take for Guyana (less favourable terms) (PSA model)

Increases participation rate/power shift to the State Oil companies have more dominant control and power. Fiscal terms for oil company and country (more favourable towards the oil companies) At minimum, higher royalty (5%-10%), 51/49 profit share, plus corporate taxes 2% royalty + 50% profit share (current framework, no taxes)

Access to capital Can raise capital on international markets Access to international capital market, debt and equity

Other Key Considerations

* Internationally, the Red Line8 and Achnacarry9 Agreements of 1928 allowed the major oil companies, namely: ExxonMobil, Socal, Gulf and Texaco, Royal Dutch Shell, British Petroleum and CFP not only to plan investment in reserves located in the Middle East, by allocating production shares to the various territories in which they had concessions, but also to control the market from the point of view of prices. As late as 1972, these seven companies, of which five were American, controlled 91 per cent of Middle East output and 77 per cent of the non-communist world’s oil supply outside the United States. In this respect, US companies controlled the vast bulk of the supply of oil to the key allies of the United States. According to the Financial Times, the “new seven sisters”, the “most influential energy companies from countries outside the Organisation for Economic Co-operation and Development”, are Saudi Aramco, Russia’s Gazprom, CNPC of China, NIOC of Iran, Venezuela’s PDVSA, Brazil’s Petrobras and Petronas of Malaysia.

* Almost four decades later, “big oil” has been pushed into the role of competitor with state-owned companies. As part of this power shift, there is a contest about framing the rules for competition and regulation in the international energy system. Saudi Aramco and ExxonMobil remain entrenched at the top of the 100 leading oil companies (based on a composite set of indicators).

* Almost four decades later, “big oil” has been pushed into the role of competitor with state-owned companies. As part of this power shift, there is a contest about framing the rules for competition and regulation in the international energy system. Saudi Aramco and ExxonMobil remain entrenched at the top of the 100 leading oil companies (based on a composite set of indicators).

* There is a growing perception fueled by big oil that NOCs have an ‘unfair’ (anticompetitive) advantage over IOCs because of the diplomatic and financial support NOCs get from their home government.

* State-owned energy companies will become even more important in coming years. According to the International Energy Agency, in the next four decades, developing countries – most with state-owned companies – will be the source of 90 per cent of all new supplies of oil. According to a Rice University study, state-owned companies already control almost 80 per cent of world oil reserves and will dominate the market in the future.

* State-owned energy companies will become even more important in coming years. According to the International Energy Agency, in the next four decades, developing countries – most with state-owned companies – will be the source of 90 per cent of all new supplies of oil. According to a Rice University study, state-owned companies already control almost 80 per cent of world oil reserves and will dominate the market in the future.

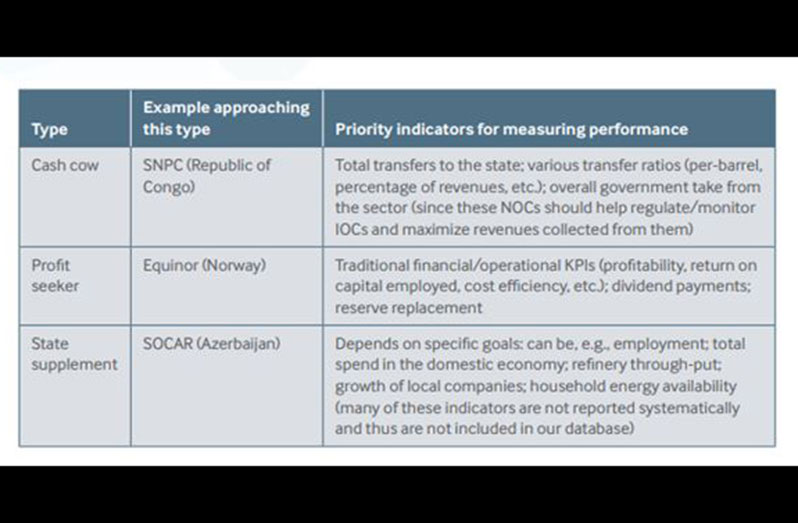

NOCs Typically Pursue three stylised type of goals

https://www.virtusinterpress.org/IMG/pdf/10-22495cocv11i1c8art2.pdf.

https://www.files.ethz.ch/isn/98218/20-03-09_StateOwnedOil.pdf.

Arguments Against the NOC for Guyana by the Critics

So far there are only two individuals and one international institution that have publicly argued against a NOC for Guyana. Interestingly, common in their arguments is that the only reason why Guyana should not pursue this option is because it is susceptible to corruption or the perception of corruption. Unfortunately, this justification being the primary justification proffered by the opponents against the NOC is weak and ludicrous.

Merely basing a decision of such high national importance on the basis of the perception of corruption or suspicion of a manifestation of corruption cannot be the only factor to consider. What about weighing the pros and cons? Typically, in small developing countries like Guyana, the allegations and perception of corruption are far greater than the reality of and existence of corruption. This is not to say that safeguards should not be put in place to minimise corruption. In fact, it would have been better for the opponents to suggest ways in which the perception of corruption can be minimised should the country opt for the NOC. The bottom line is such that safeguards, transparency and accountability mechanisms can be put in place and be legislated.

Conclusion / Recommendation

Conclusion

Notwithstanding the arguably, singularly weak justification against the option of the NOC, it can be explicitly deduced that when examined from a more holistic point of view – that is, the pros and cons of an NOC, this option, if considered, will almost guarantee far greater benefit and value for Guyana on multiple fronts.

With this in mind, it is quite understandable, and for obvious reasons that this approach will be less attractive and yield less favourable fiscal and economic value for multinationals relative to the host country, as well as, minimising the level of dominance, power and control that the multinationals normally enjoy in the current framework.

Recommendation

In considering the proposed model of an NOC that Guyana should pursue, the following should be considered in terms of structuring the model for Guyana:

i) With the hinted hybrid model of State-owned and Strategic investor, the ownership structure should be in accordance with the formula set out in the Local Content Act of 51/49;

ii) A Royalty of 5% from 2% in the current PSA framework;

iii) Concessionary tax rate of 25% with a five-year tax break given the capital intensive nature of the sector in order to maintain a relatively competitive fiscal environment for the strategic investor;

iv) The strategic investor to contribute the capital, technology and other resources including human resources at the Executive/Board level, as well as technical;

v) The goals of the NOC need to be aligned to the national development goals, and be framed using a combination of the cash cow, profit seeker and State supplement model.

It should be noted, too, that by virtue of setting up a National Oil Company, the governance function of the sector which is currently being carried out by the Ministry of Natural Resources, will be transferred to the NOC. This would be critical to allow for the ministry to focus primarily on regulating the sector as opposed to conducting both functions in the current framework which is not necessarily a desired governance and regulatory approach to continue into the future in the spirit of efficiency, and more importantly, accountability and transparency.

Against the backdrop of the analysis presented herein and weighing the pros and cons, it is highly recommended that Guyana pursue the option of a National Oil Company using all of the remaining oil blocks.

Author

Joel Bhagwandin

Director

Corporate Finance Advisory | SphereX Analytics

SPHEREX Professional Services Inc. | JB Consultancy & Associates

E: jbbankingadvice@gmail.com

M: 592-652-1995

W: www.spherexgy.com

LinkedIn: https://www.linkedin.com/in/joel-bhagwandin-57481470/

J.C. Bhagwandin is a Financial & Economic Analyst who has been providing insights and analyses on Guyana’s economic development, macrofinance issues and public policy for the past 5+ years. The views, thoughts and opinions expressed in this article belong solely to the author

.png)