–according to ECLAC report

AS was the case in countries the world over, Guyana’s economy was significantly impacted by the direct and indirect effects of the COVID-19 pandemic, prompting local authorities to increase spending in order to satisfy new and existing welfare needs while also sustaining the routine operations of the nation.

To offset a fiscal deficit, it is natural for governments to take loans in various forms, and it was no different in Guyana, where, within just a year, there were two budgets, Budget 2020, deemed to be an emergency provision, and Budget 2021, which amounted to $329.5 billion and $383.1 billion, respectively.

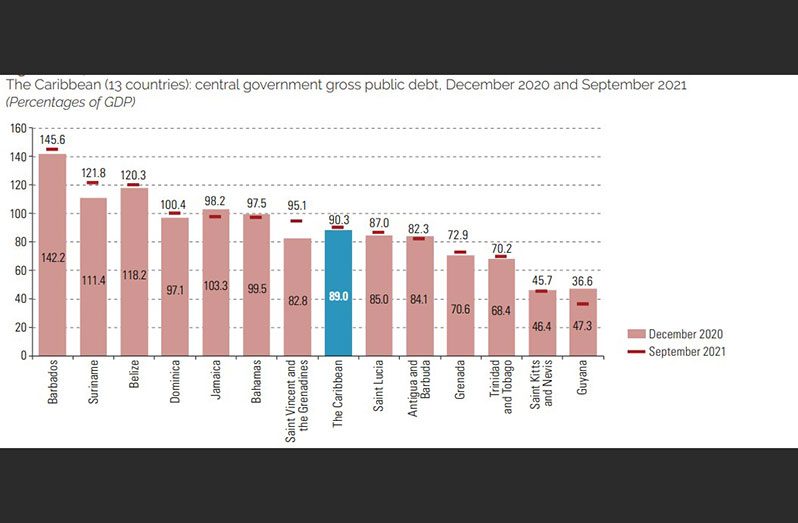

Even so, Guyana was able to maintain a positive standing in the area of debt management, recording the lowest gross public sector debt in the Caribbean. Public sector debt is defined as the total amount of debt owed by a government to its lenders.

According to the United Nations Economic Commission for Latin America and the Caribbean (ECLAC), in its latest report titled, “Preliminary Overview of the Economies of Latin America and the Caribbean 2021,” Guyana’s gross public sector debt represents 36.6 per cent of the country’s Gross Domestic Product (GDP).

This, the commission reported, is 11 percentage points lower than what was recorded at the end of 2020.

With this, Guyana stood out among its Caribbean counterparts, given that the regional average debt level was 90.3 per cent of GDP.

Based on information from ECLAC, Barbados recorded the highest level of debt, at 145.6 per cent of GDP, followed by Suriname at 121.8 per cent, Belize at 120.3 per cent and Dominica, 100.4 per cent of GDP.

Guyana, at the end of the first half of 2021, had reported that the financial system reflected monetary and financial stability, with moderate level of credit growth as well as a well-capitalised and profitable banking, insurance and pension industry.

The country, according to the Ministry of Finance’s website, is being guided by the Public Debt Policy 2021-2024.

According to the policy, the graduation of Guyana’s economy from lower middle-income to upper middle-income status has occasioned a decline in access to the concessional financing.

“This has necessitated a heightened focus on effective debt management in order to ensure the financing of Guyana’s development initiatives in a manner which simultaneously ensures long term sustainability. The policy covers all external and domestic public and publicly guaranteed debt, from 2021-2024,” the document stated.

Guyana’s primary debt management objective, based on the policy, is to ensure that the country’s financing needs, and its payment obligations are met at the lowest possible cost over the medium and long terms, consistent with a prudent degree of risk.

“Prudent risk management is integral to the cultivation of a stable macroeconomic outlook, as well as the avoidance of sharp increases in funding costs and dangerous debt structures and strategies (including monetary financing of the government’s debt).

“Furthermore, Guyana’s debt objectives shall be aligned with the need to cover its funding gap and the goal of long-term debt sustainability,” the document related.

RESILIENT ECONOMY

Owing to prudent management of the economy by the government, the country remained resilient against internal and external shocks in 2021, recording GDP growth of 18.5 per cent, according to ECLAC.

According to the report, the Latin America and Caribbean Region will see its pace of growth decelerate in 2022 to 2.1 per cent after reaching 6.2 per cent, on average, last year.

This slowdown, according to ECLAC, takes place in a context of significant asymmetries between developed, emerging and developing countries, with regard to the capacity to implement fiscal, social, monetary, and health and vaccination policies for a sustainable recovery from the crisis unleashed by the COVID-19 pandemic.

The report shows that the region is facing a very complex 2022: uncertainty regarding the pandemic’s ongoing evolution, a sharp deceleration in growth, continued low investment and productivity, and a slow recovery in employment.

The region is also facing the persistence of the social effects prompted by the crisis, reduced fiscal space, increased inflationary pressures and financial imbalances.

Guyana, however, is projected to withstand the impending challenges as a result of its burgeoning oil and gas sector and other lucrative productive sectors. The country, according to ECLAC, stands to record GDP growth of 46 per cent by the end of this year.

Responding to this latest projection, Senior Minister in the Office of the President with responsibility for Finance, Dr. Ashni Singh, said that this is a result of the work that the government has put into creating an investor friendly environment.

“We are pleased to see the positive revision in the World Bank’s outlook for Guyana. This is good news, but we are not surprised. This is in fact to be expected given our government’s strong policy stance as it relates to economic growth, to investment, to job creation and income generation for the benefit of all Guyanese,” Dr. Singh said.

He was reported as saying that the projection also reflects the continuous optimism in the Guyanese economy, not just by those of who are here in Guyana, but also by all those persons who are following economic developments in Guyana, including the international investment community and international agencies involved in the task of monitoring economic developments.

He recalled that when the People’s Progressive Party/Civic (PPP/C) was elected to office in August 2020, a lot of work had to be done to bring back investor confidence.

This was done, firstly, by keeping the population safe while containing the adverse consequences of the COVID-19 pandemic on economic activity, and which was combined with the political situation at the time.

He said there were several interventions aimed at stimulating economic activity, including injecting liquidity in the economy through the COVID-19 cash grant, reduction of taxes, and increased public expenditure in critical infrastructure projects.

.png)