A TOTAL of 130 countries backed the 15 per cent minimum global corporate tax rate proposed by United States (US) President Joseph Biden but Chairman of the Caribbean Community (CARICOM), Gaston Browne, said that this could result in challenges for Caribbean economies if no special provisions are made.

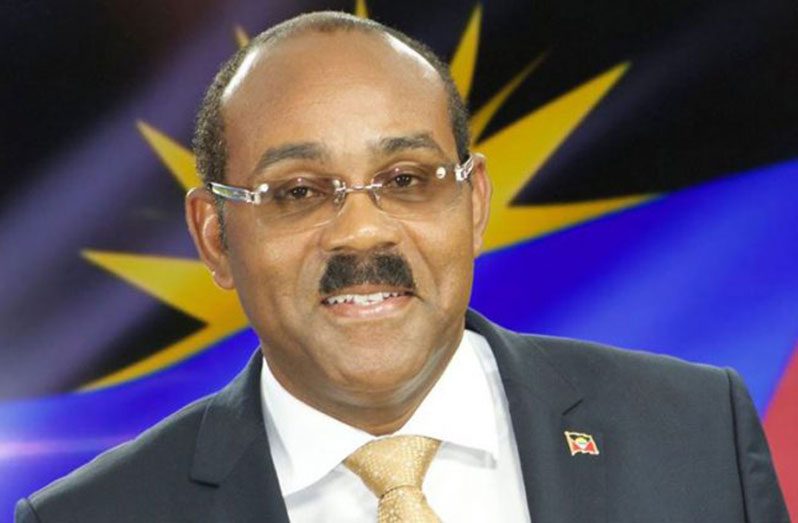

Browne, the Prime Minister of Antigua and Barbuda who is serving his six-month tenure as Chairman of CARICOM, expressed his concerns over this tax rate during a recent press conference, held at the end of the 42nd regular meeting of the conference of Heads of Government of CARICOM.

“In essence, we are very concerned of the potential impact of this proposed global corporate minimum tax on our revenue and the impact on the development of our people,” the CARICOM Chairman emphasised.

Though he stated that the Heads of Government would have an “urgent meeting” on the matter before the end of July, he indicated that CARICOM was already considering some special “carve out” or some “compensatory mechanism” if countries move ahead with the proposal.

The Organization for Economic Cooperation and Development (OECD) – the organisation guiding the negotiations on this minimum tax, – said that this minimum tax rate would generate $150 billion in additional tax revenue each year.

The Wall Street Journal has reported that this imposition of this tax rate is part of a wider overhaul of the rules for taxing multinational companies. With the backing of these 130 countries, those governments will now seek to pass laws ensuring that the companies headquartered in their countries pay the 15 per cent minimum tax in each country they operate. This is expected to reduce opportunities for tax avoidance.

Importantly, however, there are countries in the Caribbean – such as the Bahamas, the British Virgin Islands and Barbados – which are considered ‘tax havens’ due to their lower corporate income tax rates. This has attracted foreign direct investment and has allowed for these economies to garner revenues.

“The reality is that many of our countries, we have low-tax offshore sectors and the introduction of a 15 per cent (global minimum corporate tax) will result in a significant reduction of revenues and that in itself could undermine the development of respective countries and respective peoples,” Prime Minister Browne explained.

Already, it has been reported that several Caribbean countries, including The Bahamas, Jamaica, Bermuda, the Cayman Islands, and the British Virgin Islands are among 130 jurisdictions that have agreed to the outline of a two-pillar plan to overhaul the global tax system.

Barbados and St Vincent and the Grenadines are two of nine countries which did not come into agreement, however. Guyana was not listed on the document as a member of the OECD/G20 inclusive framework for this plan.

With some countries within the CARICOM expressing their support for this minimum tax rate, while others oppose it, Prime Minister Browne related, “We believe that, perhaps, the coordination on this issue may not have been the best but if this is allowed to go unchallenged and we do not advocate for a certain carve out for Caribbean countries or CARICOM countries then we could see a significant displacement in the region.”

He also said that no formal, legal commitments have been given as yet and as such, CARICOM members can still work to devise strategies to mitigate any potential risk or they can be advised to hold on further commitments.

“The idea is not to be contentious but to hold high-level dialogue with the policy makers in the G7 and the G20 to make sure our interests are protected,” he said.

The Prime Minister also emphasised that CARICOM is not “opposed, necessarily” to the global tax regime initiative but emphasised the need to protect Caribbean economies at the same time.

.png)