–World Bank says global commodity recovering slowly

OIL, like most global commodities, has taken a hit because of the novel coronavirus (COVID-19) pandemic, but the World Bank has reported that oil prices are recovering slowly and will return to pre-pandemic levels in 2021.

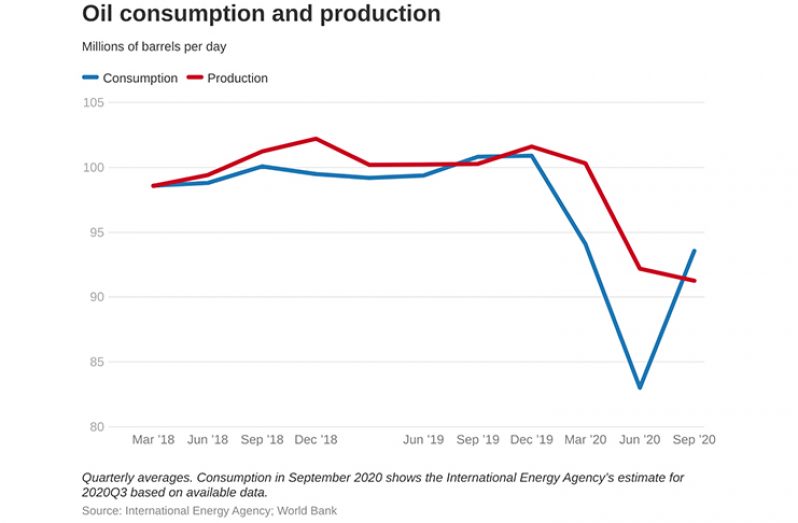

According to the World Bank’s Commodity Market Outlook report for October 2020, almost all commodity prices recovered in the third quarter of 2020, following steep declines early in the year due to the COVID-19 pandemic.

The energy sector, however, has not recovered well. In April, oil prices sharply declined (even going sub-zero for a short period) due to the reduced demand caused by the pandemic and the collapse of the “oil pact” to limit oil production between two of the globe’s largest oil producers: Saudi Arabia and Russia, which led to their oil flooding the global market.

According to the World Bank’s data, oil prices were $23.34 per barrel (Brent) and $16.52 per barrel (WTI) then. Prices have been slowly recovering since then and at the end of September, the prices were $41.09 (Brent) and 39.60 (WTI). These prices, the World Bank related, are only one third of the pre-pandemic levels.

The West Texas Intermediate (WTI) crude price is a benchmark used for US oil prices, whereas the oil-producing nations in this part of the globe (that is, Trinidad and Tobago, Guyana and

Suriname) use the Brent North Sea Crude, the international benchmark for oil prices.

“The pandemic is likely to have lasting impacts on oil consumption by changing consumer and employment behavior. Air travel may see a permanent reduction, as business travel is curtailed in favor of remote meetings, reducing demand for jet fuel. A shift to working from home could reduce gasoline demand, but this may be offset by increased use of private vehicles if people remain averse to using public transport,” the World Bank stated.

Previously, in an interview with the Guyana Chronicle, Senior Trinidadian Economist, Dr. Roger Hosein said that the current global decline in the demand for oil, resulting in lower-than-usual oil prices, provides a “valuable lesson” for Guyana on the volatility of the oil industry which it has now become part of.

.png)