…modernisation of NPS could save gov’t $6.5B annually

AN outdated financial architecture will soon be modernised with the passage of the National Payments System (NPS) Bill which seeks to introduce legislation for the establishment, regulation and oversight of a NPS.

After a fairly short debate on Thursday, the members of the National Assembly unanimously passed the Bill which both the Government and Parliamentary Opposition believe is necessary for the modernisation of the local financial system.

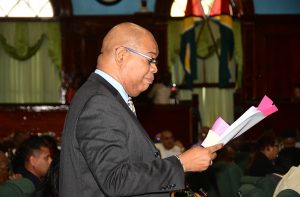

Finance Minister, Winston Jordan in his presentation of the Bill said the NPS does not only entail payments made between banks but also the total payment process which includes all systems, mechanisms, institutions, laws and so forth that come into play from the moment an end user, using a payment instrument, issues an instruction to pay another person or business through to the final inter-bank settlement of the transaction in the book of the Bank of Guyana (BoG).

The International Monetary Fund/World Bank Financial Market Infrastructure report had revealed that Guyana’s NPS is still coming into existence or as the minister said, “green”.

“Payment service mechanisms lack the needs of the economy… the NPS gaps include deficiencies in the underlying, legal and regulatory framework, inter-bank payment mechanism and retail services,” said Jordan.

The minister said it was no secret that most payment transactions require physical exchange of paper-based payment instruments and some manual processing. This was closely examined by Opposition Member of Parliament, Nigel Dharamlall who referred to the NPS plan of 2018 which highlighted that as of October 2015 there were 243 million payment transactions per year with cash accounting for 99 per cent of those payments.

“There is still no infrastructure to support electronic transitions including critical wholesale payments and securities settlement; inter-bank currency trade, money market transaction; collateral placement in government securities and government securities trading are executed bilaterally,” admitted Minster Jordan, adding that there was no market infrastructure to electronically record transactions, manage risks, provide market transparency or enable the Bank of Guyana (BoG) to monitor development on a timely basis.

That was the case although there were innovative retail payment services including bill payment and a growth and demand in electronic-money (E-money) services.

In an effort to ensure that those demands are met, Section XI of the Bill provides for the legal recognition of electronic records and electronic signatures. Clause 48 provides that electronic funds transfers and records of electronic funds transfers are enforceable and may be used as evidence. Clause 49 sets up additional conditions with which a payment service provider should comply to obtain a licence for the issuance of electronic money.

According to a World Bank study to which the minister referred, if Guyana modernises its payment system by introducing the electronic payments, Government could save $6.5B annually.

The minister argued that the previous system was so outdated that Government’s payments to employees and pensioners required a combination of in-person delivery of physical cheque or vouchers and electronic delivery of payment information.

“As such the payment system strategy will be geared at identifying the core payment infrastructure needs and developing a sound legal and regulatory framework and catalytic pillars for advancing the stage of electronic payments,” said the minister.

While those systems should be improved, the minister said it should be supported by organisation arrangements that leave room for the Bank of Guyana (BoG) to design and implement the strategy.

Over the past four years the Government has been trying to reform the NPS because the existence of a sound and predictable environment for payment is considered as a basis for a strong and efficient system.

The Bill also provides for the licensing of payment service providers and systems operators. The Bank is also given the power to impose individual conditions for the operation of systems and the provision of services, ask for information, and agree with the individual operator or payments service provider on limitations in the activity or specific protective measures or impose sanctions and withdraw the relevant licence.

Part IV of the Bill provides for the on-going oversight by the Bank. These powers are defined as broad and general to permit the bank of Guyana to diversify the levels of control according to each specific sector of the National Payments System. These include the power to audit, having access to all records and information, examining and inspecting where necessary the oversight of systems and payment service providers. Clause 17 provides that the Bank has the power to adopt measures of a general or individual nature.

While Opposition MP, Juan Edghill said the Bill will modernise Guyana’s financial architecture, he said some of the clauses were ambiguous and should be strengthened.

Edghill however said aside from that, the NPS provide benefits for persons not only on the coast but also create opportunities for persons living in the hinterland.

Minister within the Ministry of Finance, Jaipaul Sharma pointed out that a lack of an efficient national payment system impeded the ability of commercial banks to provide adequate services to their clients

Guyana, he noted, is however moving towards advanced payment methods since it falls short of meeting the financial needs of citizens..

.png)