…GRA says billions of dollars recouped, PPP years lawless

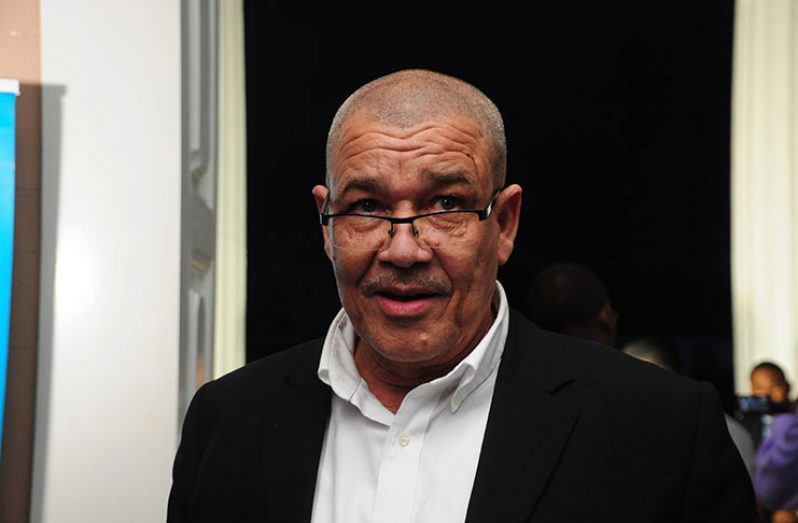

COMMISSIONER-GENERAL of the Guyana Revenue Authority (GRA), Godfrey Statia, said that billions of dollars in revenues have been recouped from seizures of illegal fuel over the past three years, as the GRA continues to dent the ‘Black Market’ with support from its sister agencies.

While combating smuggling of fuel and other contraband remain an uphill task, Statia ‘shot down’ claims by Leader of the Opposition Bharrat Jagdeo that the revenue body is utilising “a slap-on-the-wrist” approach in addressing the issue. In the Sunday, February 10, 2019 Edition of the Kaieteur News, the opposition leader accused the GRA of encouraging fuel smuggling. On Wednesday, the commissioner-general set the record straight on the issue of smuggling in Guyana, even as he expressed disappointment over sentiments expressed by the opposition leader.

Noting that fuel smuggling is just one of the many areas of revenue loss to the authority and the country by extension, the commissioner-general said the inherited system of licensing and exemptions, and the lack of human and physical resources and the cohesion between sister agencies, allow for this activity. “The GRA has long recognised that smuggling is rampant and that the country loses billions of dollars as a result of this illegal practice. At the level of customs, under-invoicing and over-invoicing, misclassification of imports, related party transactions and transfer pricing many times go unnoticed by officers either through collusion, lack of equipment, knowledge and training or downright laziness.

Coupled with the societal norm of the belief of having to “give a raise” to get things done, taxpayers continually contribute to this continued state of affairs, which in the majority of cases are [sic] needless, since the “raise paid” exceeds the taxes that would have been payable should the taxpayer “not pay the raise,” Statia explained.

CORRECTIVE ACTION

He said that being cognisant of the issues, the GRA has taken corrective action to bolster resources and foster more collaboration with sister agencies to safeguard and protect borders from nefarious activities. Statia pointed out that since he took office in 2016, the measures put in place have allowed for billions of dollars in revenue to be recouped from seizure of illegal fuel alone.

“In Region One alone, over $375M was collected from fuel smuggling in 2018, while the Law Enforcement and Investigation Division (LEID) recovered over $600M in duties, taxes and fines, of which $124M was a result of fines, and $119M from sales and auctions from seizures,” he said.

Having reinforced its presence at the frontier locations and shifted much of its Revenue Protection and Risk Management focus away from low-risk and trusted traders, the GRA has been able to zero in on high-risk traders and smugglers.

The commissioner-general said that while the GRA agrees that Section 205 of the Customs Act Chapter 82:01 enables it to place persons before the courts and have them imprisoned for no less than 12 months and not more than three years once convicted, such approach would clog the court system.

“The authority…recognises that if everyone who breaks the law, either through ignorance, or purposely so, with the intent to defraud the revenue, the entire court system will be clogged. Industry, manufacturing and commerce will be brought to a halt,” Statia said.

He added “We live in a society where laws are broken by the very persons who are selected or elected to uphold them, and yet require a higher standard from the humble public servant.”

However, it was noted that the majority of cases taken before the courts were either not timely heard or were dismissed for one reason or another. While the authority awaits decisions from the court, the assets are left to languish at the warehouse or ‘at sea” at the GRA’s expense, and are often unfit for operation thereafter.

“From 2017, in light of the numerous cases for which legal action was being considered, the authority made a considered decision to adopt a more reasonable and consistent approach to breaches in the law, thereby allowing the GRA to broaden its pursuit of more offenders, and allow for certain cases for the offenders who wish to settle their matters in lieu of court proceedings to pay fines, with the severity of fines being increased with the frequency of these offences, and severe infractions leading to court action,” the commissioner- general said.

The decision, he noted, is in accordance with Section 271 of the Customs Act. That section states: “Notwithstanding any other provisions of this Act, the comptroller may, in any case he deems proper and in substitution for any proceedings in a court of summary jurisdiction, accept on behalf of the State a sum of money by way of compensation from any person reasonably suspected of a contravention of the Act or any regulations made thereunder: provided that such compensation shall be accepted only where the person reasonably suspected of such contravention has expressed his willingness in the form prescribed by the comptroller that the contravention as aforesaid shall be so dealt with.”

Based on the system established by GRA, first-time offenders are required to pay a fine equivalent to one (1) time the Customs Duty and Taxes; second offenders are required to pay a fine equivalent to three (3) times the Customs Duties and Taxes. In the case of third-time offenders, they are required to pay fines equivalent to three (3) times the value of the goods; and in the event, there is a recurrence, legal proceedings are instituted against the respective offender(s).

“This system is consistently applied across the board, and I will be the first to admit that in some instances it is abused. However, “the slap on the wrist” implies that there is information out there on some defaulters that the GRA is not privy to,” Statia said.

The Authority, he said, would be most grateful for any information on acts of fuel smuggling so as to enforce the penal system. The whistleblower policy allows for information to be held in strictest confidence, he assured.

Contrary to the sentiments expressed by the opposition leader, the GRA Commissioner-General made it clear that the authority takes no political directive in the administration of the tax laws.

“Though created by the government through legislation in 2000, to say that it is a “creature” of this government,” is a misnomer. The Authority has a governing board, and as of July, 2016 to now, I can say with conviction, that no such control has been so exercised by this government,” he said.

Contending that the statements made by the opposition leader was at least most unfortunate, and irresponsible, Statia said Jagdeo should have known better, having served as finance minister with the overall responsibility of the Revenue Authority. As a former President, he is fully aware of the vision, mission and the core principles of GRA, the commissioner said.

.jpg)