-companies providing services on behalf of gov’t to be inspected, those found in breach could lose their contracts – Jagdeo

GUYANA’S National Insurance Scheme (NIS) will be conducting an inspection of security companies providing services to government agencies across the country.

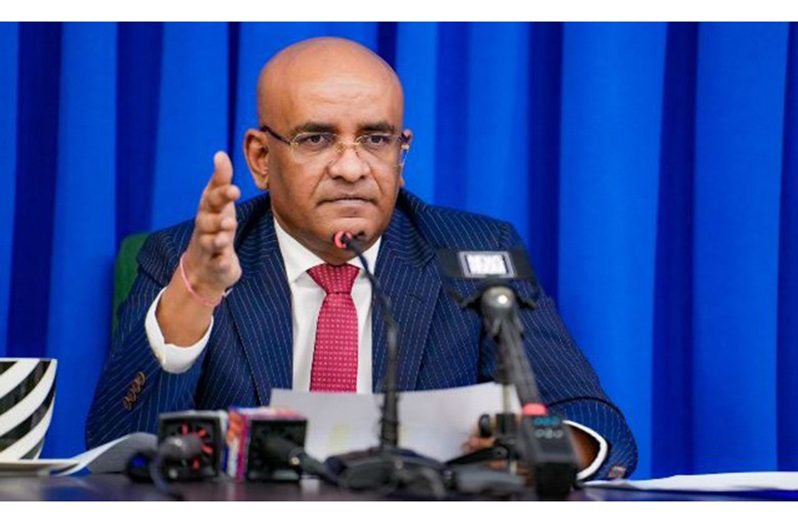

This is according to Vice-President, Dr. Bharrat Jagdeo, who noted that the government would flag those companies who fail to remit NIS deductions.

At a recent news conference, Jagdeo told reporters that several citizens employed by various security companies across the country have complained that payments are being deducted from their salaries; however, their employers are not remitting these to NIS.

This was among several major concerns raised during a recent government outreach, Jagdeo disclosed.

“One issue that has been coming up, quite a bit, is how people are treated by these security companies. A lot of the companies that provide security for the government in different parts of the country, many of them have a habit of deducting NIS payments but not making the payments, “he said.

“If they (employees) later have an injury or something of this sort, when they go to the NIS, they can’t receive benefits. So, we have ordered the NIS to have an inspection of all of these companies that are providing service on behalf of the Government of Guyana who have had contracts, and we’re expecting a report in two weeks’ time. And should we have an adverse finding in relation to particular companies on this matter they run the risk of losing their contract,” Jagdeo explained further.

Only recently, Attorney-General (AG) and Minister of Legal Affairs, Anil Nandlall, had issued a strong warning to employers, reminding them that it is a criminal offence to withhold National Insurance Scheme (NIS) contributions from employees without remitting them to the NIS.

“The security companies, they get paid for a service. They have to pay the people who are working for them, and they have to also ensure and pay them on time and ensure that their deductions for taxes and for the NIS, especially NIS, that those are remitted,” Dr. Jagdeo added.

Following a recent ruling by the local courts, the Attonery General reminded that while employers are allowed to make NIS deductions from their employees’ salaries, a failure to pay over those monies to the NIS constitutes a criminal offence.

Nandlall had raised this issue while addressing circulating reports regarding an appeal filed by NIS against a High Court decision.

In that decision, High Court Judge, Damone Younge, ordered the NIS to pay a pension to Sharif Zainul, a former employee of Toolsie Persaud Limited (TPL).

Nandlall explained that the appeal was not initiated by the Attorney General’s Chambers but by the NIS itself, shedding light on critical aspects of the case.

“No such appeal was filed by the Attorney General’s Chambers. An appeal has been filed, but it has been filed by the National Insurance Scheme.”

Zainul, through his legal representatives, solely sued the NIS, neglecting to include his employer.

He highlighted the crucial issue at hand: Toolsie Persaud Limited was not made a party to the proceedings, and the appeal seeks to address this omission.

“The NIS records show that no remissions were made by the employer to the NIS. The gentleman apparently had records that were produced to the court to establish that deductions were made from his wages or salaries.

“However, the NIS records do not establish that those deductions were actually paid over to NIS, and that is the problem with the case. Because we know, you know that there are many employers who are actually deducting NIS payments from employees,” he said.

As such, the AG warned that deducting NIS payments from employees but failing to remit those payments to the NIS constitutes a criminal offence under the law.

NIS extends Social Insurance Coverage on a compulsory basis, to all persons between the ages of sixteen (16) and sixty- (60) years who are engaged in Insurable Employment.

According to NIS’ website both the Employer and Employee pay Contributions into the Scheme based on a ‘Payroll System’. The total Contribution for Employed Contributors is 14 per cent of the actual wage/salary paid to the employee. This is derived from a 5.6 per cent deduction from the employee’s pay, and the remaining 8.4 per cent paid by the employer on behalf of the employee. The actual wage/salary is, at present, subjected to a ceiling of $280,000.00 per month or $64,615.00 per week for national insurance purposes.

.jpg)