– Minister Singh says,

– notes momentum fuels interest from international financial institutions

GUYANA’S economy has been flourishing with an impressive average growth rate of 10 per cent in recent years, primarily due to its booming oil and gas sector. As a result, international banks now have promising opportunities in the country.

While detailing Guyana’s economic landscape during his presentation at this year’s Energy Conference and Supply Chain Expo, on Wednesday, Senior Minister in the Office of the President with Responsibility for Finance, Dr. Ashni Singh, highlighted the country’s rapid growth and the substantial impact this has had on the banking and financial sectors.

He pointed out the significant changes in the country’s banking landscape, particularly in relation to the increasing credit offered to the private sector.

The Minister pointed to his chart, which shows growth in credit to the private sector spread across several sectors, underscoring the diverse growth in lending for home ownership, agriculture, and other household activities.

This expansion, Minister Singh explained, indicates a robust response from the domestic financial system to the burgeoning needs of the country’s economy.

He further highlighted that the growth in credit was not just a quantitative leap but also a qualitative one, as the domestic banks, despite being relatively small, have been responding within their capacity.

However, this growth also opens opportunities for international banks in Guyana.

“There’s a limit beyond which the domestic banks have been responding… and so there’s an opportunity even for international banks in Guyana,” Dr. Singh remarked, highlighting the potential for increased international banking presence in response to the country’s economic dynamics.

The finance minister also pointed out the significant role of multilateral and international financial institutions, such as the World Bank and the Inter-American Development Bank (IDB) Bank, which have notably increased their lending to the private sector in Guyana.

This involvement of international players, he said, underscores the country’s growing credibility and attractiveness as an investment destination.

Moreover, the minister elaborated on the private sector’s robust response to the conducive economic environment created by the government.

He noted the remarkable growth in home loans for homeownership, a direct response to the government’s housing programme, signifying the sector’s almost risk-free lending environment.

“Nobody wants to lose their home,” he said, explaining the low default rates on home loans in Guyana, which enhances the attractiveness of the sector for banking investment.

Dr. Singh, in his presentation, explained that the country is on the brink of a financial revolution, buoyed by its strategic economic reforms and burgeoning oil and gas sector.

With the government’s targetted investment in public capital goods and infrastructure paving the way for sustained growth, he posited that the banking sector in Guyana was poised for expansion, offering significant opportunities for both domestic and international investors.

The minister explained that the transformation in the banking sector mirrors the larger economic success story unfolding in Guyana, positioning it as a premier destination for investment in the region.

He explained that the nation has seen an extraordinary surge in its economic activities, primarily fuelled by significant discoveries and developments in the oil sector.

With an impressive average economic growth rate of 10 per cent over the past three years, Guyana stands out as one of the fastest-growing economies globally.

The heart of Guyana’s economic success lies in its strategic management of the burgeoning oil industry.

“We are producing in excess of 600,000 barrels of oil per day right now,” stated Dr. Singh, highlighting the rapid escalation of oil production capacities.

He pointed out that the country is not resting on its laurels; with ongoing exploration and a recent licensing round, there is every expectation that proven reserves and production trajectory will continue to climb, solidifying Guyana’s position as a significant player in the global oil market.

The Minister highlighted the government’s commitment to responsibly harness this oil windfall.

In February, Parliament approved the historic $1.146 trillion budget which is aimed to deliver accelerated improvement to the lives of Guyanese and development.

It was the third budget that will benefit from financing from the proceeds of Guyana’s new and emerging oil-and-gas sector,

The National Assembly had approved the Fiscal Enactments Bill which balances immediate withdrawals and long-term savings from the National Resource Fund (NRF) which will support public infrastructure and social services development.

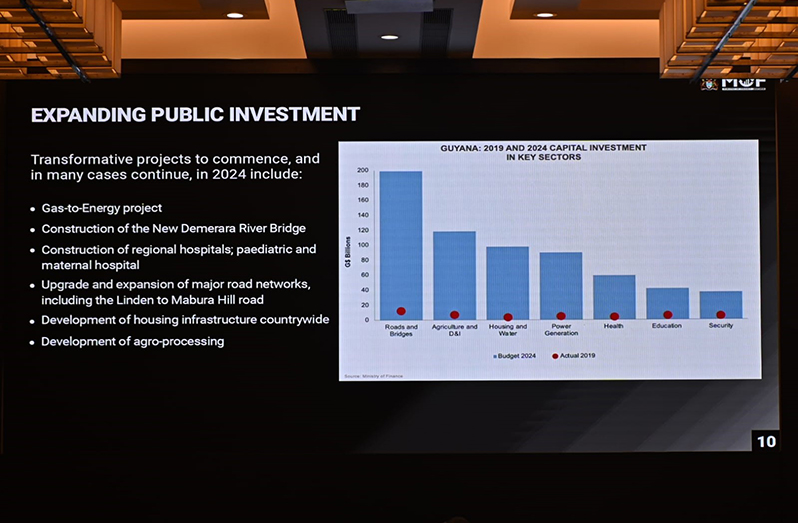

With allocations from the budget, sectoral investments are being channelled into public capital goods and infrastructure, including roads, bridges, and healthcare facilities, aimed at catalysing long-term economic growth and improving the citizens’ well-being.

“We are strongly outperforming the rest of the world… our economy has more than tripled in size,” he asserted, showcasing the transformative impact of these investments.

Furthermore, the government is not only concentrating on oil but is also actively expanding its economic base to ensure sustainable development.

Initiatives are underway to boost agriculture, aiming for self-sufficiency in crops like corn and soybean, and to develop a competitive ICT sector. These efforts reflect a broader strategy to build a globally competitive, non-oil sector.

In terms of fiscal management, Guyana has demonstrated remarkable prudence and foresight.

The Minister proudly noted the significant reduction in the nation’s debt-to-GDP ratio, from over 600% in the late 1980s and early 1990s to less than 30% today.

This achievement is particularly noteworthy considering it was accomplished before the oil boom, indicating a long-standing commitment to fiscal health and economic stability.

The strategic geographic location of Guyana further enhances its appeal to investors. Dr. Singh pointed out, “We are literally 45 minutes by air away from Trinidad and Tobago… and very soon, an eight to 10-hour drive away from northern Brazil.”

This positioning, he explained, is seen as an asset, potentially establishing Guyana as a regional hub for various industries, especially for businesses looking to capitalise on the burgeoning oil and gas sector.

Guyana’s approach to economic development and fiscal management, as outlined by Dr. Singh, serves as a compelling model for resource-rich countries worldwide.

By prioritising sustainable growth, diversification, and strategic investments while maintaining robust fiscal discipline, Minister Singh pointed out that Guyana is not just navigating its current economic boom but is also laying the groundwork for continued prosperity and stability in the years to come.

.jpg)