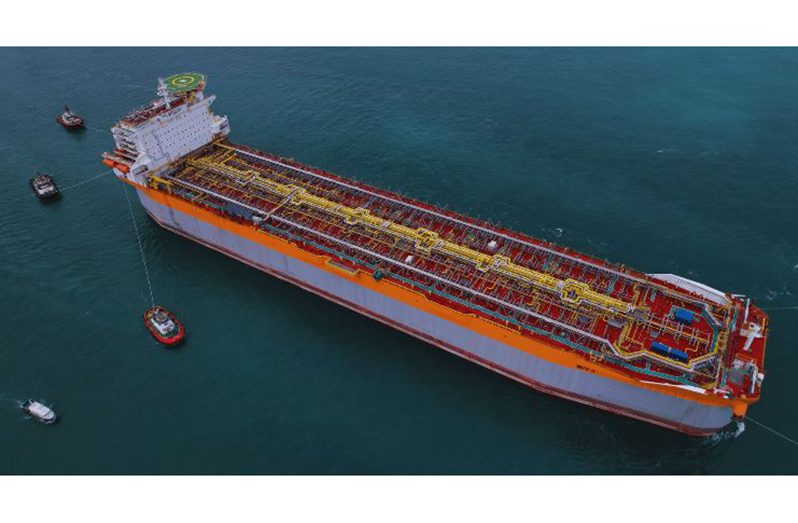

THE ‘ONE GUYANA’ Floating Production Storage and Offloading (FPSO) vessel is expected to leave Singapore for Guyana next year, according to ExxonMobil Guyana President, Alistair Routledge.

During a recent press conference at the company’s Kingston, Georgetown office, Routledge explained that the vessel, which is still under construction will set sail for Guyana’s shores around the end of the first quarter of 2025.

“The hull is fully constructed. The first module has been lifted onto the topside, it comes out of the drydock, and now all the other modules that need to go onto the topside of the FPSO are being finalised and added on,” Routledge said.

The vessel, which is currently drydocked at the Keppel yard in Singapore, is a project within the Stabroek Block offshore Guyana, operated by ExxonMobil. Its design is based on SBM Offshore’s industry leading Fast4Ward® programme that incorporates the company’s new build, multi-purpose floater hull combined with several standardised topsides modules.

The FPSO will be designed to produce 250,000 barrels of oil per day and will have associated gas treatment capacity of 450 million cubic feet per day and a water injection capacity of 300,000 barrels per day.

The FPSO will be spread moored in water depth of about 1,800 metres and will be able to store around two million barrels of crude oil.

ExxonMobil will take ownership of the FPSO upon completion. The vessel will be part of the Yellowtail development project, which includes six drill centres and up to 51 wells.

In March 2023, SBM hosted the Steel Strike Ceremony at Industrial Fabrications Incorporation (InFab) on the East Coast of Demerara, to signal the commencement of work by the companies—InFab, Guyana Oil and Gas Support Services Incorporated (GOGSSI) and Zeco Group of Services.

The estimated investment for the ‘ONE GUYANA’ FPSO vessel is reported to be approximately $10 billion.

ExxonMobil Guyana Limited continues to exceed expectations in oil production. With a current daily output of 645,000 barrels of oil, the company has surpassed its initial targets.

The operations are spread across three FPSO facilities – Liza Destiny, Liza Unity, and Prosperity – all of which are operating beyond their nameplate capacities. The ‘ONE GUYANA’ vessel will bolster these production numbers.

The year-end goal is to reach a total cumulative output of 500 million barrels, marking a major milestone for Guyana since the start-up in the Stabroek Block five years ago.

Also on the front burner, ExxonMobil is gearing up this year for an ambitious exploration and appraisal campaign in the offshore Stabroek Block, with plans to drill at least seven wells this year.

Out of the $29 billion invested, the company has recouped approximately $19 billion, leaving an outstanding cost of $10 billion.

As cost recovery completes, Guyana’s share of revenues will increase from 14.5 per cent to nearly 52 per cent, significantly boosting the country’s income from its oil resources.

Since beginning operations in 2018, ExxonMobil and HESS have made a substantial investment in the country, with Routledge detailing the figures involved.

Under the terms of the Production Sharing Agreements with ExxonMobil Hess, Guyana receives a two per cent royalty on pre-cost revenues and 50 per cent of profits, with a 75 per cent cap on revenues used for cost recovery.

This arrangement has allowed Guyana to earn over US$1 billion so far. While costs are still being recovered, Guyana’s government typically sees about 52 per cent of profits, equivalent to 14.5 per cent of total revenues.