Introduction

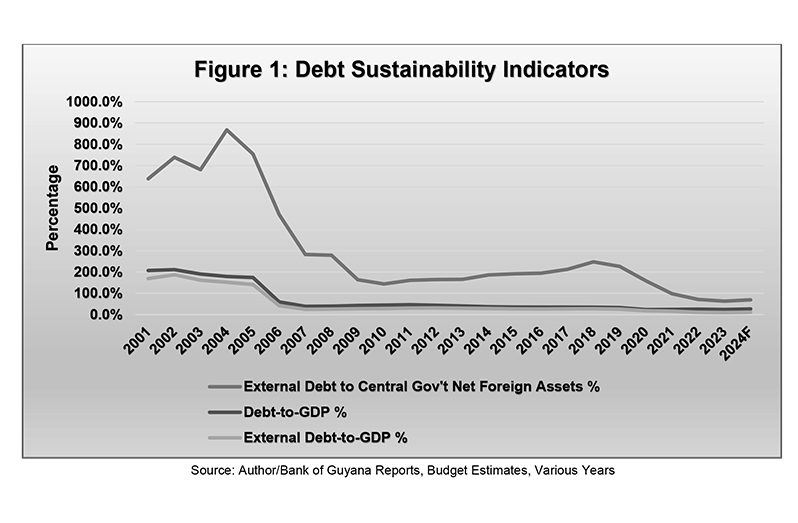

THE national budget for 2024 is financed by 37% debt, including both domestic and external sources, which translates to a fiscal deficit of 8.5% of GDP. The political opposition contends that the level of increase in the debt may not be sustainable, a view which is endorsed by other segments of commentators within the public sphere. However, this author contends that the proponents of this view have failed to examine the broader debt sustainability framework, which would show, as illustrated herein, that all of the debt sustainability indicators are well within the low-risk category. More importantly, the impact of debt on the economy’s productive output, both within the context of the public and private sectors’ context, as well as household income have been ignored. This article seeks to address these dimensions of the discussion and analysis.

Global Context

Total global debt (public plus private debt stocks) declined 10 percentage points of GDP and reached 238% of GDP in 2022. In U.S dollars, global debt remained stable at US$235 trillion. The fall in public debt slowed compared to the previous year, as it fell 3.6 percentage points of GDP to 92% of GDP in 2022. The fall over the last two years reversed about half of the surge during the pandemic. Private debt by households and non-financial corporations made the largest contribution to the overall decline, as it dropped to 6.4 percentage points of GDP to 146% of GDP in 2022. In many countries, especially in advanced and emerging markets, excluding China, private debt is now below pandemic levels.

The two years of large declines, amounting to 20 percentage points of GDP, only partially reversed the spike from the pandemic, as global debt remained 9 percentage points above its pre-pandemic level in 2022. Global debt appears to have returned to its historical upward trend. Managing debt vulnerabilities should be key.

Discussion and Analysis

Debt is neither bad nor good. Debt facilitates the creation of wealth, viz-á-viz, increasing the money supply, thereby increasing wealth. But debt has to be managed sustainably because there are multiple risks associated with debt. When debt is undertaken to finance consumption expenditure, this should always be contained to a minimal extent. Consumption activities do not generate future income streams. Debt financing, on the other hand, when channeled towards productive activities that would generate and expand future income streams is necessary, albeit within a sustainable framework.

With that in mind, debt is not an isolated, absolute variable. Debt is dependent on other variables. Primarily, debt is relative to (1) the productive capacity (potential future revenue streams) and productive output (current levels of production) of a country in the case of public debt, of a firm in the case of corporate debt, of an individual in the case of household debt. Thus, debt is also relative to (2) the revenue (cash flow) derived from the productive activities, and (3) relative to the market value of total assets utilised to generate the productive output when put to work. Generally, these are the fundamentals that are of key importance to always bear in mind when conducting a debt sustainability analysis, whether it is within a household context, corporate context, or a country’s context.

In the case of a country, the productive assets of a country include the physical resources, human resources (population), and the natural resources. The productive activities carried out by individuals, firms, and the State/Government, in turn generate national income and/or wealth for the country, its people (households) and firms (Gross Domestic Product (GDP)).

Over the last two decades (2001-2023), total public debt increased threefold (from $276b to $940b). Considering this, it is worth noting that for the same period, GDP (the economy’s productive output) increased by nearly thirtyfold (2,829%) or 10x the level of increase relative to public debt; non-oil GDP (the non-oil economy’s productive output) increased ninefold (827%) or 3x the level of increase relative to public debt; central government revenue increased twelvefold (1,110%) or 4x the level of increase relative to public debt; household net income increased twelvefold (1,080%) or 4x the level of increase relative to public debt; business enterprises net income increased eighteenfold (1,676%) or 4x the level of increase relative to public debt; and altogether, national income increased thirteenfold (1,209%) or 4x the level of increase relative to public debt.

In light of the foregoing, wherein the level of debt employed is relative to other factors such as current levels of income and productivity as well as future income earning potential, based on the investments undertaken therefor. The economy’s productive, income and/or wealth generating capacities have far outpaced the level of debt undertaken that was partially attributed to these outcomes.

Therefore, it is safe to conclude that Guyana’s public debt indicators are well below the low-risk category in accordance with the IMF risk profile benchmarks, whereby countries with a debt-to-GDP ratio of <50% are considered low risk, 50-90% are considered moderate risk and >90% are considered high risk. To this end, public debt-to-GDP ratio is 24% as of 2023, which is projected to increase by three (3) percentage points at the end of 2024. The public debt service indicators are also well within the low-risk range, with a debt service-to-revenue ratio of 6% and non-oil revenue of 9.5%, down from a high of 125% in 2001.

Moreover, Guyana’s total debt, which includes both public and private sector debt represented 35% of GDP at the end of 2023. This is 203 percentage points below the global debt-to-GDP as of 2022, which stood at 238%. The global public debt-to-GDP was 92% in 2022, whereas Guyana’s public debt-to-GDP is less than 30% of GDP, about 65 percentage points below the global level.

Conclusion

Taken together, all of Guyana’s debt indicators are well within the low-risk range and more importantly, far below the global levels. This trajectory is expected to remain in the low-risk range over the near to medium term.

About the Author

___________________

Joel Bhagwandin, MSc., is the Director of Financial Advisory, Market Intelligence, and Analytics at SphereX Professional Services Inc. SphereX provides in-depth analyses on national cross cutting issues surrounding public policy, business and finance in Guyana, and regional and global issues in economics and finance. The views, thoughts and opinions expressed in this article belong solely to the author.

.jpg)