KEY FACTS ABOUT THE GOVERNMENT’S HOUSING PROGRAMME:

The Low-Income Mortgage Program was introduced about sixteen (16) years ago under former President Dr. Bharrat Jagdeo (Now Vice President), with a maximum ceiling of $8 million.

The average interest rate (below the average lending rate of about 10 per cent-16 per cent) is 5.25 per cent. This low interest rate which in turn enabled access to affordable financing for new low-income families was made possible through an arrangement brokered between the Government and the banks whereby the Government waived the taxes payable on the interest earned on home loans.

The maximum repayment period is 30 years.

The equity homeowners/borrowers are required to inject is about 10 per cent-20 per cent.

Additionally, there is a Mortgage Interest Relief (MIR) program implemented by the PPP/C Government whereby eligible applicants (first time homeowners and the principal amount borrowed must not exceed $30 million), such persons shall be allowed a deduction of interest paid on housing mortgage loans from their chargeable income.

The average annual interest paid on an $8 million loan would work out to about $262k and in the case of a $20 million loan would work out to $655k. The total loans and advances to households including home improvement loans, education, travel, personal and others at the household level, stood at $16 billion in 2007, which increased to $40 billion or by $24 billion in 2023, representing an increase of 153 per cent from where it stood 16 years ago.

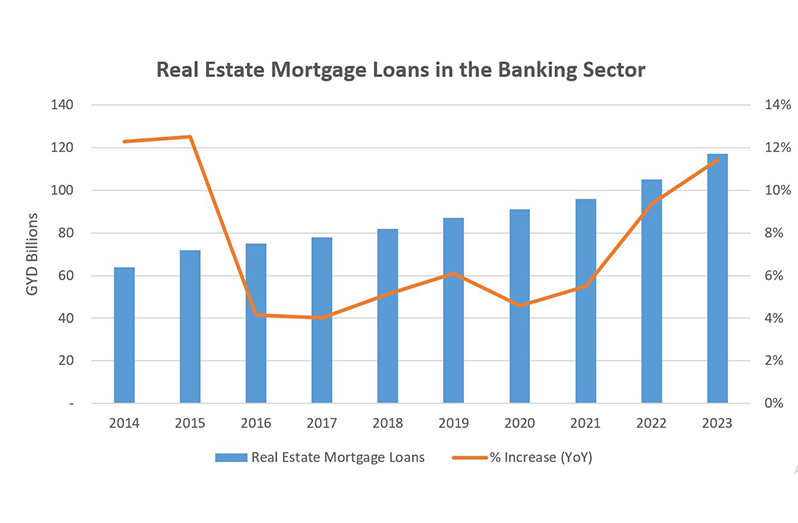

Real Estate Mortgage Loans increased from $56.6 billion in 2013 to $117 billion in 2023, reflecting an increase of $61 billion or 110 per cent for that period. This is indicative of steady growth attributable to the fact that the low-income home ownership programme is most effective, such that low-income families can afford to borrow and access loans to own their own homes at below market rates.

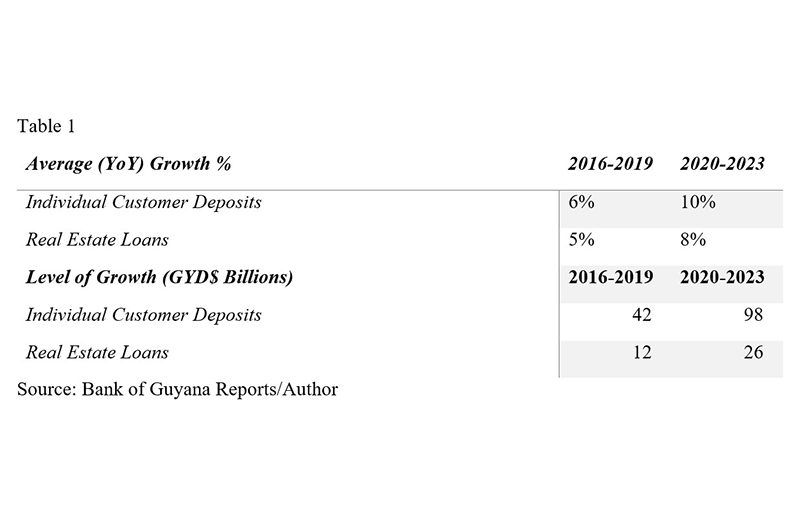

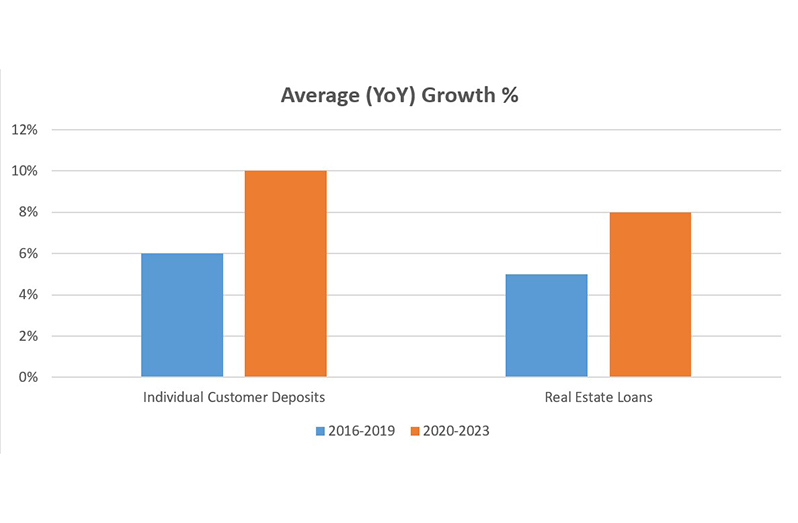

The growth in the individual deposit portfolio and real estate loans in the commercial banking sector are indicative of increased levels of disposable income, as shown in the comparison between the period between 2016 and 2019 relative to 2020-2023.

To this end, the average year-over-year (YOY) growth in individual customer deposits for the period 2016-2019 was six per cent, and real estate loans was five per cent. In monetary value, the level of increase recorded was $42 billion and $12 billion respectively for this period.

Conversely, for the period 2020-2023 individual customer deposits reflected stronger growth at an average YOY rate of 10 per cent and real estate loans at an average YOY growth of eight per cent. In monetary terms, this increase was $98 billion and $26 billion respectively, reflecting a growth rate that was more than two-times the growth rate recorded for the corresponding period.

This outturn is an indication of the impact, altogether, of the economic policies and interventions administered by the government, coupled with the unprecedented vibrant growth in the overall economy.

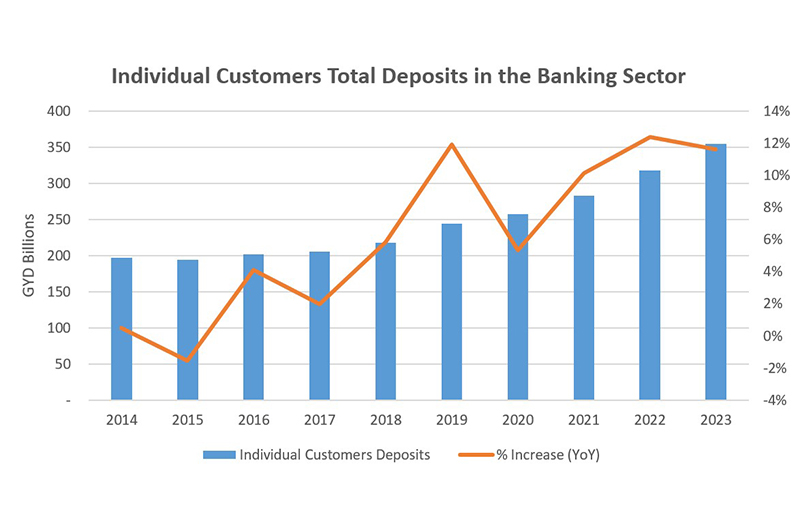

Individual customer deposits in the commercial banking sector grew from a position of $197 billion in 2014 to reach $355 billion in 2023, reflecting a cumulative increase of $158 billion or 80 per cent.

Long Term Investment in the Economy to Improve National Competitiveness. For the period 2020-2023, the Government invested approximately $800 billion or an average of $267 billion annually aimed at increasing the national productive output and improving national competitiveness in the economy.

The aforesaid are investments in transforming, for example, the energy landscape (the gas-to-energy project), developments in the infrastructure sector, the economic services sector, and regional development.

DIRECT AND INDIRECT BENEFITS ACHIEVABLE THROUGH THESE INVESTMENTS INCLUDE, FOR EXAMPLE, GAS-TO-ENERGY PROJECT:

Halving electricity cost, translating to increased disposable income, lower production cost for the manufacturing sector, thereby transferring approximately $20 billion into household savings annually.

Annual savings in foreign exchange of an estimated US$300 million.

Enable structural transformation from a predominantly primary producing economy to more of a tertiary producing economy by way of greater national competitiveness.

Overall, the estimated direct and indirect benefits of $200 billion annually.

KEY BENEFITS: INVESTMENT IN ROAD AND BRIDGE INFRASTRUCTURE

Improved efficiency (efficient transportation and logistics, movement of goods and people).

Reduction in transportation and logistics costs on all levels, household, commercial and industrial.

Improved connectivity and accessibility.

Boost to local businesses.

Opening up of new opportunities, access to additional / new resources, such as land.

Real estate value appreciation.

Long term cost savings

CONCLUSION

The sum total of the immediate relief measures including foregone revenue to the treasury, amounts to an estimated $189 billion annually, representing 6.45 per cent of overall GDP (2022), 24 per cent of the national budget (2023), and 63 per cent of the NRF Balance as at the end of 2022.

Overall, the resultant effect (indirect + direct impact) of all of the immediate cost of living measures combined for an average household with a low-income mortgage that would be eligible for the MIR (a direct benefit),

approximates to an annual average additional disposal income of $1.4 million or $117k/monthly, albeit indirectly.

.jpg)