By Joel Bhagwandin, MSc.

GUYANA is projected to experience sustained double-digit growth over the next decade with continued oil production and exploration.

The government is pursuing an expansive economic diversification and transformative development agenda. Macroeconomic stability, high investors’ confidence―and from a global perspective, perceived low-to-moderate political risk―are the hallmarks to achieving the transformational development that the government is advancing.

On July 5, 2023, this author participated in a debate organised by the students’ association of the University of Guyana against Economic Adviser to the Leader of the Opposition, Elson Low. The moot of the debate was “Guyana is not on the right path to development given its newfound oil resources”. Elson Low was proposing, and this author was opposing.

One would expect that given the moot, Elson Low would have presented a blueprint of an alternative development path―which he failed to do.

His argument was deeply incoherent and lacked substance, such that even a third form secondary school student by the name of Reginald Brown from St Stanislaus College, recognised the weakness of Low’s arguments. The student posed the following (brilliant) question to him (Low) during the floor debate segment:

“What would be an alternative development path you’d propose and what sectors would you prioritise?”

In response to the student’s question, Elson Low visibly fumbled and exhibited nervousness. But to appear smart, he rambled and bluffed his way stating that “there should be no poverty that we need to model a vast amount of scenarios, he thinks tourism has some potential, and manufacturing…” And he rambled on for about three minutes and could not have answered the question.

At minimum, it was expected of him to use the opportunity to expand on the Opposition Leader’s 10 points plan he presented in the National Assembly in his budget 2023 debate, as his substantive arguments. Disappointingly, he did not. The debate would have been a bit more interesting had he done so.

So, again, one has to ask, where is the opposition’s alternative blueprint? To argue that Guyana is not on the right path of development, is effectively arguing against transformational projects such as the gas-to-energy, the new road networks (four-lane highways) across the country, a secondary city (Silica city), the reintroduction of railways, the Low Carbon Development Strategy, new modern hospitals across the country, the 20,000+ scholarships, road connecting Lethem to Georgetown so that Northern Brazil international markets through Guyana, leading to Guyana becoming a transshipment/trading hub aided by the deep-water ports, the regional food and energy security agenda, and positioning Guyana as a strategic and geopolitically important country within the Region (CARICOM), South America and Globally, etc.

DISCUSSION AND ANALYSIS

In my presentation, I argued that Guyana’s development path is a journey that began three decades ago under the current government, and that development is not an overnight process. In so doing, I highlighted Guyana’s economic history, how the economy evolved, and some of the key developmental challenges and needs. In this regard, reference was made to the 1996 National Development Strategy (NDS), which was not prepared by a United Nations intern, but, over 200 Guyanese stakeholders, including the political opposition.

ECONOMIC HISTORY PRE- AND POST-1992

Guyana was once a Centrally Command State where more than 80per cent of the productive sectors were controlled by the State. In the post 1992 era, Guyana transitioned from a Centrally Command and bankrupt State to a mixed- economic system with more predominant features of a free market economy. Guyana’s debt-to-GDP stood at over 900per cent at one point in time.

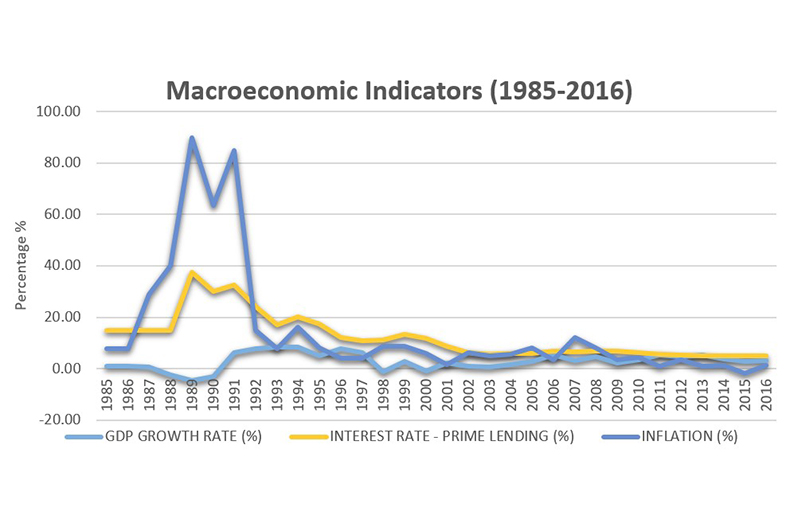

During this period, Guyana recorded the highest inflation rate of 89.7 per cent in 1989, the highest interest rate (prime lending rate for the period) of 37.5per cent in 1989, negative growth rates were recorded in 1988-1990, the exchange rate devalued from G$4.25/US$1 in 1985 to G$27/US$1 in 1989, G$112/US$ in 1990, G$138/US$1 in 1994, G$178/US$1 in 1999, G$200/US$1 by 2004. Additionally:

Net International Reserve pre-1990 was nil. By 1990, net international reserve (US$103M). Until 1992, we had a positive net international reserve of US$15M.

Foreign Direct Investment (FDI) in 1992 was recorded at US$138M and averaged US$200M up to 2017.

DEVELOPMENT CHALLENGES

Guyana’s development challenges can be characterised by the following:

Human Capital/Labour Market Constraints: skills deficit, less than five per cent of the working population possess tertiary level education (Guyana Labour Force Survey Report, 2021 Q3). The labour force participation rate was among the lowest (49 per cent (2021), below the global average of 60 per cent. Low-income countries’ labour force participation rate averaged 70 per cent (ILO study).

Energy: energy cost among the highest averaging US$0.30 cents per kwh;

Infrastructure Deficit: physical, social, technology;

Ease of doing business/red tapes / bureaucracy; and

Political stability/investors’ confidence historically: several periods of political instability.

Development Challenges: Periods of Political Instability and (1) Natural disaster (post-1992)

1992–1997: there was a short period of street protests and violence having restored democracy, following which the economy took off (short period of stability).

1997–2001: prolonged street protests and disruption (elections time)

2002–2003: prison break, crime wave spiraled out of control and politically motivated disruptions.

2004–2008: unrests, politically motivated disruptions

2008–2012: Lusignan, Lindo Creek, Bartica massacre, violence erupted when protestors blocked the Wismar Mckenzie bridge.

The 2005 flood (natural disaster) estimated economic loss of $93B representing 60 per cent of GDP (Budget speech, 2006).

Minority Government in 2011-2014, leading to snap elections in 2015 (Gov’t encountered difficulty in passing budgets and laws in the National Assembly, political deadlock) Guyana was placed on the grey list internationally for failing to enact certain legislative amendments to the Anti-Money Laundering Laws.

PRE-OIL ECONOMY BY 2014 (OIL DISCOVERED IN COMMERCIAL QUANTITIES IN 2015)

Despite all of the foregoing challenges, by 2014, Guyana achieved macroeconomic stability from a bankrupt state in 1992 with the following macroeconomic outcomes:

Real GDP stood at US$4B from US$200M,

Per capita income moved to US$5,000 from less than US$300,

Net International Reserve stood at US$652M from US$15M,

Exchange rate stabled at G$208.5/US$1,

Prime lending rate (weighted average) down to 11per cent from 37.5per cent,

Debt-to-GDP Ratio down to 40 per cent from a high of 900 per cent,

GDP growth rate of four per cent, and

Inflation rate 1.2 per cent down from 89.7 per cent.

CURRENT ECONOMIC LANDSCAPE – POST OIL (2022)

Real GDP stood at US$14.3B, non-oil GDP stood at US$5B,

Per capita income US$18,333,

Net International Reserve stood at US$932M,

Exchange rate stable at G$208.5/US$1: stable exchange rate since 2004 (19 years),

Prime lending rate (WA) 8.23 per cent,

Debt-to-GDP Ratio 26 per cent,

GDP growth rate of 62.3 per cent, and non-oil GDP 11per cent, and

Inflation rate of 7.2 per cent, below the global average of 8.7 per cent.

DEVELOPMENT NEEDS

Guyana has a major infrastructure deficit: Infrastructure needs include roads, bridges, ports, moving development towards the South (inland), new secondary city to be developed (Silica City);

Climate Resilient infrastructure (expanded LCDS),

Modern Public Health Care and Infrastructure,

Making Education affordable and accessible, overhaul the Education curriculum, designed to equip the future labour force with the skills and competences for the future economy

Government is aiming to provide free tertiary education by 2025

Affordable housing across the country targeting 50,000 new homes by 2025,

Strengthening national security,

Investing in people, human resources of the public sector, better wages, salaries, and working conditions.

ECONOMIC TRANSFORMATION

Major transformational projects include the gas-to-energy and the Amaila Falls Hydro-electric projects aimed at reducing energy cost by 50 per cent,

Economic transformation from a largely primary producing economy to a tertiary producing economy,

Major focus and investment in economic diversification, agriculture, Agro-processing, the services industry, manufacturing, ICT, and eco-tourism, and building out the oil and gas value chain, and

Regional food and energy security agenda, thereby tapping into a US$5B and US$1B market, respectively.

CONCLUDING REMARKS

Guyana is projected to experience sustained double-digit growth over the next decade with continued oil production and exploration. The government is pursuing an expansive economic diversification and transformative development agenda.

The medium-term focus areas are investment in public infrastructure sector, agriculture /agro-business/agro-processing, transforming the energy landscape with cheaper and reliable energy supply. Other key focus areas include education, health and digitising the IT infrastructure of the public sector to aid improved efficiency in delivering public service.

Noteworthy, the projected earnings from the oil and gas resources is modest when juxtaposed with the massive development needs of the country, and the need for climate resilient development within the Low Carbon Development framework. It is important to note that macroeconomic stability, high investors’ confidence―and from a global perspective, perceived low-to-moderate political risk―are the hallmarks to achieving the transformational development that the government is advancing.

__________________

Joel Bhagwandin, MSc. is the Director of Corporate Finance & Investment Advisory, Business Intelligence, Financial & Economic Analysis at SphereX Professional Services Inc. He can be reached at jbhagwandin@spherexgy.com.

.jpg)