SUMMARY: the contractionary fiscal policies and lack of an economic diversification programme, lack of substantive capital projects across all sectors by the previous administration, under the stewardship of the former Finance Minister, resulted in the decline and underperformance of the non-oil economy during the period 2015–2020. This in turn led to the creation of the foundational work upon which the paradoxical Dutch Disease permeates the economy during that period.

The reversal of the economic policy philosophy to one that is expansionary and conducive to broad-based and inclusive economic growth by the current administration through budgets 2020, 2021 and 2022; and notwithstanding the challenges posed by COVID-19 pandemic, and external shocks, the non-oil economy is showing visible signs of recovery and projected to experience positive growth in the medium-term. Consequently, it is safe to conclude, therefore, that budget 2022, in particular, sought to build out the prerequisite foundation for the economic diversification and transformation of the economy, and in so doing, to mitigate the risks of the paradoxical resource curse and Dutch Disease.

BACKGROUND

Reference is made to the former Finance Minister, Winston Jordan’s argument that Guyana is already gripped by the Dutch Disease. Mr. Jordan argued that “the Government’s incessant ‘diversification talk’ does not change the fact that the contributions of other sectors are declining due to what he believes is a clear case of economic mismanagement. Jordan reasoned that there is only so much blame that the Government can throw at the feet of the COVID-19 pandemic and the Russia-Ukraine war.” An analysis conducted by SPHEREX Analytics, however, evidently, and arguably contradicted Mr. Jordan’s contentions.

DISCUSSION AND ANALYSIS

Public Expenditure Analysis

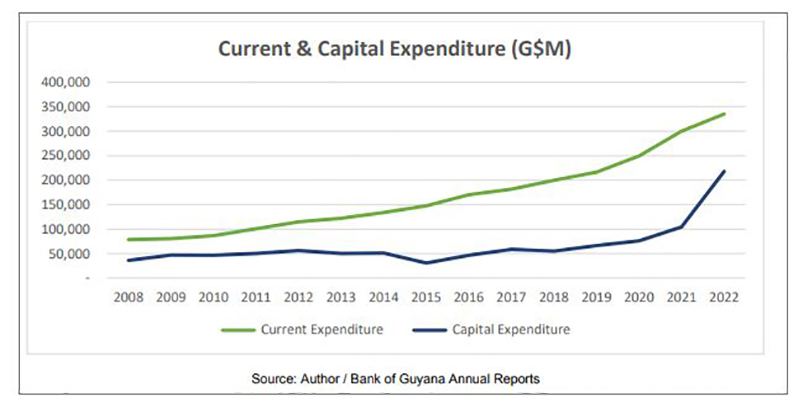

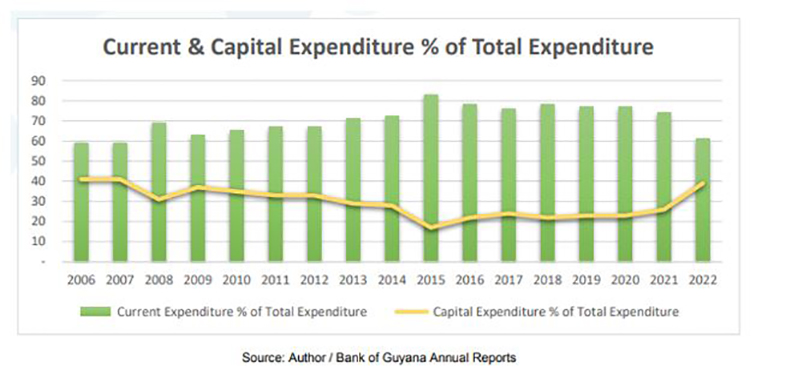

An examination of the growth trend for current and capital expenditure for the period 2008 – 2022 (spanning 15 years), current expenditure increased from $78.5 billion in 2008 to $335 billion in 2022 or by 329 per cent or an average annual growth rate of 22 per cent. Capital expenditure on the other hand increased from $36 billion in 2008 to $218 billion in 2022 or by $182 billion, representing an increase of 505 per cent. This level of increase in capital expenditure alone represents almost 91 per cent of the total budget for 2022. During the period 2008 – 2014, there were three instances that recorded marked decline in capital expenditure.

In 2008, capital expenditure declined by 16 per cent relative to the previous year but recorded a sharp increase by 31 per cent in 2009. In 2010 capital expenditure declined by a mere one per cent, however, in 2013 capital expenditure declined by 11 per cent. This was largely due to a change in the political landscape for the first time where in 2011 following national elections, a minority Government emerged, and the political opposition had a one-seat majority in the National Assembly.

As a result, several budgets were re-engineered where sharp cuts were imposed by the political opposition. Due to the many deadlocks that characterised this period in Guyana’s political history, a snap election was called in 2015. This also explained the starker decrease in capital expenditure by 40 per cent in 2015. In 2016, capital expenditure increased by 53 per cent but continued a downward trend in 2017 through 2020.

As a result, several budgets were re-engineered where sharp cuts were imposed by the political opposition. Due to the many deadlocks that characterised this period in Guyana’s political history, a snap election was called in 2015. This also explained the starker decrease in capital expenditure by 40 per cent in 2015. In 2016, capital expenditure increased by 53 per cent but continued a downward trend in 2017 through 2020.

Moreover, during the period 2006 – 2014, capital expenditure accounted for 41 per cent of total expenditure in 2006 and 2007 and averaging 32.3 per cent for the period 2008 – 2012. In 2015, this trend changed dramatically where there were notable increases in current expenditure as a percentage of the total expenditure versus capital expenditure as a percentage of the total budget, wherein capital expenditure for the period 2015-2019 accounted for 21 per cent on average, the lowest average recorded over the past two decades. During the period 2015 – 2022, budget allocations towards the economic sectors declined by 10.32 per cent in 2016 and 27 per cent in 2019, thus resulting in the underperformance of some of the major economic sectors during this period. This trend changed in 2020 where allocations towards the economic sectors increased by 24.46 per cent in 2020, 25.31 per cent in 2021 and 27 per cent in 2022.

In the infrastructure sector during this period there was a sharp increase of 146 per cent in 2016 largely because of a sharp decline by 19 per cent in 2015. In 2015 allocations increased by 24 per cent which then declined sharply by less than one per cent in 2018 and one per cent in 2019.

This trend changed dramatically in 2020 with a 21 per cent increase in 2020, 38 per cent in 2021 and 91 per cent in 2022.

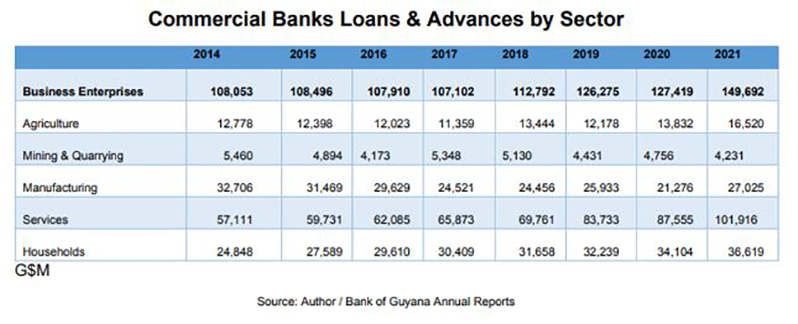

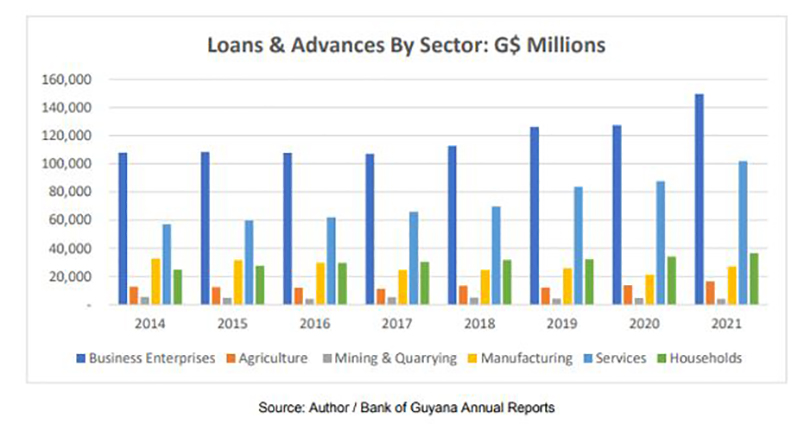

During the period 2013 – 2021, private sector loans and advances moved from $128 billion to $191 billion by the end of 2021 or by 49 per cent. During this period, it was observed that the highest growth rate for private sector loans and advances was recorded in 2014 of 14 per cent. In 2014, with a handicapped minority Government, growth was more or less stagnated; loans and advances grew by seven per cent and four per cent in 2014 and 2015 respectively. In 2017 and 2018, the growth rate for loans and advances recorded were a measly one per cent. It should be mentioned that this period was characterised as a paradigm shift in the underlying philosophy of public policy by the administration at that time.

To this end, the public policies pursued arguably inhibited private sector growth, inter alia, increasing the cost of doing business and the implementation of a web of burdensome tax measures. In 2018 and 2019, credit to the private sector started to recover with a four per cent growth in 2018 and 10 per cent growth in 2019 – largely owing to increased activities in the oil and gas sector. This trend was short-lived in 2020 when growth fell to two per cent on account of the pro-longed political impasse in that year coupled with the impact of the COVID-19 pandemic. Despite this, with a shift in the public policy philosophy once again to a more business friendly environment, credit to the private sector recorded its highest growth rate in 2021 of 13 per cent since 2013.

During the period 2014 – 2021, loans and advances to the agriculture sector declined by three per cent in 2015; – three per cent in 2016; and 5.52 per cent in 2017. In 2018, credit to the agriculture sector increased by 18 per cent and declined by nine per cent in 2019 before improving by 14 per cent in 2020 and 19.43 per cent in 2021 – following the change in economic policy. A similar trend was observed for the mining and quarrying sector and the manufacturing sector. Overall, business enterprises experienced the highest growth in credit in 2021 by 17.48 per cent compared to an average annual growth rate of 2.74 per cent during 2014 – 2020.

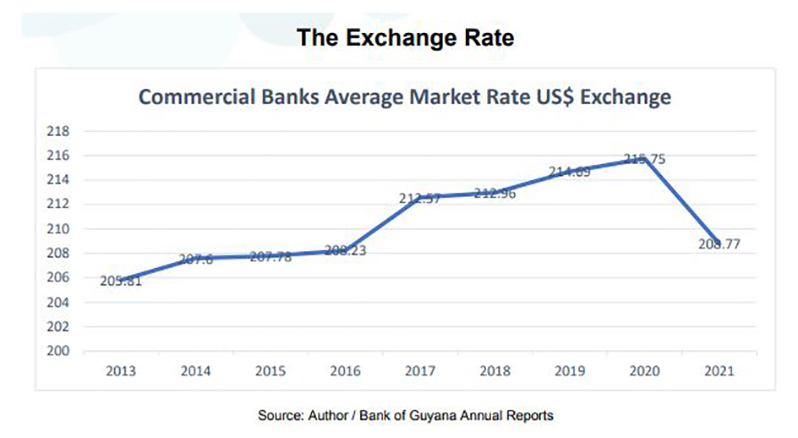

The average market rate for the USD/GYD exchange rate during the period 2013–2021 moved from $205.81 in 2013 to a high of $215.75 in 2020 representing a depreciation of about five per cent of the domestic currency against the US$ over an eight-year period. However, as is expected with the oil windfall, stronger exports, and increased inflows of foreign exchange (FX); the domestic currency is expected to appreciate–albeit gradually. In this regard, the average market exchange rate moved from $215.75 in 2020 to $208.88 reflective of an appreciation of 3.2 per cent of the domestic currency against the US dollar.

CONCLUDING REMARKS

The economic policies administered through budgets 2020 through 2022 in response to inflationary pressures and improving the competitiveness of businesses – have resulted in notable improvements in the performance of the non-oil traditional sectors. Further, it is important to highlight that budget (s) 2020, 2021 and 2022 contained substantial allocations towards economic diversification and improving the non-oil economic sectors.

This is critical to avoid the paradoxical resource curse and / or Dutch disease. Moreover, 40 per cent of the total budget are allocated towards capital projects – that is, to finance a number of major infrastructure development projects. Comparing capital expenditure in budget 2022 relative to 2021, it is observed that capital expenditure increased by approximately 110 per cent over the previous year.

It is this type of “investment posture” versus reckless spending on recurrent and non-productive expenditure that avoids the resource curse or Dutch disease. Overall, budget 2022 laid the foundation for Guyana’s economic transformation. In this regard, several major transformational projects are slated to commence in 2022, namely the Amaila Falls Hydro project, the gas-to-energy project and these coupled with the massive investments in public infrastructure, including housing, roads, and bridges, etc.

It is safe to conclude, therefore, that budget 2022, in particular, continue to build on the strong foundational work as a prerequisite for the economic diversification of the economy and to mitigate the risks of the paradoxical resource curse and Dutch Disease.

.jpg)