THE analysis contained herein reveals that under the current fiscal regime within the framework of the PSA, Guyana’s total share of profit oil and royalty for the financial year (FY) 2020 amounted to $25.5 billion which increased to $79 billion in FY 2021 – while the oil companies net take in profit oil for FY 2020 amounted to $22 billion, which increased to $68.1 billion FY 2021.

It is worthwhile to note that Guyana’s share in profit and royalty is greater than the net profit of the oil companies.

To this end, the oil companies share of profit oil for FY 2021 amounted to $68 billion or US$325 million, while Guyana’s total [actual] share in royalty and profit oil stood at $85.3 billion/US$408 million, representing $17 billion/US$81 million or 25 per cent more than the oil companies.

The depreciation and financing expenses attributed to the decommissioning (provision) liability represents less than one percent of gross revenue – thus having almost zero impact on profit oil. Similarly, financing cost represents less than one percent of gross revenue due to the low level of debt employed in the financing structure of the oil companies.

Overall, the analysis disproves the following contrary views of other analysts and political commentators where: i) ExxonMobil or the oil companies walk away with more profit oil than Guyana is far from the truth.

Overall, the analysis disproves the following contrary views of other analysts and political commentators where: i) ExxonMobil or the oil companies walk away with more profit oil than Guyana is far from the truth.

Guyana’s net take in royalty and profit oil is actually greater than the oil companies’ share of profit oil; ii) The decommissioning provision is a balance sheet item which affects both the fixed asset and liability side, and has a minimal to virtually zero impact on the profit oil.

In other words, the full sum of decommissioning provision which is approximately US$357 million up to FY 2021 is not a deductible from profit oil as has been incorrectly reported and misconstrued by a certain section of the media and other analysts; iii) Finally, the oil companies employed a low level of debt in their financing structure thus reducing the financing cost for total debt which in turn has minimal to virtually zero impact on profit oil.

BACKGROUND

ExxonMobil and its consortium partners, Hess and CNOOC recently filed their audited financial statements for FY 2021 with the Deeds Registrar.

This was followed by a few commentators and analysts alike commenting on the company’s declared profit for its Guyana operations where the company reported that it made a profit of G$132 billion for 2021 while the consortium together made a profit of G$314.5 billion for 2021.

The company reported that it made a profit for the first time since 1999. Further, Tom Sanzillo in a recent report published by the IEEFA and carried in certain section of the local media, argued that ExxonMobil’s current and future debt will ultimately be borne by Guyana.

This argument was subsequently debunked by SPHEREX analytics, the Vice President, the Ministry of Natural Resources, and ExxonMobil. In view of the foregoing, this paper presents an analysis of the consolidated financials of ExxonMobil’s subsidiary and its consortium partners, Hess and CNOOC.

This argument was subsequently debunked by SPHEREX analytics, the Vice President, the Ministry of Natural Resources, and ExxonMobil. In view of the foregoing, this paper presents an analysis of the consolidated financials of ExxonMobil’s subsidiary and its consortium partners, Hess and CNOOC.

REVENUE

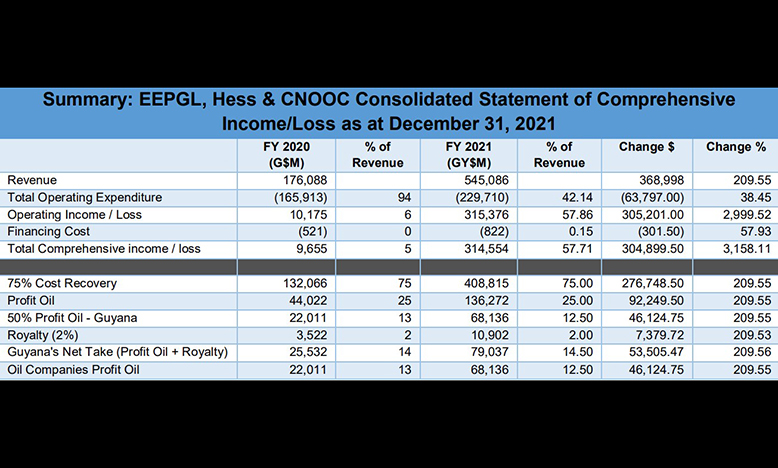

The consolidated financial statements for ExxonMobil Guyana, Hess and CNOOC for the period ended December 2021 revealed total revenue of $545 billion up from $176 billion recorded in the previous year or by $369 billion representing an increase of 210 per cent.

EXPENDITURE

Total operating expenditure increased from $166 billion in FY 2020 to $230 billion in FY 2021, representing a 38 per cent increase.

Notably, total operating expenditure represented 94 per cent of revenue in FY 2020 and decreased to 42 per cent of revenue in FY 2021. Financing cost increased from $521 million in FY 2020 to $822 million in FY 2021 or by 57 per cent, representing 0.15 per cent of gross revenue.

PROFIT OIL AND COST RECOVERY

The consolidated statement of comprehensive income / loss recorded for FY 2021 recorded a profit of $314 billion representing an increase of $305 billion when compared to FY 2020 position or an increase of 3,158 per cent.

It should be noted, however, that the oil companies did not collectively walk away with G$314 billion or US$1.5 billion in profit as is being misconstrued by some commentators and local journalists / media houses.

In accordance with the fiscal provisions in the Production Sharing Agreement (PSA), cost recovery which includes recovery of the initial capital expenditure (CAPEX) (pre-exploration, exploration and development costs), and operating expenditure (OPEX) is capped at 75 per cent of revenue.

Hence, with the application of this formula profit oil for FY 2020 was $44 billion which increased to $136.3 billion in FY 2021 or by 210 per cent. As such, Guyana’s share of profit oil amounted to $22 billion in FY 2020 and $68 billion in FY2021.

GUYANA’S NET TAKE: ROYALTY AND PROFIT OIL

Guyana’s total share of profit oil and royalty for FY 2020 amounted to $25.5 billion which increased to $79 billion in FY 2021 – while the oil companies net take in profit oil for FY 2020 amounted to $22 billion which increased to $68.1 billion FY 2021.

This means that Guyana’s share in profit and royalty is greater than the net profit of the oil companies. Further to note, royalty is paid to Guyana in cash while profit oil is paid in raw crude which means Guyana is responsible for the marketing and sales of its share of crude. Consequently, Guyana’s share in profit oil is in actuality greater than the oil companies.

There is likely to be a marginal disparity in the exchange rate applied by the oil companies versus Guyana’s share of profit oil and royalty which would account for the higher difference accrued to Guyana albeit to a lesser extent (prevailing average market rate is $215 whereas Bank of Guyana average rate is $209.2, approximately $6 lower than the market average).

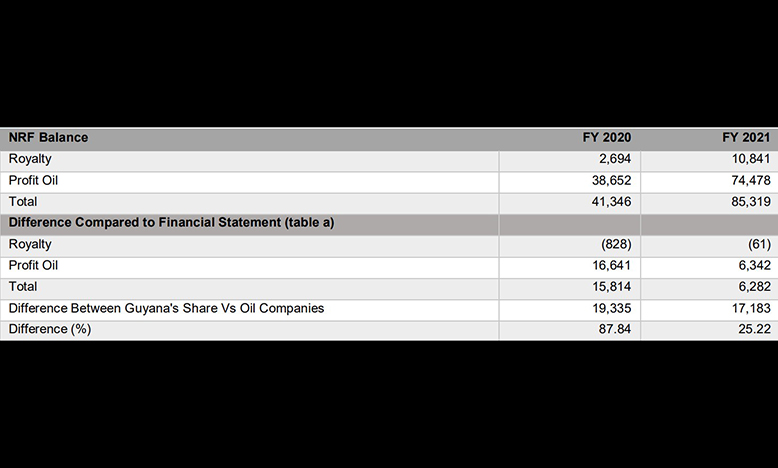

To that end, the table below illustrates a comparison of Guyana’s actual profit oil paid into the Natural Resource Fund (NRF) versus the profit as reported in the financial statements.

As shown in the table (a) above, Guyana’s total share in royalty and profit oil according to the in the financial statements would work have worked to $25.5 billion.

The actual profit oil and royalty for the said period as reported in the NRF, however, stood at $41.3 billion in FY 2020 representing a favorable variance of $15.8 billion or 88 per cent while for FY 2021 Guyana’s total share stood at $85.3 billion as reported in the NRF, representing $17.1 billion or 25 per cent more than what is reported in the financial statements of the oil companies.

Moreover, the oil companies share of profit oil for FY 2021 amounted to $68 billion while Guyana’s total [actual] share in royalty and profit oil stood at $85.3 billion – that is, $17 billion or 25 per cent more than the oil companies.

.jpg)