— before showing early signs of recovery, says IDB report

TAX revenues in Latin America and the Caribbean (LAC) fell by eight per cent on average in nominal terms and by eight per cent as a share of Gross Domestic Product (GDP) in 2020 because of the COVID-19 pandemic, according to a new report released on Friday. However, the region’s economic recovery and a rebound in commodity prices supported a recovery in tax revenues in 2021.

According to a release, Revenue Statistics in Latin America and the Caribbean 2022, released during the 56th General Assembly of the Inter-American Centre of Tax Administrations (CIAT), shows that the decline in tax revenues in LAC in 2020 exceeded the region’s economic contraction in nominal terms.

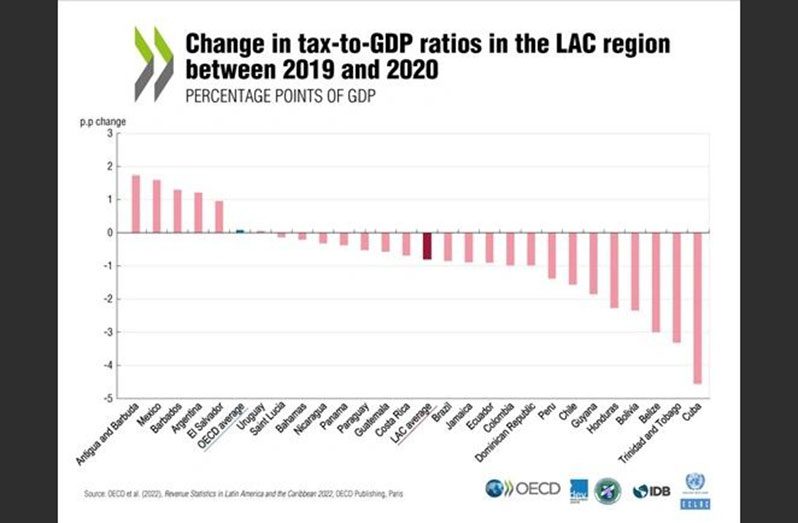

Tax-to-GDP ratios fell in 20 of the 26 LAC countries covered by the report and LAC’s average tax-to-GDP ratio fell by 0.8 percentage points (p.p.) to 21.9 per cent. Tax-to-GDP ratios in the LAC region ranged from 12.4 per cent in Guatemala to 37.5 per cent in Cuba in 2020.

The decline in LAC’s tax-to-GDP ratio in 2020 contrasted with the Organisation for Economic Co-operation and Development (OECD) area, where the average tax-to-GDP ratio rose by 0.1 p.p. to 33.5 per cent. The gap between the LAC and OECD averages widened to 11.6 per cent of GDP in 2020 from 10.7 per cent of GDP in 2019 as a result.

Revenues from all main tax categories declined in nominal terms between 2019 and 2020 on average across the LAC region. Taxes on goods and services, which accounted for about half of total tax revenues in LAC, were the worst affected, decreasing by seven per cent of GDP on average. Revenues from corporate income tax (CIT) declined by two per cent of GDP while revenues from personal income tax (PIT) and social security contributions (SSCs) remained relatively stable as a percentage of GDP, the release noted.

The impact of the pandemic on tax revenues differed between LAC and the OECD. As a percentage of GDP, taxes on goods and services remained unchanged in the OECD, while CIT revenues declined by twice as much as those in the LAC region and PIT and SSCs both increased. Relative to the OECD, PIT and SSCs accounted for a small share of total tax revenues in the LAC region (28.2 per cent in LAC in 2020 versus 49.4 per cent in the OECD in 2019).

A special feature in the report highlights a decline in hydrocarbon revenues for a sample of major producers in the LAC region, from 3.1 per cent of GDP in 2019 to 2.1 per cent of GDP in 2020, but these revenues rebounded to an estimated three per cent of GDP in 2021. Meanwhile, mining revenues for major producers in the region fell from four per cent of GDP in 2019 to three per cent in 2020 but rose to an estimated six per cent of GDP in 2021. A second special feature tracking monthly revenue data during the COVID-19 pandemic for a sample of 18 LAC countries reveals that cumulative revenues from PIT, CIT, VAT and excises between January and August 2021 rose 4.6 per cent in real terms from the equivalent period in 2019 as economies in the region recovered.

Revenue Statistics in Latin America and the Caribbean 2022 is a joint publication by CIAT, the United Nations Economic Commission for Latin America and the Caribbean (ECLAC), the Inter-American Development Bank (IDB), the OECD Centre for Tax Policy and Administration and the OECD Development Centre. A launch event for the 2022 edition of the report will take place during ECLAC’s XXXIV Regional Fiscal Policy Seminar, the release concluded.

.png)