DURING the period 2015 – 2022, budget allocations towards the economic sectors declined by 10.32 per cent in 2016 and 27 per cent in 2019, thus resulting in the underperformance of some of the major economic sectors during this period. This trend changed in 2020 where allocations towards the economic sectors increased by 24.46 per cent in 2020, 25.31 per cent in 2021 and 27 per cent in 2022.

In the infrastructure sector during this period there was a sharp increase of 146 per cent in 2016 largely because of a sharp decline by 19 per cent in 2015. In 2015, allocations increased by 24 per cent which then declined sharply by less than one per cent in 2018 and one per cent in 2019. This trend changed dramatically in 2020 with a 21 per cent increase in 2020, 38 per cent in 2021 and 91 per cent in 2022.

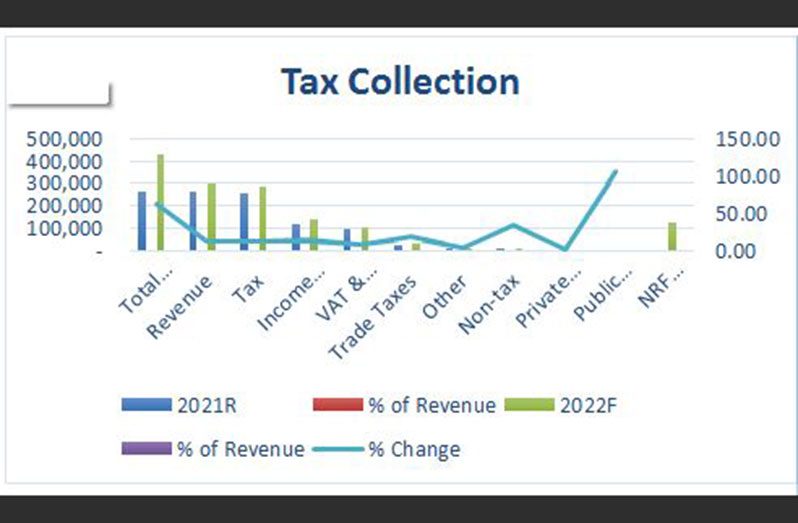

Total revenue is projected to increase by 62 per cent in 2022 over 2021. Traditional tax revenues are projected to grow by 13.36 per cent in 2022. Notably, income taxes accounts for approximately 50 per cent of total tax revenues, and total tax revenues account for 95 per cent of total revenue.

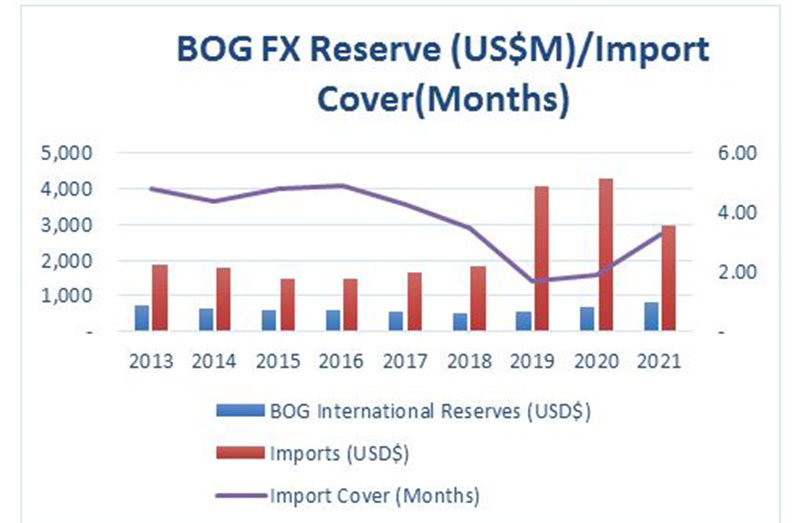

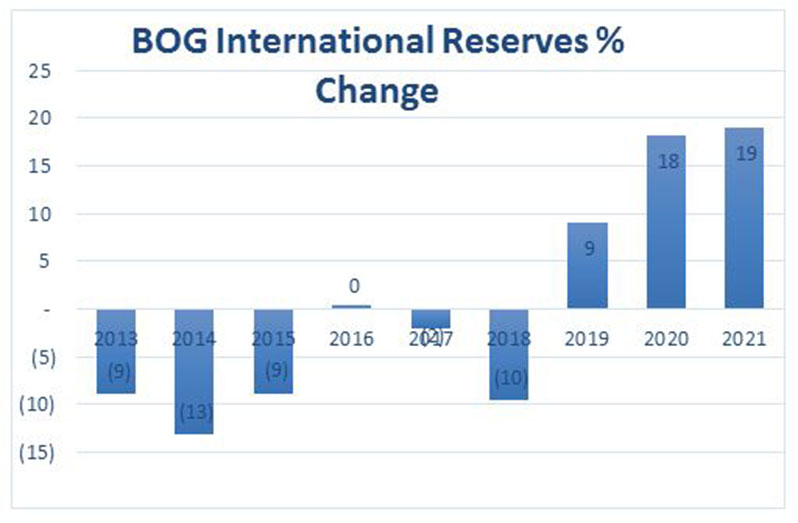

BANK OF GUYANA INTERNATIONAL RESERVE

Bank of Guyana International Reserve stood at US$751 million in 2013 and by the end of 2021, increased to US$811 million or by eight per cent. However, of interest to note though is that the international reserve position in 2013 represented almost five months import cover and up to 2016, the bank’s international reserve position represented about four months import cover–above the three months’ benchmark. This trend changed in 2018 when the bank’s international reserve position fell to three months import cover and in 2019–2020, represented less than two months import cover. In 2021, the Bank of Guyana’s international reserve position improved relative to import cover, where in 2021 it represented just over three months import cover. This trend is expected to continue into 2022 onwards on account of increased oil production.

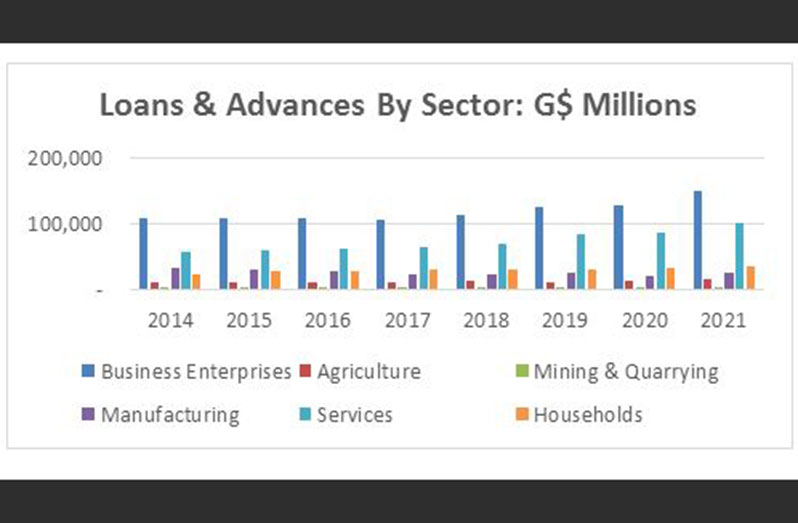

During the period 2013 – 2021, private sector loans and advances moved from $128 billion to $191 billion by the end of 2021 or by 49 per cent.

During this period, it was observed that the highest growth rate for private sector loans and advances was recorded in 2014 of 14 per cent. In 2014, with a handicapped minority government, growth was more or less stagnated; loans and advances grew by seven per cent and four per cent in 2014 and 2015 respectively. In 2017 and 2018, the growth rate for loans and advances recorded were a measly one per cent. It should be mentioned that this period was characterised as a paradigm shift in the underlying philosophy of public policy by the Administration at that time. To this end, the public policies pursued arguably inhibited private sector growth, inter alia, increasing the cost of doing business and the implementation of a web of burdensome tax measures. In 2018 and 2019, credit to the private sector started to recover with a four per cent growth in 2018 and 10 per cent growth in 2019 – largely owing to increased activities in the oil and gas sector. This trend was short-lived in 2020 when growth fell to two per cent on account of the pro-longed political impasse in that year coupled with the impact of the COVID-19 pandemic. Despite this, with a shift in the public policy philosophy once again to a more business friendly environment, credit to the private sector recorded its highest growth rate in 2021 of 13 per cent since 2013.

During the period 2014 – 2021, loans and advances to the agriculture sector declined by three per cent in 2015; – three per cent in 2016; and 5.52 per cent in 2017. In 2018, credit to the agriculture sector increased by 18 per cent and declined by nine per cent in 2019 before improving by 14 per cent in 2020 and 19.43 per cent in 2021 – following the change in economic policy. A similar trend was observed for the mining and quarrying sector and the manufacturing sector. Overall, business enterprises experienced the highest growth in credit in 2021 by 17.48 per cent compared to an average annual growth rate of 2.74 per cent during 2014 – 2020.

Total public debt stood at US$1.359 billion in 2012 which increased to US$3.127 billion by the end of 2021 representing an increase of 130 per cent over this ten-year period, or an average annual growth rate of 13 per cent. At the same time, real GDP moved from US$4 billion in 2012 to US$8.6 billion by the end of 2021 representing an increase of 115 per cent over this period or an annual average growth rate of 11.5 per cent.

During the period 2012–2021 the debt-to-GDP ratio was 34 per cent in 2012 which further decreased below 30 per cent in 2014 and remained below 30 per cent up to 2018. During the period 2018 – 2020, the debt-to-GDP ratio reached its highest of 37 per cent, 52 per cent and 43 per cent, respectively – higher than the period between 2013 – 2017, albeit below the 60 per cent benchmark. However, by the end of 2021, the debt-to-GDP ratio declined from its highest level of 52 per cent in 2019 to 36 per cent. In 2022, the debt-to-GDP ratio is forecast to reduce further from 36 per cent to 28 per cent. This is reflective of prudent debt management coupled with the expansion of the economy driven by the oil economy and the draw down from the NRF thereby reducing the level of borrowing. Moreover, this outturn is indicative of the fiscal space available to support the economy’s aggressive development and expansionary agenda within the framework of a sustainable development model.

THE EXCHANGE RATE

The average market rate for the USD/GYD exchange rate during the period 2013–2021 moved from $205.81 in 2013 to a high of $215.75 in 2020 representing a depreciation of about five per cent of the domestic currency against the US$ over an eight-year period. However, as is expected with the oil windfall, stronger exports and increased inflows of foreign exchange (FX), the domestic currency is expected to appreciate – albeit gradually. In this regard, the average market exchange rate moved from $215.75 in 2020 to $208.88 reflective of an appreciation of 3.2 per cent of the domestic currency against the US dollar.

The economy is expected to experience buoyant growth in 2022 supported largely by the budget measures, programmes and policies. To this end, the medium-term outlook is therefore positive, and real GDP growth forecast for 2022 is 47.5 per cent.

CONCLUSION/SUMMARY

This article is a direct response to several international so-called analysts and economists who sought to pronounce on Guyana’s economic affairs without performing any meaningful, rigorous and scholastic analyses on Guyana’s economic affairs, historically and currently. The article fairly exposed the inherent biases, weaknesses and flaws of the (referenced) articles (by the authors Sanzillo & Kreeft, Miranda, and Yhip) which have been dominating the local media houses and being used as reference points as credible analyses to support many uninformed and misinformed narratives by certain groups in Guyana.

With respect to how the oil and gas resources will be utilised, there is also an explicit articulated policy on this subject wherein it will be expended to a large extent in public investment projects to build and diversify the economy within the context of a sustainable development framework.

Guyana is on a path to steer clear of any type of the paradoxical Dutch disease or resource curse, provided that all things remain equal–that is to say, the current economic philosophy and policies, the current fiscal public financial management framework continues over the long term, and aggressively pursuing the realisation of the development trajectory of the country.

There is an abundantly clear continuation of the current Administration’s prudent economic management practices, conducive to broad-based wealth creation and prosperity, drawing from their proven track record. The author who argued without any supporting evidence that the inequality gap will widen, the evidence that exist is quite to the contrary. That is, historically, more than 90 per cent of Guyanese were living in poverty and owing to this, many migrated to other countries. Despite the political and other challenges since 1992, without any oil resources, more than 70 per cent of the population has been lifted out of poverty– through prudent fiscal and financial management of the country’s economic affairs by the Administration at that time, which is the same Administration that is once again given the responsibility to govern.

————————————————————————————————————————-

————————————————————————————————————————-

About the Author

Joel Bhagwandin is a Financial & Economic Analyst who has been providing insights and analyses on Guyana’s Economic Development, macrofinance issues and public policy for the past 5+ years. The views, thoughts and opinions expressed in this article belong solely to the author. The author’s professional profile on LinkedIn can be viewed @: https://www.linkedin.com/in/joel-bhagwandin-57481470/. Email: jbbankingadvice@gmail.com

.png)