JB’s Insight: Economic & Finance Issues

Summary

Background

Budget 2022 is the largest in Guyana’s history and the first to unlock the resources from the Natural Resource Fund (NRF). The massive $553B budget represents 30.1 per cent of 2021 real GDP, 62 per cent of Guyana’s pre-oil GDP (2018), and a 37 per cent increase over the previous fiscal year of 2021.

The budget was presented under the theme “steadfast against all challenges, resolute in building our one Guyana”.

Discussion and Analysis

Discussion and Analysis

Review of 2021 Performance

Real Gross Domestic Product (GDP) for 2021 is estimated to have grown by 20 per cent, while non-oil GDP is estimated to have grown by 4.6 per cent in 2021. Notably, this positive performance of the non-oil sector represents marked improvement as a result of the policies implemented through budget 2021. The non-oil economy contracted in 2020 owing to the five month’s elections saga coupled with the adverse impact to the economy by the COVID1-19 pandemic.

Sectorial Performance

In 2021, the agriculture, forestry and fishing sector contracted by approximately 10 per cent in 2021. This is largely due to reduced output in the sugar, rice and other crops subsector which was affected by the devastated floods in 2021.

Despite this, all the other sectors recorded improved performance over the period 2020 where the mining and quarrying sector grew by 27 per cent, the manufacturing sector grew by three per cent, the construction sector grew by 23 per cent and the services sector recorded 11 per cent growth over the corresponding period.

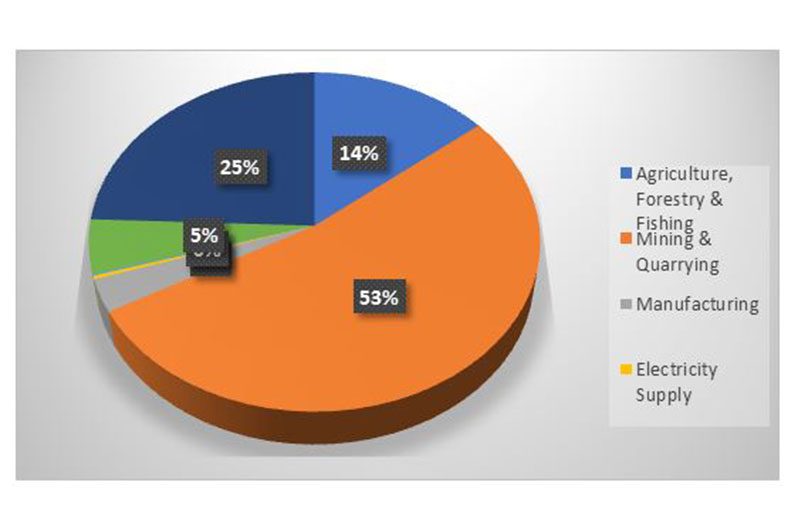

In 2021, the agriculture, fishing and forestry sector accounted for 14 per cent of GDP, while the mining and quarrying sector accounted for 51 per cent, the manufacturing sector accounted for three per cent, the construction sector accounted for five per cent and the services sector accounted for 24 per cent.

Inflation

Inflation rate in 2021 increased to approximately six per cent compared to 0.9 per cent in 2020. This outturn is largely on account of rising food prices driven by global supply chain disruption and rising shipping cost due to the economic impact of the global pandemic.

Budget 2022 contains fiscal measures to cushion inflationary pressures in 2022 such as the reduction in excise tax on fuel from 50 per cent to 35 per cent in February 2021 and from 35 per cent to 20 per cent in October 2021. In January 2022, a further reduction was implemented from 20 per cent to 10 per cent.

In addition, the extension of the freight cost adjustment to pre-pandemic levels, the allocation of $5 billion to meet cost of living interventions, and the increase in the income tax threshold from $65,000 to $75,000; altogether are geared towards cushioning inflationary pressures in 2022.

The Bank of Guyana total assets moved from a position of $259 billion in 2012 to approximately $500 billion by the end of 2021 or by 93 per cent, an average annual growth rate of 9.3 per cent. During the same period, commercial banks total assets moved from $378 billion in 2012 to $709 billion by the end of 2021 or by 88 per cent, an average annual growth of 8.8 per cent.

Bank of Guyana International Reserve

Bank of Guyana International Reserve stood at US$751 million in 2013 and by the end of 2021, increased to US$811 million or by per cent. However, of interest to note though is that the international reserve position in 2013 represented almost five months import cover and up to 2016, the bank’s international reserve position represented about four months import cover – above the three months benchmark. This trend changed in 2018 when the bank’s international reserve position represented three months import cover and in 2019-2020, represented less than two months import cover. In 2021, the Bank of Guyana’s international reserve position improved relative to import cover, where in 2021 it represented just over three months import cover. This trend is expected to continue into 2022 onwards on account of increased oil production.

During the period 2013 – 2021, private sector loans and advances moved from $128 billion to $191 billion by the end of 2021 or by 49 per cent. During this period, it was observed that the highest growth rate for private sector loans and advances was recorded in 2014 of 14 per cent. In 2014, with a handicapped minority government, growth was more or less stagnated, generally; loans and advances grew by seven per cent and four per cent in 2014 and 2015 respectively. In 2017 and 2018, the growth rate for loans and advances recorded were a measly one per cent. It should be mentioned that this period was characterised as a paradigm shift in the underlying philosophy of public policy by the Administration at that time. To this end, the public policies pursued arguably inhibited private sector growth, inter alia, increasing the cost of doing business and the implementation of a web of burdensome tax measures. In 2018 and 2019, credit to the private sector started to recover with a four per cent growth in 2018 and 10 per cent growth in 2019 – largely owing to increased activities in the oil and gas sector. This trend was short-lived in 2020 when growth fell to two per cent on account of the pro-longed political impasse in that year coupled with the impact of the COVID-19 pandemic. Despite this, with a shift in the public policy philosophy once again to a more business friendly environment, credit to the private sector recorded its highest growth rate in 2021 of 13 per cent since 2013.

During the period 2013 – 2021, private sector loans and advances moved from $128 billion to $191 billion by the end of 2021 or by 49 per cent. During this period, it was observed that the highest growth rate for private sector loans and advances was recorded in 2014 of 14 per cent. In 2014, with a handicapped minority government, growth was more or less stagnated, generally; loans and advances grew by seven per cent and four per cent in 2014 and 2015 respectively. In 2017 and 2018, the growth rate for loans and advances recorded were a measly one per cent. It should be mentioned that this period was characterised as a paradigm shift in the underlying philosophy of public policy by the Administration at that time. To this end, the public policies pursued arguably inhibited private sector growth, inter alia, increasing the cost of doing business and the implementation of a web of burdensome tax measures. In 2018 and 2019, credit to the private sector started to recover with a four per cent growth in 2018 and 10 per cent growth in 2019 – largely owing to increased activities in the oil and gas sector. This trend was short-lived in 2020 when growth fell to two per cent on account of the pro-longed political impasse in that year coupled with the impact of the COVID-19 pandemic. Despite this, with a shift in the public policy philosophy once again to a more business friendly environment, credit to the private sector recorded its highest growth rate in 2021 of 13 per cent since 2013.

.jpg)