— says IDB report

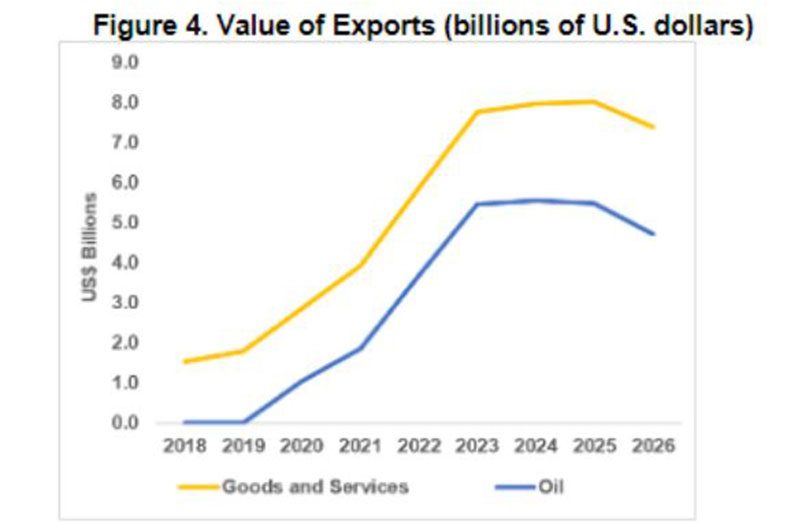

GUYANA’S total export earnings, which stood at US$998.8 million in the first quarter of 2021, could possibly increase up to US$8 billion by 2024, according to a Caribbean Quarterly Bulletin published by the Inter-American Bank (IDB).

The report, titled, ‘The Fragile Path to Recovery,’ said that Guyana’s exports in all areas are expected to increase exponentially, before experiencing a decline in 2026, which will see export earnings accounting for 59 per cent of the country’s Gross Domestic Product (GDP).

The report, which was released at the weekend, outlined that oil exports would be the driving force of the aforementioned growth, as it is projected to reach US$5.5 billion by 2024.

The report specified that oil exports are estimated to increase from US$1 billion in 2020 to US$5.5 billion in 2024, pushing total exports up to US$8 billion.

“These increased exports are supporting a higher current account balance, which increased from -34 per cent of GDP in 2019 to -13.5 per cent in 2020. High levels of Foreign Direct Investment (FDI) inflows of 33 per cent and 32 per cent of GDP in 2019 and 2020, respectively, were driven by commercial activities of foreign oil operators and contributed to financing the current account deficits,” the report explained.

It outlined that net FDI inflows for the country increased from an average of US$ 122 million per year in 2015- 2017 to US$ 1,580 million in 2018- 2020. It was noted that positive export inflows are offset by negative labour/investment income outflows, reflecting the export earning of the oil consortium reaching 43 per cent of GDP in 2023 and almost perfectly mirroring oil export earnings, as indicated by the International Monetary Fund’s April 2021 World Economic Outlook.

On net, capital inflows exceeded current account outflows by US$60 million and contributed to strengthening international reserves from US$576 million in 2019 to US$680 million in 2020, approximately 12 per cent of GDP, according to the Bank of Guyana’s 2020 report.

It was only recently that Minister of Natural Resources, Vickram Bharrat, informed the 31st Sitting of the National Assembly that Guyana’s Natural Resources Fund (NRF) contained a total of US$436 million, which remains untouched.

RECOMMITTED

As he stood to defend the Petroleum (Exploration and Production) Amendment Bill, Minister Bharrat recommitted the People’s Progressive Party/Civic (PPP/C) Government’s promise to be transparent in relation to the use and management of the oil funds.

Minister Bharrat further assured that he and his colleagues in government “intend to ensure there is strong parliamentary oversight” of the country’s oil revenues, especially as the earnings from the country’s petroleum sector alone could very well surpass US$500 million by the end of the year.

President, Dr. Irfaan Ali, had pledged the government’s commitment to strengthening the existing systems that govern the use of Guyana’s oil revenues. “We committed, during the campaign, that there will be no secrecy in revenues received by the country from our natural resources, especially oil and gas, and we have stuck to that commitment,” President Ali told reporters during his latest press conference.

He said that, in doing so, the government has always ensured that the public was notified of all the monies deposited into the NRF, also known as the Sovereign Wealth Fund. The oil earnings, the President related, are also gazetted. Even further, Dr. Ali said that the oil revenues will also be documented online. “We are moving a step further in creating a balance sheet that persons can examine, online, and be kept abreast of revenues and expenditure,” the Head of State said previously.

SAFEGUARDING RESOURCES

He reasoned that the NRF is critical to safeguarding resources for future generations of Guyanese. President Ali noted, however, that such efforts coincide with the fact that the country has “immediate needs” that have to be financed. Dr. Ali had affirmed that even if the government decides to dip into the NRF, mechanisms are in place to ensure that any and every withdrawal has to receive the requisite approval from the National Assembly. “Any projects to be financed from these funds must be approved by the National Assembly,” President Ali stressed.

Added to that, the Head of State had said that efforts were underway to craft a new legislative framework to govern the important Natural Resources Fund. He related that even though the PPP/C Government would have liked for the legislation to have been presented to Parliament before it went into recess, the document was still being finalised.

Dr. Ali is hopeful that the significant pieces of legislation could be presented to the House by the end of this year. Currently, even with oil prices on a global rise, Guyana has still been reaping the benefits of a burgeoning petroleum sector. Guyana sold its first one million barrels of crude on February 19, 2020, raking in nearly US$55 million. In its second million-barrel sale, the country received US$35 million, and another US$46 million as proceeds from the sale of its third million-barrel of crude, and US$49.3 million from its fourth oil lift.

Further, it earned in excess of US$60 million from the sale of its sixth oil lift, and US$79.6 million for its seventh. The country also received US$13.9 million in royalties during the first quarter of this year

.png)