– to enable company to continue oil exploration activities offshore Guyana

– drilling of Kawa-1 well remains on track for this year

By Navendra Seoraj

AS part of efforts to ensure that CGX Energy Inc. remains on course to drilling its first well offshore Guyana this year, Frontera Energy Corporation has injected US$19 million (approximately G$4.1B), in the form of a loan, into the company, which is the operator of the Corentyne and Demerara blocks.

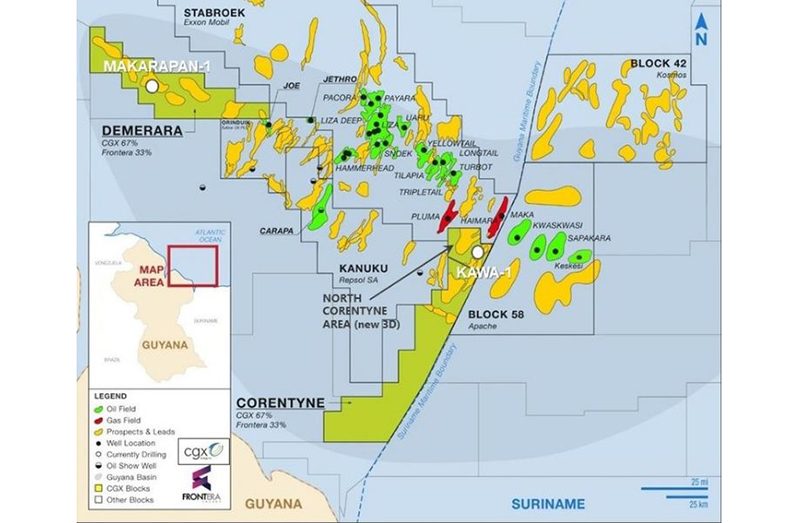

Frontera Energy Corporation which, together with CGX, holds Petroleum Prospecting Licences for the Corentyne and Demerara blocks, announced, on Friday, that it has entered into an agreement with CGX for a US$19 million loan, which will enable the company to continue financing its share costs related to the Corentyne, Demerara and Berbice blocks, the Berbice Deep-water Port, and other budgeted costs, as agreed to by Frontera.

“Our joint venture with CGX represents a significant growth opportunity for both companies and is rooted in a commitment to the Guyanese Government to develop these world-class assets with a focus on local engagement and the development of infrastructure,” Chief Executive Officer (CEO) of Frontera, Orlando Cabrales, was quoted as saying in a statement which was issued on Friday.

According to Frontera, the loan to CGX will be available for drawdown in tranches on a non-revolving basis until October 31, 2021, or the date on which CGX (or its subsidiaries) enters into a binding transaction that provides funds to repay the amounts outstanding under the loan.

“The loan, together with all interest accrued, shall be due and payable on June 30, 2022, or such later date as determined by Frontera, at its sole discretion. Interest payable on the principal amount outstanding shall accrue at a rate of 9.7 per cent per annum, payable monthly in cash, with interest on overdue interest.

“If the loan is extended by Frontera past June 30, 2022, at its sole discretion, the new interest rate will be 15 per cent per annum. The loan will be secured by all the assets of CGX. The loan agreement also includes a standby fee of two per cent multiplied by the daily average amount of unused commitment under the loan payable quarterly in arrears by CGX during the drawdown period,” Frontera said.

The loan, contemplated by the term sheet [a bullet-point document outlining the material terms and conditions of a potential business agreement], remains subject to customary conditions, including the negotiation and execution of definitive agreements between Frontera and CGX and obtaining regulatory approvals. The lending firm said there is no guarantee that definitive agreements will be executed on the terms contemplated, or at all.

In speaking further about this initiative, Cabrales said: “Completing the loan agreement with CGX is an important step forward and the joint venture remains firmly on-track to spud its first offshore Guyana well as planned in the second half of this year.”

Executive Co-Chairman of CGX, Professor Suresh Narine, was quoted in the statement as saying: “These are exciting times for CGX, the joint venture and our stakeholders as we get closer to spudding Kawa-1.

“We have exciting exploration plans for the Kawa-1 and Makarapan-1 wells on the Corentyne and Demerara Blocks and, as importantly, we are developing the infrastructure necessary to support and enhance broader energy and trade industry activity through the Berbice Deep-water Port Project. We look forward to executing on our programmes and creating value and opportunity for our stakeholders.”

It was reported in February that an independent prospective resource study has affirmed the world-class prospects of the Corentyne and Demerara blocks.

“As confirmed by the independent resource evaluation commission, the Guyana basin offers the joint venture access to a leading offshore oil opportunity. We expect a robust Guyana work programme with the advancement of our exploration wells, as we continue executing on our plan to realise this value for our shareholders.

“The independent prospective resource study reaffirms our excitement about the world-class prospectivity of the Corentyne and Demerara blocks offshore Guyana,” former CEO of Frontera, Richard Herbert, said.

The independent prospective resource study and report captured the Corentyne North Area, Corentyne Main Area and Demerara Block, offshore Guyana.

Outside of the prospective projects, U.S oil giant, ExxonMobil, is the only operator, so far, which has started production offshore Guyana. This company – operator of the Stabroek, Canje and Kaieteur blocks – has made 18 discoveries since May 2015 and began production in December 2019 from the Liza Phase-1 development project. Since 2015, ExxonMobil has increased its estimated recoverable resource base in Guyana to more than nine billion oil-equivalent barrels.

With prospects at the Corentyne and Demerara blocks appearing to be favourable, Frontera and CGX is evidently looking to follow suit and move ahead with its operations.

.png)