–as company weathers 2020 ‘storm’

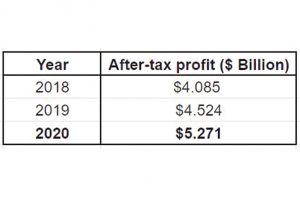

THE Banks DIH Company has surmounted the difficulties presented by the global pandemic, in addition to the challenges presented by a five-month-long elections quagmire, ending the 2020 Financial Year with an after-tax profit of $5.27B.

According to its 2020 Annual Report, the company generated $30.46B in revenues up until the end of the financial year in September 2020. This was an increase of $871M, or 2.9 per cent, from the $29.59B recorded in 2019.

Revenue is that total amount of income generated through the sale of food and beverage manufactured by the group, as part of its operations. The profits, however, were garnered from taking away all expenses, including taxes.

Banks’ profit after tax for 2020 was $5.271B. This was an additional $747M, or 16.5 per cent, from the $4.524B in after-tax profit recorded in 2019. Before taxes were deducted, the company’s profit stood at $7.329B.

It is important to note that the company’s success was recorded during a particularly challenging year globally, and more so, locally.

“I can report that the group, having experienced those challenges, by virtue of teamwork and commitment was able to surmount the obstacles presented, utilising the combined strengths of our workforce, the market acceptance of our brands, our effective selling and distribution network, and our loyal customer base,” Chairman and Managing Director Clifford Reis said in the Chairman’s report.

He explained that it was the combined contribution of this resource base that enabled Banks to achieve increased revenue streams, in addition to more efficiently controlling expenses and financial resources.

CAPITAL INVESTMENT PROJECTS

The chairman also related that a number of capital investment projects at the production and related facilities were undertaken during the period under review. These, he posited, allowed for the more efficient conversion of raw materials into finished products, while also enhancing efficiency in day-to-day operations.

The relocation of the Liquor Warehouse to Thirst Park was completed, in addition to the completion of the extension of the stores to accommodate increased and improved storage. Across the facilities, additional infrastructural repairs and upgrades were made.

Importantly, it was reported that key capital projects which began during the period under review, are expected to be completed in the new financial year. This includes the construction of the multi-level parking facility and headquarters for the new Banks Automotive and Services Inc.

In addition to the revenue and profits for the company, the Banks DIH Limited Group incurred a trading $8.851 B profit from operations, and the profit after tax attributable to the shareholders of the parent company was $5.666 B. This followed the accumulation of $34.22 B in the group’s third-party revenue.

SUBSIDIARIES

Meanwhile, Citizens Bank Guyana Inc, the 51 per cent-owned subsidiary of Banks DIH, raked in $982.2M in profits after taxes following the collection of $3.749 B in revenues. This after-tax profit was an increase of $26.9M from the $955.3M recorded in 2019.

The net interest income, which is simply the difference between the income a bank earns from lending and the interest it pays to depositors, was recorded as $2.835B. Citizens Bank’s earnings per share (EPS) was $16.51.

Additionally, the 100-per-cent-owned subsidiary, Banks Automotive and Services Inc generated $8.6M in profits before taxes, following the accumulation of revenues of $78.2M.

Looking ahead, Reis reminded that the Board of Directors has approved the diversification of the company’s business model to include business ventures into transportation and alternative energy solutions.

“We will pursue this new and emerging segment of our business activities with diligence and purpose, as has been our intention over the past 65 years of our existence,” Reis assured.

.jpg)