– international investigation company, Global Witness urges

An International investigation company has put forward that United States (US) State Department should encourage U.S Oil giant, ExxonMobil to renegotiate “new and fair deal” oil deal with Guyana to save the country from losing an entitled $55 billion dollars.

In a report produced by Global Witness, the organisation laid the opinion that Guyana presented “feeble negotiation terms” and the “aggressive company” [ExxonMobil] pounced on this when it “negotiated an exploitative deal”.

The organisation has also theorised that Natural Resources Minister, Raphael Trotman, who signed the Exxon deal in June 2016, may have been compromised even though they admitted that they have no proof of this. “Global Witness does not have evidence that Trotman was unduly influenced by his lavish Exxon meeting. But there is evidence that he negotiated badly for Guyana, one of the poorest countries in the Western Hemisphere,” the report titled ‘Signed Away’ stated.

Government, in an immediate statement, said it noted the report and will be making a formal statement on it. Foreign Secretary, Carl Greenidge, last week had warned Guyanese against the report, saying the NGO is known for sourcing its information through questionable means such as secret filming, satellite imagery, drone footage and anonymous sources. He chastised the company for having nothing to say on Guyana’s behalf when Venezuela laid claim to more than half of the country and its resources. “Some set of Guyanese have sought to bring an NGO – a very controversial NGO – to present a report which will claim that this government has been managing its business improperly, corruptly, inefficiently and billions of dollars have been lost to the poor,” he said. “When [the border controversy] was going on, this NGO, called Global Witness, was nowhere to be found. They had nothing to say on our behalf when another country was trying to steal our resources. If our resources are stolen, they are lost to our poor. But now that oil has been discovered, this NGO has suddenly got a feeling for the poor,” Greenidge further added.

With regards the renegotiating of a new agreement with Esso Exploration and Production Guyana Limited partner of U.S. oil giant ExxonMobil, Director of the Department of Energy, Dr. Mark Bynoe is on record saying that while the agreement may not be excellent, it is not very poor. “Contracts are (placed) on a spectrum and they range from excellent to very poor. What we can say is that the current PSA may not be excellent but it is not very poor either,” Dr. Bynoe told reporters during a press conference at the Ministry of the Presidency late last year. At the time, he was responding to the question of whether government would renegotiate the 2016 agreement in light of continued criticisms from both civil society and the political opposition over several aspects of the agreement, including the percentage of royalty.

Dr. Bynoe said that a review of the PSA with ExxonMobil has to be contextualized in terms of the volume of the investment, the risks taken, and the period in which the investment occurred.

“As a government, we have already expressed the need to honour the sanctity of the contract and we will continue to do that, but contracts do evolve,” he emphasised while noting that government will continue to engage ExxonMobil to ensure that the value proposition to Guyana increases.

Weighing in on the issue, the Energy Department’s Oil and Gas Adviser, Matthew Wilks, said the renegotiation of contracts in the oil industry must be done on a mutual basis, noting that from the initial stage, they are mutually agreed upon. “The success of Guyana is being based on Guyanese approach to contractual law which is sanctity to contract, generally, whatever contract there may be, whether it is in the oil sector or outside of the oil sector,” Wilks told reporters.

Cautioning that investors are looking on, he said any unilateral decision with respect to a contract can be a deterring factor. “If you start unilaterally trying to change contracts, you frighten investors, and you only have to look at other jurisdictions where this has occurred for one reason or the other…and you would see investors stop investing,” the Oil and Gas Adviser said.

Like Dr. Bynoe, he said when analysing a contract, consideration must be given to the time in which it is signed, the level of investment, and the risk taken. “When you are seeking or you look up opportunities to change the terms of the contract, you could only do that when the circumstance arises, and when it is mutual; you cannot force it,” he said. While the government has not agreed to renegotiate the contract with ExxonMobil, the Department of Energy has initiated the process of designing a new model contract that will be used for future PSAs. Wilks said, like any contract, the model contracts are developed, based on the existing environment of a given sector.

Giveaway of oil blocks by PPP

The Global Witness report also spoke to the signing away of the Kaieteur and Canje oil blocks just before the 2015 elections by the former Administration under former Natural Resources Minister, Robert Persaud, as “an extraordinary degree of ignorance about the ultimate owners of the winning companies”.

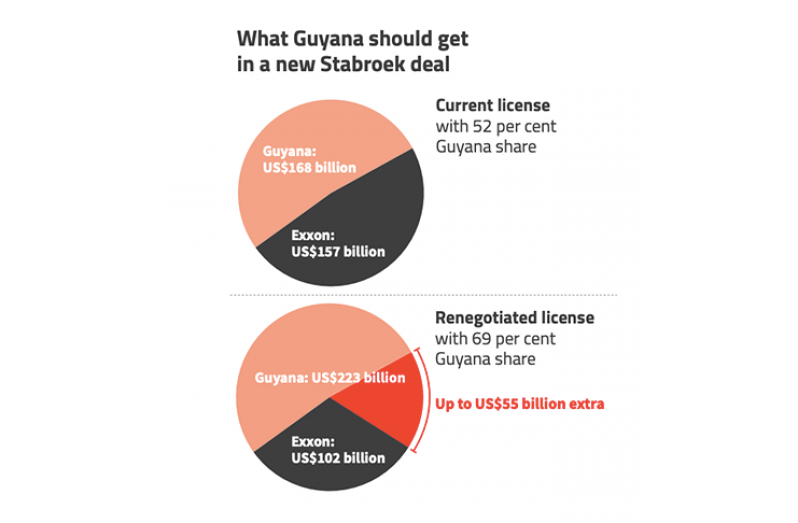

Global Witness argued that Guyana can use the estimated $55 billion dollars lost in the current Exxon deal to build better schools, address the sugar industry, fight corruption and fix its sea defences. “And this is a story about the US, and how it can help,” the report stated: “…the US should strengthen a proposed rule implementing Section 1504 of the 2010 Dodd-Frank Act. This rule should – but currently does not – require that oil companies publish their payments on a project-by-project basis. The US should also support Guyana if it chooses to renegotiate the Stabroek licence, ensuring that Exxon comes to the table.”

The company projected that ExxonMobil can afford Guyana increasing its oil revenue

share from 52 per cent return on every barrel of oil sold to 69 per cent. It contended: “Even if Guyana renegotiates Stabroek, estimates show that Exxon will still get a return on its investment of 18 per cent.”

Throughout the report, Global Witness maintained that the Stabroek negotiations appear to have been rushed and that “Exxon’s seemingly aggressive tactics worked”. Even so, it also maintained: “Global Witness does not have evidence that Trotman’s Stabroek negotiations were influenced – unwittingly or otherwise…” as well as “Global Witness does not allege that Exxon deliberately misled Guyana or withheld information about Liza 2 while negotiations continued”. The position suggested that the views held cannot be entirely confirmed. Nonetheless, the company put forward several recommendations to the government and ExxonMobil. The report reminded that in April 2019, US Ambassador to Guyana, Sarah-Ann Lynch, said that Guyana has the right to renegotiate and that the US “certainly won’t interfere with that.”

Global Witness put forward: “Countries like Nigeria and Papua New Guinea have recently called for oil companies to renegotiate the terms of their licences. Guyana can do the same by negotiating a better Stabroek deal and, given how important the licence is to the company’s future, Exxon should come to the table….If the Guyanese government does decide to renegotiate, Global Witness believes the State Department should support the government’s decision, telling Exxon it needs to come to the table and defending Guyana’s right to get a good deal.”

It was also recommended that Guyana allow Exxon to extract oil from the 16 wells it has

already drilled, but allow no additional drilling in the Stabroek licence and cancel its nine other allocated licences and not award any new licences. Regarding the Canje and Kaieteur Blocks awarded under the management of Persaud and signed by former President Donald Ramotar, Global Witness stated that the “awards do exhibit red flags”.

“Based on publicly-available documents, the companies awarded Kaieteur and Canje appear to have very limited track records in the oil industry,” the document stated.

“It would be extraordinary if the reports upon which Persaud made his Kaieteur and Canje awards did not include this critical information. If Persaud did not know who owned the companies receiving the two licences – at least at the time of the award – he or his team ought to have made further enquiries.”

The company urged that Guyana’s government “redouble the efforts of its investigation into the award of the Kaieteur and Canje licences” currently being conducted by the State Assets Recovery Agency (SARA). It recommended that if the investigation uncovers evidence of wrongdoing, those involved should be held accountable while Exxon should declare how it addressed any red flags associated with Kaieteur and Canje when it purchased shares in the licences.

.jpg)