…AG threatens legislation to bring lawyers, real estate agents in compliance with AML regime

By Svetlana Marshall

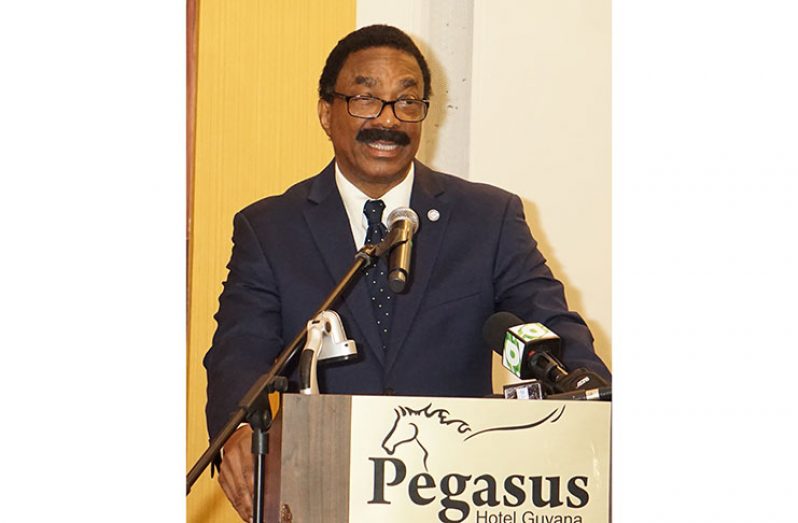

GUYANA has made significant strides in combating money laundering and terrorism financing but vulnerable groups such as lawyers and real estate agents remain a cause for major concern, as the country prepares for the fourth Round of Mutual Evaluation, Attorney General and Minister of Legal Affairs Minister, Basil Williams, said on Thursday.

In his address during the opening ceremony of Guyana’s Money Laundering and Terrorism Financing (ML/TF) National Risk Assessment Seminar at the Pegasus Hotel, the Attorney General said it was as a result of the strong political will demonstrated by President David Granger, the government, and the Attorney General’s Chamber, that the country was removed from the Financial Action Task Force’s (FATF’s) Blacklist in 2016.

In an effort to strengthen its AML/CFT regime, which was considered weak by FATF and the Caribbean Financial Action Task Force (CFATF), the David Granger Administration, upon entering office in 2015, put a number of legislative framework in place including an the Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) Amendment Act, thereby clearing the way for the establishment of an Anti-Money Laundering and Countering the Financing of Terrorism and Proliferation Financing Co-ordination Committee. It also passed the State Assets Recovery Act, Protected Disclosures Act, and the National Payments Systems Act in 2018 to bolster its legislative response.

While the country has the legislative framework in place, the Attorney General said it was important for vulnerable groups to comply with the recommendations established by both FATF and CFATF as Guyana prepares for its 4th Round of Mutual Evaluation in 2023. Singling out the country’s legal professionals, Minister Williams said it has been more than two years that the lawyers have been asked to comply with recommendations established by the regional and international financial watchdogs.

“It is important that you (the lawyers) come within the requirements of the FATF. The recommendations and one of the requirements is that you be supervised either by yourselves or by a supervisory entity. If we have to go to legislation to create it, we will have to do that because of course, Guyana cannot be blacklisted because the lawyers feel that there are in a special category,” the Attorney General made clear.

Attorneys have been deemed “high risk” with respect to money laundering and financing of terrorism due to the fact that they engage in the purchasing and buying of real estate; the management of client’s finances and assets; and the management of bank and savings accounts among others.

Falling within the Designated Non-Financial Businesses and Professions (DNFBPs) category, attorneys are expected to comply with Recommendation 10 (Customer Due Diligence); Recommendation 11 (Record Keeping); Recommendation 12 (Politically Exposed Persons); Recommendation 15 (New Technologies); Recommendation 17 (Third Parties); Recommendation 18 (Internal Controls); Recommendation 19 (High Risk Countries) and Recommendation 21 (Tipping Off and Confidence) as set out by FATF/CFATF. In complying with those recommendations, they are expected to file suspicious transaction reports. Minister Williams expressed the hope that under the leadership of Attorney-at-Law, Teni Housty, the Guyana Bar Association (GBA) would embrace the FATF recommendations.

Housty, who was among those present during the opening ceremony, on the sidelines told the Guyana Chronicle that the matter is actively engaging the Bar Association. “We and our colleagues throughout the Caribbean recognise the importance and the fact that measures are coming, and we are all looking at it holistically,” the President of the Bar Association said.

Meanwhile, while renewing the government’s commitment to the fight against money laundering and terrorism financing, the Attorney General said the National Risk Assessment, the second of its kind for Guyana, is critical. “This assessment is very important to point out to us the high-risk areas so that when we are budgeting, we would direct our expenditures to these areas,” Minister Williams explained.

Guyana’s National Risk Assessment (NRA) Coordinator, Alicia Williams, explained that the assessment is being conducted by a working group of 75 persons – representing public and private sector organisations in the country. “It will allow us to identify any new emerging money laundering and terrorist financing threats and vulnerabilities,” the Coordinator explained, while adding that attention is being placed on the Oil and Gas Sector, proliferation financing, virtual assets and illegal wildlife trade. The assessment, she noted, will allow Guyana to address its vulnerabilities ahead of the mutual evaluation.

This second round of National Risk Assessment is being conducted for a period of 10 months – from December, 2019 to September, 2020, in keeping with the World Bank’s recommended three-phase process.

“It is a capacity building exercise that will enable us to undertake future risk assessment without external support. It is to include all AML/CFT stakeholders from public and private sectors to bring in different perspectives and enhance their cooperation,” the NRA Coordinator stated.

In providing an overview of the first assessment, which was conducted for a period of 12 months (2016-2017), the NRA Coordinator said on the financial side focus was placed on the banking sector, insurance entities, money transfer agencies and cambios. Casino, lotteries, pawn brokers, accountants, attorneys-at-law, real estate agents, credit unions, cooperatives, dealers of precious and semi-precious stones and dealers of precious metals, who fall within the Designated Non-Financial Businesses and Professions (DNFBPs) bracket, also came up for assessment.

“The working group found that the overall money laundering risk for Guyana was high. That was informed by the country’s overall threat, which was also rated as high and the overall vulnerability which was rated medium-high,” the NRA Coordinator explained.

According to her, the country’s threat level of terrorism was rated as medium. “The most vulnerable sectors were attorneys-at-law, accountants, real estate agents and used-car dealers,” she pointed out, while noting that those categories of professionals and businesses were deemed high risk. “The driving factor for this rating was the fact these sectors at that time, were subject to little or no regulation and supervision for AML/CFT purposes,” she further explained.

Sectors for medium-high money laundering vulnerabilities were the bank, money transfer agencies, cambios, credit unions, dealers in precious metals, dealers in precious and semi –precious stones and cooperatives. The least vulnerable sectors were pawn brokers, betting shops, insurance companies.

It was noted that recommendations made in the National Risk Assessment Report were included in a Risk-Based Action Plan. That action plan outlined the actions to be taken by the various agencies, and the timeframe in which they must be completed.

The NRA Coordinator said, in keeping with the recommendations placed on the table, the AML/CFTPF National Coordinating Committee was established. Memorandums of Understanding (MoUs) have also been established between the Financial Intelligence Unit (FIU) and AML/CFT supervisory authorities. It was noted too that, the FIU staff capacity was increased from eight to 11 and that includes an accountant and the attorney. The Special Organised Crime Unit’s (SOCU) staff capacity was also increased from eight to 13, and further amendments made to the AML/CF Act.

Minister of Business, Haimraj Rajkumar; Governor of the Bank of Guyana, Dr. Gobind Ganga; Director of Public Prosecutions, Shalimar Hack; Commissioner of Police, Leslie James; Director of the FIU, Matthew Langevine; Solicitor General, Nigel Hawke; Chief Parliamentary Counsel, Charles Fund-A-Fatt and members of the Diplomatic Corps were among those that attended the opening ceremony of the Money Laundering and Terrorism Financing National Risk Assessment Seminar.

.jpg)