…holds talks with gov’t on rural banking

ONE year after opting to close its operations in Guyana, prominent Indian financial institution, Bank of Baroda, has signalled its intention to expand in the area of rural banking and offer other services.

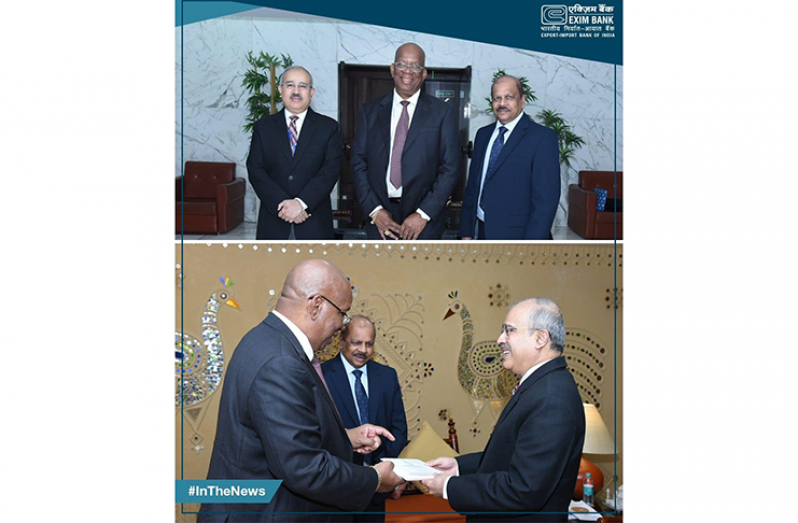

The bank had engaged Minister of Finance, Winston Jordan and Governor of the Bank of Guyana, Dr. Gobind Ganga, in discussions on how the bank can consolidate its operations here. Those discussions were held at the Bank of Baroda’s Headquarters in India, where Guyana is represented by Minister Jordan and Dr. Ganga.

“We have been engaging the officials of the bank and we have discussed ways how the Government can assist,” said Minister Jordan during an interview with Social Activist, Mark Benschop on Benschop Radio, on Tuesday evening.

The minister said the discussions were fruitful, so he anticipates that the Bank of Baroda will remain in the local market for years to come. Bank of Baroda was founded in the city of Baroda (now Vadodara), Gujarat, Western India in 1908. Since then it has become a global presence with locations in 24 countries worldwide.

The Bank of Baroda (Guyana) Inc. was one of the earliest overseas branches of the Bank of Baroda. It was established in Georgetown, Guyana on March 31, 1966, less than a year after the formation of the Bank of Guyana, and prior to Guyana’s independence.

In 1999 the branch in Guyana was converted to a wholly owned subsidiary of the Bank of Baroda. In 2012 the bank established a branch in Mon Repos on the East Coast of Demerara. It now has two branches in Guyana. The bank controls about three per cent of the banking market shares in Guyana. In all, the bank has 9,583 branches worldwide with 69 million customers.

It was reported that the bank’s local subsidiary’s total business stood at $14.56B at the end of September 2018, down from $20.576B at the end of March 2017 and $21.09B at the end of March 2016.

In December, according to a Request for Proposal (RFP), the bank said that it was seeking investment bankers for the sale/disinvestment of its entire 100 per cent stake in the Bank of Baroda (Guyana) Inc. (BOBGI) operations. That decision has since been rescinded and it seems as though the bank is on track to stability in the local market.

.jpg)