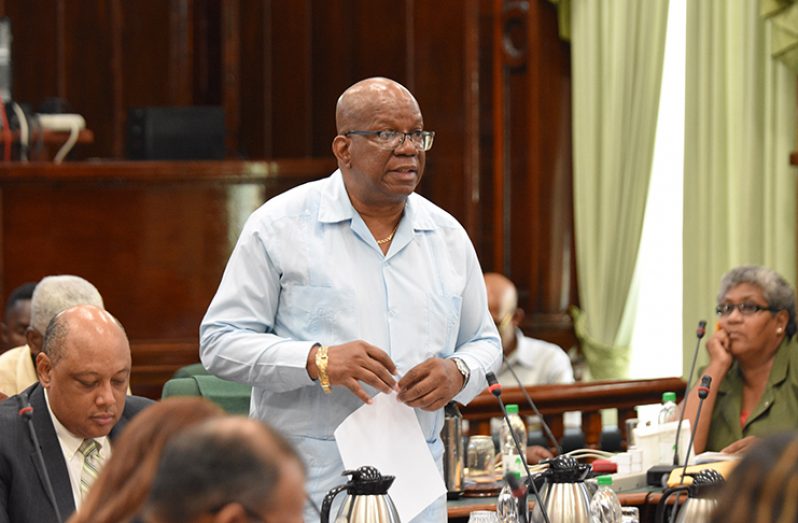

THE Government of Guyana has made progress in the area of Public Debt Management, according to the Public Debt Annual Report 2017 which was presented to the National Assembly on Monday by Finance Minister Winston Jordan.

For the year 2017, the total public debt-to-GDP increased marginally to 46.1 per cent from 45.7 per cent at the end of 2016.

According to the report, the success recorded in 2017 was a result of the implementation of a range of programmes and projects aimed at enhancing the country’s laws and operational and governance practices.

With technical assistance from the Commonwealth Secretariat (COMSEC) and the Centre for Latin American Studies (CEMLA), the government through the Finance Ministry in 2017 continued the process of reviewing and modernising the legal framework for public debt management in the country. The fundamentals in public debt management, sustainable funding strategy, medium-term public debt management strategy, debt-sustainability analysis and self-assessment performance were among areas covered during a number of technical forums attended by finance officials. It was noted too that officials were also trained in the use of tools, facilities and the new features in the latest version of the Commonwealth Secretariat Debt Recording and Management System (CS-DRMS).

According to the report, the draft Public Debt Management Bill (PDMB) remains a work in progress. The bill seeks to improve and modernise the legal framework for public debt management. It is expected to be completed this year.

For the past four years, Guyana has worked with CEMLA with funding from the Swiss Government under the Public Debt Management Capacity Building Programme (PDP).

“One of the main outputs from this collaborative effort has been the preparation of Guyana Public Debt Management Procedures Manual, as reported in the second edition of the Public Debt Annual Report. This manual, which was formally approved in December 2016, was implemented with effect from January 3, 2017,” the report states.

The manual has been adopted by the Finance Ministry’s Debt Management Division (DMD) as an official document of the government and is used as a tool when conducting debt-management operations.

“It is a ‘stepping stone’ for public debt management in Guyana, as it aids in streamlining the back-office operations with other relevant departments and institutions,” the report states.

In the report, the Finance Minister said the government remains committed to improving transparency and accountability, in an effort to ensure effective public debt management.

Though Guyana has recorded progress in the management of its public debt, Minister Jordan said the country continues to face a number of challenges.

“As a small, open economy, Guyana is particularly vulnerable to the effects of globalisation. In recent times, we have been faced with new challenges, one of which is maintaining debt sustainability in a volatile and uncertain global economy.

The recent Debt Sustainability Analysis indicates that given the openness of the economy and its continued dependence on a narrow range of commodities for the bulk of its export earnings, the country would continue to be susceptible to external shocks which, in turn, could affect the sustainability of our debt,” Minister Jordan explained.

He said too that the country is also highly vulnerable to commodity price shocks, as well as demand shocks, which originate in countries that purchase goods and services from Guyana.

“We are also faced with a number of development challenges, including: infrastructure development in a largely isolated interior; the decline of traditional agriculture; and reduced access to grants, technical assistance and concessional lending, the latter of which presents a major challenge to debt sustainability,” the finance minister added.

Nonetheless, he gave the assurance that the government is exploring new strategies to reduce Guyana’s reliance on external debt, including a domestic bond market. It was explained that such a move would reduce the country’s vulnerability to exchange rate risk, which is currently high.

.jpg)