…GuySuCo says $30B bond was a bad deal

…Min. Holder, CEO say in dark over transaction

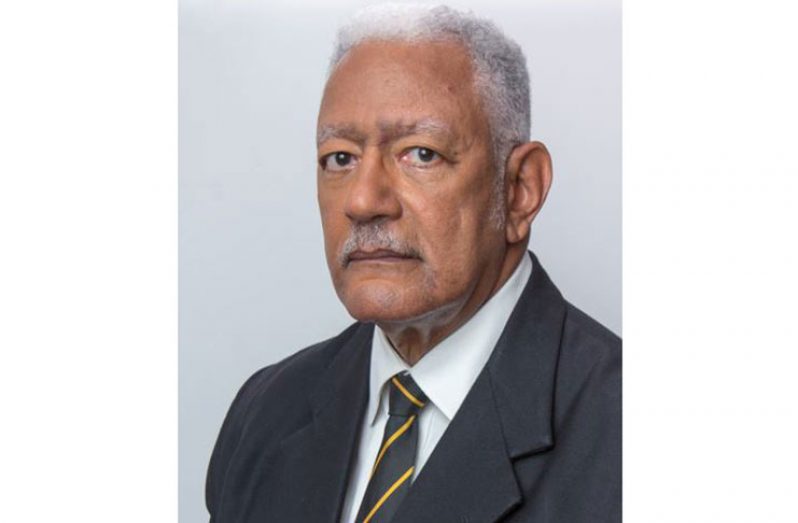

Agriculture Minister Noel Holder and Chief Executive Officer (CEO) of the Guyana Sugar Corporation, Dr. Harold Davis Jnr have expressed deep concern over the handling of the $30B syndicated bond secured by the National Industrial and Commercial Investment Limited’s (NICIL) Special Purpose Unit (SPU) to revive the industry, with the latter describing the deal as a bad one and the minister saying he has been left completely in the dark about the transaction.

Reports surfaced in another publication earlier this week indicating that Republic Bank would have halted GuySuCo’s bond financing over claims that the money was not used for its intended purpose. GuySuCo had received two disbursements–one for $880M and another for just over $1.1B. Dr. Davis on Wednesday confirmed that the corporation did receive approximately $2B but made it clear that the money was not misused. He told Guyana Chronicle that the close to $2B handed over to GuySuCo was addressed to “employment costs,” noting that the corporation has a large workforce, and to cover basic operating expenses, and capital projects. “The money was not used for the repaying of a debt; the money was used for the payment of interest, which is part of our operating expenses. When you incur credit from creditors, elements of interests have to be paid. If you take a mortgage you pay interest; these are operating expenses, they are legitimate operating expenses,” he explained.

Dr. Davis said a percentage of the money was used to facilitate capital works as well. “So the rest of the money that was requested was addressed to essential capital that also passed through a tender process and approved by the ministry,” he said. He maintained that the sugar corporation has always been transparent about the use and intended use of the funds.

Last month, the SPU disclosed via a press statement that almost $2B was disbursed to GuySuCo for operational expenses of the Albion, Blairmont and Uitvlugt estates. In that statement, it was explained that through local financing, arranged by Republic Bank Limited, the SPU managed to successfully negotiate a Bond Facility for $30B, with significant input from the Ministry of Finance, and of the full sum secured, $17B was requested in the first tranche.

Deeply concerned

Meanwhile, the minister has expressed deep concern over the handling of the bond and the rate of disbursement to GuySuCo. At a news conference on Wednesday at the Ministry of Agriculture, Minister Holder said that the functions of the SPU were clear when the A Partnership for National Unity + Alliance for Change (APNU+AFC) Government took a decision to scale-down the operations of GuySuCo. He said the SPU was established to manage the divestment of the Skeldon Factory and other assets owned by GuySuCo. Its functions also include facilitating the process of valuation, marketing, advertising and the drafting of legal framework. As stated in the ‘State Paper on the Future of the Sugar Industry’ presented to the National Assembly in May 2017, GuySuCo’s operations have been reduced to three estates: Albion, Blairmont and Uitvlugt Estates from a total of seven estates. It was expected that with funds secured from the sale of its assets, investments would have been made to rehabilitate its fields and factories, allowing them to be more efficient, resulting in better yields. Instead, a bond was secured but the monies have not been forth coming.

“The SPU having been formed found itself unable, in a timely manner, to divest these estates to getting it valued by PricewaterhouseCoopers (PwC). So in order to let GuySuCo get ahead with its projects, it then went and sought finance pending the sale of these estates so that GuySuCo can get its money,” the Agriculture Minister explained.

He said, however, while SPU would have secured the $30B bond facility, to date, the Agriculture Ministry or the Management of GuySuCO has not seen the Trust Deed. A trust deed is an act of conveyance creating and setting out the conditions of a trust. “So they (SPU) apparently secured some $30B bond which GuySuCo’s Management has not seen, which the Minister of Agriculture has not seen, and frankly speaking, don’t really want to see,” he told reporters.

The minister hinted that while a percentage of the bond was released to the SPU, the money has not been handed over in full to GuySuCo. “I can’t understand why you will get $30B, pay 4 per cent interest, sit on it, and don’t hand it over to who supposed to use it, but that is for the politicians to look at, and the politicians are looking at it,” the Agriculture Minister said.

In the dark

Dr. Davis told this newspaper that GuySuCo is in the dark when it comes to the bond facility, and its terms and conditions, and as such could not speak to any violation. “We don’t know what are the conditions of the trust bond,” he posited but emphasised that the money was used to cover employment expenses, and justifiably so. “They were all transparent,” he further emphasised. The CEO is now of the view that SPU inked a bad deal and GuySuCo and the Ministry of Agriculture should have been consulted on the bond facility. “Whatever it was, I think it was a bad deal. In the first place, GuySuCo should have been consulted on what the bond was about and we should have been clear on that, and we still aren’t,” Dr. Davis said.

He noted that while $17B was made available to the SPU, to date, GuySuCo has only received close to $2B. GuySuCo has made a third request for finances but that is still pending. “We recently made an application release of funding for September’s operating expenses and some capital projects,” he said.

Dr. Davis told this newspaper that a request by GuySuCo for finances to facilitate essential retooling is also pending. “The monies were never released, so GuySuCo is still living in a very difficult place.” Under the new Board of Directors headed by John Dow, GuySuCo is hoping to upgrade its facilities to improve its yields, produce value added products such as plantation white sugar, and thirdly, produce energy through co-generation.

Back in July the SPU had defended the conditions of the bond, saying that it was secured solely by the full faith of bondholders in the Guyana government and not against any assets of NICIL or GuySuCo. Further, the SPU said the commercial lending rate for Guyana is 13.00 per cent, while the NICIL bond was issued at 4.75 per cent, which is 8.25 per cent lower than the rate that most companies borrow at in Guyana. The current inflation rate in Guyana is 2%; therefore, any prudent investor would demand a return higher than the rate of annual inflation, the NICIL unit said.

The GY$30 billion would be used, the SPU said, to help finance “an ambitious strategic plan to turnaround the fortunes of the Guyana sugar industry.” According to the Unit, in part, the strategy involved the development of two co-generation facilities, upgrades to the existing sugar factories to produce white sugar, the restructuring of debt, and ongoing training and education for the workers and management of Guysuco. “To augment the plan, financing was sought to implement NICIL’s strategy to the tune of G$30 billion and awarded a mandate to the leading arranger of debt financing in the Caribbean– Republic Bank Limited,” SPU said.

.jpg)