–Statia says its doable, but hard work for GRA

THE government has proposed to grant amnesty to all delinquent taxpayers, whether corporate or individual, who are in default of either the filing of true and correct tax returns, or payment of their true and correct taxes.

This was announced by Minister of Finance, Winston Jordan during his presentation of the 2018 Budget to the National Assembly on Monday.

The amnesty is expected to take effect from January 1, 2018 and will last up to September 30, 2018.

“Taxpayers who file and pay all principal taxes on or before June 30, 2018 will have all interest and penalties waived, while those who file and pay all principal taxes between July 01, 2018 and September 30, 2018 will have 50 percent of interest and penalties waived,” Minister Jordan announced.

But there’s a caveat, in that taxpayers who expect to benefit from this amnesty must file true and correct returns. Those found to be in violation of this stipulation, the minister said, will be subject to an audit and the attendant penalties and interest will be applied.

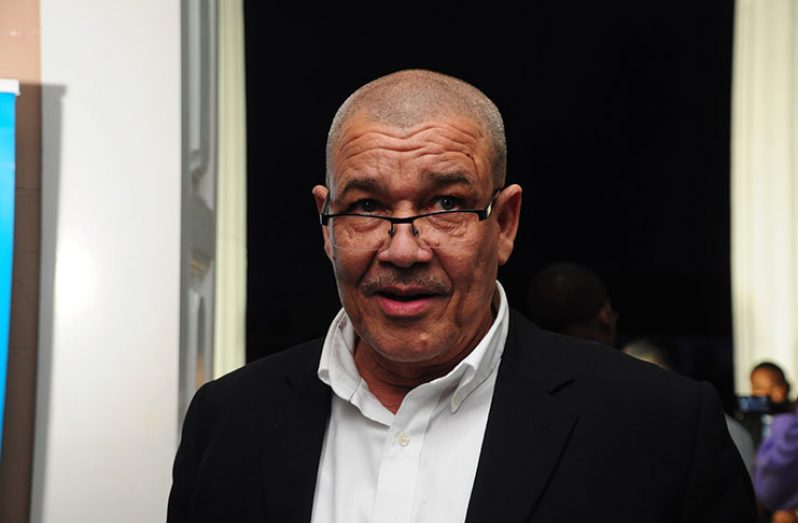

Commissioner-General of the Guyana Revenue Authority (GRA), Godfrey Statia told the Guyana Chronicle last night that his agents will have their jobs cut out for them, especially when considering all that was said by the Minister of Finance.

“The amnesty entails a lot of work, because we have to quantify taxes that are outstanding, and identify what are true and correct,” Statia said.

In order to get the work done, Statia said, the Authority will have to shift around its staff in order to maximise output. The GRA will also be devoting increased resources to the enforcement of the income tax laws.

.jpg)