— President says matter under consideration

THE Government of Guyana is currently contemplating the reversal of some budgetary tax measures implemented during the 2017 national budget.

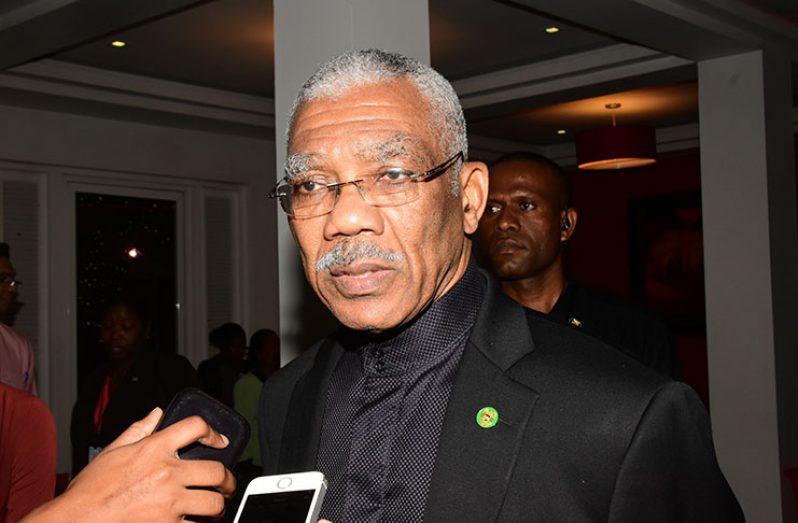

Head-of-state President David Granger told the Guyana Chronicle in a recent interview that the implemented tax measures were not ornamental and were implemented because of revenue shortfalls.

“We are actually looking at means to reduce the taxation burdens,” said President Granger as he explained that the APNU+AFC administration did not implement the new tax measures to put an unnecessary burden on citizens.

Finance Minister Winston Jordan had announced during the reading of the 2017 budget that a 14 per cent Value Added Tax (VAT) would be placed on Private education (tuition), electricity, water, medical supplies and services.

News of the new tax measures did not sit well with the citizenry and resulted in several protests on VAT on private education in particular. Protestors contended that the new tax imposed is burdensome to the working class, while noting that Guyanese are already finding it difficult to survive in this economy.

Several private schools and some students have called on the government to reverse the 14 per cent VAT on private tuition fees. In response, the government committed to revisiting its decision but noted that there are many private institutions that do not pay taxes to the Guyana Revenue Authority (GRA).

Dr Brian O’Toole, head of Nations University, during a consultation had said that the solution to the issue is “not to punish who pay tax” but to go after those who are not compliant.

But President Granger said while assessments are still ongoing on the matter on the reversal of some of the new tax measures, he was not in a position to state which measures exactly would be reversed.

“Yes, we did put it (VAT) on private education but the likelihood is that we will be able to find revenue from other sources and that would be removed,” the President told the Guyana Chronicle.

WIDESPREAD

The President said too that tax evasion is widespread across the country and must be curbed.

Many of the private schools, 33 of which operate within Georgetown, are unrecognised and of the 33 schools in Georgetown, 21 are unrecognised while 12 are. This represents a major problem for the Ministry of Education and the Guyana Revenue Authority.

In April, the President during his television programme, the Public Interest, called on citizens to be more patient and tolerant as he too desires to see changes made.

“We are asking people to be more patient, more tolerant, we have committed to reviewing it and I would like to see it lowered,” the head of state said.

He explained: “We have explained that we had to widen the tax base, there was widespread tax evasion, we need to collect taxation and that is how governments work, once you see there is massive evasion and non-compliance, it then means that the government work will be hampered.”

He explained that in order for the country to pay for services provided it must garner revenue and as such, government continues to look for other sources of revenue.

“As you know, sugar has not been performing; timber has not been performing because of the problems in the international market. So we have to look at other sources of revenue,” President Granger told this publication on Thursday at State House.

In November 2016, Finance Minister Winston Jordan presented a whopping $250B budget for 2017, the biggest for the coalition government, since assuming office in May 2015.

Presented under the theme, “Building a diversified green economy: delivering the good life to all Guyanese,” the budget addressed new tax measures aimed at stimulating the country’s economy.

As such VAT was reduced to 14 per cent from 16 per cent. However, citizens have to pay VAT on their electricity and water bills. Once the electricity bill exceeds $10,000 and the water bill is more than $1,500, then the 14 per cent VAT will have to be paid.

.jpg)