IN 2012, the People’s Progressive Party (PPP) Government disclosed to the Guyanese public

that it was pursuing the Amaila Falls Hydropower Project (AFHP), which would receive US$80M funding from the Government of Norway under the Guyana Redd+ Investment Fund

(GRIF) as part of the Low Carbon Development Strategy. However, the project in its entirety had an estimated cost of US$858M.

Shadowed by a lack of transparency, it was presented to the National Assembly and the current Government, which was then in Opposition, raised several objections, citing the fact that adequate information had not been provided on the financing of the project and the design had several flaws. As such, the viability and longevity of the project could not be guaranteed.

With the new Government taking office in 2015 with the goal of placing the country on a path of ‘green’ growth, the project was discussed with the Norwegian Government and an agreement was reached to have an independent third party review of the project to determine its viability. The Government of Norway has released the report on the review of the Amaila Falls Hydropower Project (AFHP) done by Norconsult, an engineering and design consultancy firm out of Norway, which was commissioned to complete an ‘objective and facts-based’ assessment of the project on the agreement of two Governments.

The Guyana Government is working to complete a long-term energy plan, which outlines a mix of renewable energy options and it believes that the report identifies several risks and flaws in the design of the project, which threatens its long-term effectiveness and may prove too costly and burdensome to the people of Guyana and the country as a small developing state. Credence to the Government’s position has been added by Mr. Charles Ceres; Civil, Geotechnical and Groundwater Hydrology Engineer and Head of the Project Management Office (PMO), Mr. Marlon Bristol, who believes that the Amaila Falls Hydropower Project (AFHP) would be a heavy burden to taxpayers, should the project be given the go-ahead in its current configuration. He noted that while the project has honourable intentions, it would

not be an ideal investment for the country at this stage of its development.

Sediment-handling methodology

Among the issues, which have been raised in the report, are the absence of any sediment-handling methodology in the design of the plant; the absence of a separate flywheel between the turbine and the generator and the absence of several details from the Owner’s requirement including the “minimum requirement to overall plant efficiency, which includes the hydraulic losses in the waterway.” Norconsult further points out that “19m head loss in about 3km long headrace tunnel is higher than would be expected for a hydropower plant designed by traditional procedures for hydraulic optimisation”. Additionally, “the dimensions described for the pressure shaft and pressure tunnel are also not sufficient for satisfying requirements for regulation stability.”

Providing his professional opinion after studying the Norconsult ‘Review of the Amaila Falls Hydropower Project in Guyana Report, Mr. Ceres said that the flaws and risks, which have been pointed out in the independent review are significant and fatal and, therefore, negate the efficacy of the development of this site at this time. Mr. Maxwell Jackson, Civil Engineer and Lecturer at the University of Guyana’s Faculty of Technology, who also recorded his comments on the findings of the report, said that while he would like to see the project come to fruition, the issues which have been identified, cannot be ignored. Like Mr. Ceres, Mr. Jackson said that the design configuration does raise some questions. Further, he believes that the financial model has to be examined.

“The other concern is the financial package. In my own view and most people in Guyana have always questioned the model of investment used for the project and this report questioned it. I tend to agree with the report in that light, because the package, that model that was there, was not to our benefit. It would not have been attractive enough, even if we were to use it to attract another sponsor or another developer; it would be to our disadvantage. A reformulation of the model of investment that was initially identified for that project would have to be done. The report said that and I concur,” he said.

He too addressed the availability of data for the location, noting that there is not adequate information to work with. “I personally have issues as regards the data; the actual, measured data, that we have available. As regards the hydrological data, much measurement, actual measurement for a project for hydropower of that magnitude is unsatisfactory, because you have to use a small amount of data and predict, and determine from a statistical view, what would be the data in the years ahead,” he noted.

Further to this, Norconsult recommended that three years of geotechnical and geological works be done around the site to determine the risks and viability of the output of the plant. However, Mr. Ceres explained that the investment needed in these three years does not provide any assurance of success. It could end up becoming costly with no results to show, he says.

Mr. Ceres further contended that rectifying the many issues identified will increase the total cost of the project substantially, thereby impacting the tariff rates from the outset. Additionally, there are at least six more years of work to be completed, including a minimum three years of water-flow study and analysis on the project.

Despite these issues, however, Mr. Jackson is convinced that once corrected, the project will be Guyana’s best chance of charting a course on the path of renewable energy. “Even if we are to go to solar or wind or any one, there is a gestation period that would take more than three and a half years so if we are contending now that we can’t benefit from Amaila, then we still can’t get the others now. If Amaila is not viable, how are we going to meet 100 percent emission-free generation without Amaila?” he contended.

While he agrees that modifications will be needed, Mr. Jackson further insists that the country should go ahead with the Amaila project as significant investments have already been made. “The report said that we didn’t even look at an underground power house. This in itself could have a lot of savings and if you read that report, it brings down the cost considerably and with a reduced unit cost of energy. Who is going to do the wind? These projects have gestation periods. The preparation period is extensive. It cannot happen overnight. We cannot replace our renewable contribution even by 50 percent without hydro. We have already expended a lot of money in that project. What are we going to do now,” he said.

Mr. Ceres, however, is adamant that Guyana, at this stage of its economic development, cannot afford the Amaila Falls Hydropower Project. He noted that there are other critical areas such as health and education, in which the money is better spent and suggested that later, when Guyana has become more economically stable, it can revisit the project.

“The question is; do we need Amaila at this stage? I think it is an onerous burden on our resources to spend that kind of money on Amaila Falls when we can spend less money for the same volume of power. What we need at this stage of our development is more power and more power should come from a mix of resources that are readily available to us. We can still achieve our ‘green’ economy. It doesn’t compromise that objective and for us to move to Amaila is too costly. It is a burden on taxpayers… I think that we are staring down the barrel of a potential Skeldon II project again; and I don’t think that we should be doing that. The way that the project is currently configured, it is not viable… Amaila Falls will put us on the world stage in terms of our ability to say that we are generating hydropower, but at the end of the day, Amaila doesn’t satisfy the power demands of our country because as the report says, we would have to build a second hydropower plant by 2025,” Mr. Ceres said.

Mr. Ceres also noted that while the location and the intent of the project may have been honourable, the engineering design leaves a lot to be desired. Solar energy, affordable and effective, is another option that is available to help Guyana reach its renewable energy goals, he said.

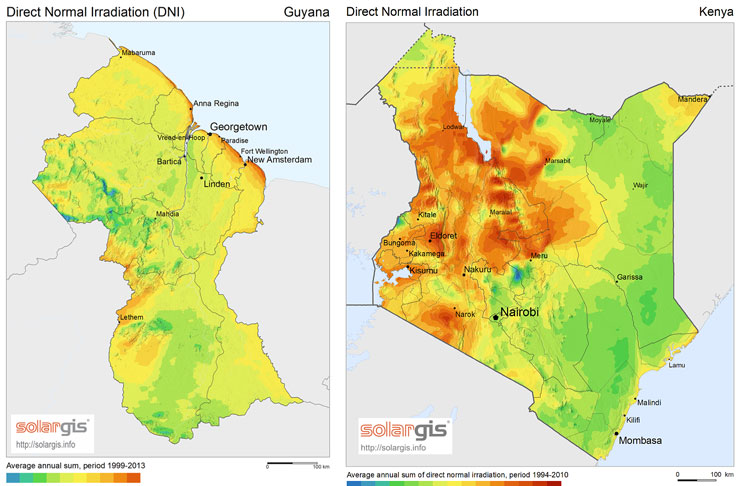

“Germany currently produces 40,000 MW of solar power. Direct normal irradiation for Germany ranges from 700 – 1300 kWh/m2. Similar data for Guyana and Kenya are respectively 1000 – 1800 and 1000-2400 kWh/m2. Kenya has been able to deliver reliable solar power to consumers for US $0.12/kWh, which compares remarkably well with the US $0.0904 and U.S. $0.112 proposed for AFHP. More significantly, Kenya has just signed a contract to build a 40 MW solar power plant for a projected cost of US $10m. This equates to US$250,000 per MW compared to AFHP costs of US $ 5M perMW. The Norconsult report documents that approximately 73 percent of the project cost or some US$585 million would be spent on the dam and transmission line only. The GoG should attempt to replicate the efforts of Kenya to build several solar plants, which will not require the extensive length of transmission line required for AFHP. These options will significantly reduce the overall cost of adding generation capacity to the existing network and will satisfy the Government’s objective,” he said.

Mr. Ceres stated, though, that the development of the other energy options in Guyana would only take shape with acceptance by the Guyanese people that there are several other renewable energy options. The country’s resources, he posited, can be much better spent developing renewable resources in closer proximity to its current capacity, which would prove to be less costly than the hydropower project.

“For too long, the discussion has been only about hydropower. We haven’t looked at the other mixes that we can put together to satisfy the power of the country. We should be examining the total mix that is available to us; solar, wind and biomass. I think we need to have this discussion because people seem to think that Amaila is the only solution. Speaking as a Guyanese, who would have to pay for these resources and for the development of Amaila Falls, I think that in the short term we can use the money that is available to us in a much better way. We can optimise the use of that money much more than we can if we build Amaila Falls,” the professional said.

The engineer added that the level of uncertainty is a significant risk for such a large investment, even if changes are made. “Incurring these additional expenses do not provide a guarantee that whatever solution they come up with would be viable, because it is still in its exploratory stage. Let’s say we go out there and spend three years compiling hydrological data as Norconsult has recommended and it comes back and proves that the project is not viable, we have already expended three years waiting. That three years could have been much better spent looking at alternative energy sources, which we know are available,” Mr. Ceres further added.

Head of the Project Management Office of the Ministry of the Presidency, Mr. Marlon Bristol, in an invited comment, said that the Government’s concerns over the project have been vindicated. He noted that the flaws identified, do not augur well for the country, given the cost implications. He noted that the government has to act responsibly in making a decision of this nature. “I think at the end of the day, the Government has to be very responsible in the action that it takes and at this moment in time and given the current configuration, I don’t think it will be possible to take the risk associated with the potential cost increase from rectifying some of the design issues and the fact that it would have implications for the tariffs up front,” Mr Bristol said.

Other Options

The Government of Guyana proposes to utilise a mix of energy options, starting with less risky options such as solar and wind, as outlined in Budget 2017. Already, provisions have been made for expansion of the scope of clean, alternative energy in the country, resulting in more reliable electricity supply; the establishment of programmes to promote energy efficiency at a household level for financial savings to householders; budgetary allocations of almost $1 billion dollars for renewable energy and energy- efficiency projects; the installation of solar photovoltaic (PV) systems on the rooftops of 64 Government buildings; the installation of a large-scale solar farm at Mabaruma with smaller solar farms in Lethem, Mahdia and Bartica; a one-off tax holiday concession of two years for corporation tax to the business community for the importation of items related to wind and solar energy investments, water treatment, waste disposal and recycling facilities and the replacement of inefficient lights with their energy-efficient counterparts.

Mr. Ceres believes that rice industry waste can generate a significant amount of power with the quantity of rice husk, which is produced on a daily basis. “We have looked at biomass in Guyana and you know we can generate power for all the Essequibo Coast from biomass from rice husk? We have enough rice husk on the Essequibo and the Corentyne to generate as much as six megawatts of power, but I don’t think anyone has looked at those as options and those are options that are readily available and less costly… So what we need to do as a people is to examine what are the least-cost options available to us,” he noted.

.jpg)