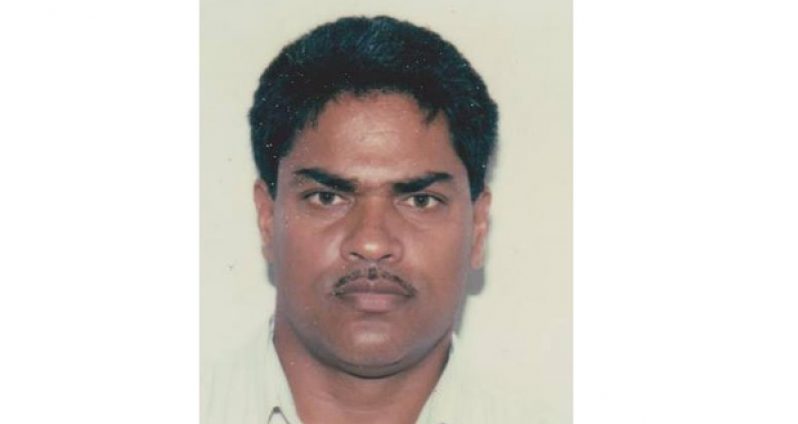

FORMER General Manager of the Guyana Oil Company (GuyOil), Badrie Persaud has finally broken his silence on his dismissal and has defended recent revelations that he awarded millions of dollars in contracts to his nephew and brother.The Board of Directors of GuyOil fired Persaud on February 27 following the findings of the forensic audit, undertaken by Nigel Hinds Financial Services, for the period November 01, 2011 to May 31, 2015.

That audit found that Persaud had failed to disclose his close relationship to persons who had been granted contracts, and recommended that he be “disciplined for non-disclosure of conflicts of interest” for awarding contracts to his brother and a nephew; and for abusing his authority, and breaching the procurement policy.

It was discovered that over the period under review, Persaud awarded transportation contracts worth $62M to his brother, Indarjeet Persaud, and a construction contract valued at $860,000 to his nephew, Avinash Persaud.

LENGTHY STATEMENT

In response, Persaud, in a lengthy statement, on Wednesday defended the contracts, explaining that in the case of his nephew, four acres of land were reclaimed from the river at the Providence terminal, East Bank Demerara, which entailed the levelling of the land.

He explained that because the contract was not a large one, contractors were not inclined to take it on.

One even went as far as asking for $4.5M to do the job, Persaud said, adding that in the circumstances, it was given to his nephew, whose bid was the lowest.

“This was considered very unreasonable. At about the same time, Avinash was mobilising his equipment in Georgetown to go to the Linden Highway, and I told him about the work we had at the terminal. He was asked to make contact with the terminal manager, visit the site, and submit his price for the work. His price was $860,000. So management had two prices: $4.5M vs $860,000,” the former GuyOil boss explained.

In the case of the $62M transportation contract offered to his brother, Indarjeet, Persaud explained that his bid, too, was competitive.

“Given this scenario, management decided to review all the cost centres in the company’s operations, and seek ways and means to reduce same,” he said, adding:

“Operating the company’s Road Tank Wagons (RTW) stood out as a high cost centre. The unit cost to the company to truck one litre of fuel from the Providence terminal to Georgetown was calculated. This was below $2.00/L. Most contractors offered a price of $2.00/L and above.

“The price offered by Indarjeet Persaud was $1.11/L, significantly below the company’s unit cost. Tenders for trucking fuel were again requested in September, 2015 and Indarjeet Persaud’s bid was competitive. Again, no explanation was sought by the auditor. The $62M at caption was for fuel trucked over a four-year period.”

REQUEST DENIED

Persaud claims that while several managers of the company were interviewed by the auditors during the audit, he was not.

He explained that upon completion of the audit in February 2016, he requested a copy of it and asked to be interviewed on the findings but this was denied.

In defending his tenure, Persaud noted that sales at GuyOil are over $40B annually, and that the company’s credit portfolio is rigorously managed by the Credit Controller.

“For several consecutive years prior to 2015,” he argued, “no bad debt was incurred at the company. This is highly commendable for a company with sales exceeding $40B.

“In fact, the Credit Controller was often commended at the Finance & Audit Committee meetings for doing an excellent job. And the service of the Finance Manager was extended beyond retirement age on March 18, 2016.

“Certainly, his service would not have been extended if financial management at the company was poor.”

He also claims that during his time at GuyOil, sales volume increased from 864,362 to 1,242,158 barrels, and that net profit, after tax, rose from about $800M and peaked at $1.4B.

In addition, he said, daily bank balance increased from $0.5B to $7.0B, and that some $2B was expended on capital projects such as concreting wharf facilities; expanding and modernising company-owned service stations and the food court at Diamond; computerisation, and increasing fuel storage capacities at terminals from 67,000 barrels to over 80,000 barrels.

According to Persaud, all the funds used were self-generated by the company.

.jpg)