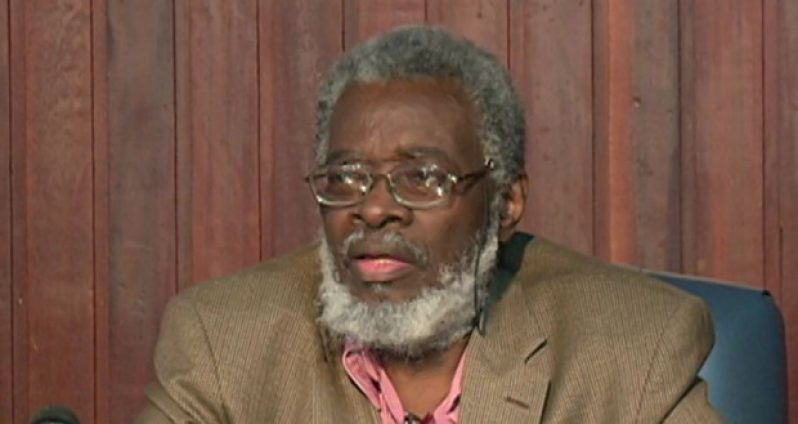

THE reduction of fuel prices at Government owned GuyOil Service Stations and their affiliates has resulted in pressure being brought to bear on operators of privately owned facilities to follow suit. While this is evident, there has not yet been a reduction in prices for cooking or aviation fuel. Speaking to the media yesterday, Head of the Presidential Secretariat, Dr. Roger Luncheon said that cooking gas prices, aviation gas and aviation fuel, were not the subject of monitoring and regulation by the state to the same extent as kerosene, diesel and gasoline fuel products, and “as such, the impact of the decision that led to the decreases in fuel and fuel product prices might not necessarily lead to decreases in the price of aviation fuel products and imported cooking gas”.

Dr Luncheon stated that Cabinet’s feeling was that the private sector would, on the basis of market forces, respond appropriately where these products are concerned “to those decreases in prices that were occurring in the other elements of the fuel industry, the domestic fuel industry”.

Internationally fuel prices have decreased from over US$110 dollars per barrel to around US$60 per barrel.

On January 20, Finance Minister Dr. Ashni Singh announced reduction in prices for fuel sold at GuyOil Service Stations and their affiliates, as part of Government’s move to cater for the dramatic drop in the world prices for crude oil. The Finance Minister announced that with effect from midnight, on January 20, fuel prices at GuyOil will be $695 per gallon for gasoline compared with $995 previously, a 30% reduction. Diesel will be $694 per gallon compared with $985 previously, a 30% reduction and kerosene will be sold at $496 per gallon as compared with $850 gallons currently, 42% reduction.

The prices are the lowest locally since May 2009, a period of almost six years according to the Minister. The excise tax has been increased to 50%, diesel to 45% and 0% for kerosene.

The Finance Minister Dr. Singh stated that Government has had a mechanism for adjusting fuel prices and under this the tax rate is adjusted in an inverse relation to the movement of world market crude oil prices, rates are adjusted downwards when international prices increase, and upwards when the afore-mentioned prices decrease. This has been used to cushion prices to local consumers from international market volatility. “For example during the period from December 2008 to March 2012, the world market price increased by 184% and the price for a gallon of gasoline in Guyana only increased by 77%. This was achieved by government lowering the tax rate during that period from 50% to 15%. Conversely as prices started to subside on the world market, the tax rate was adjusted back up. This has been done automatically and without any contention, for the past several years”.

Prices are determined by the CIF cost, landed in Guyana, the world market prices for refined fuel products and world market prices for crude oil, he further explained. Excise taxes in landed fuel and profit margins charged by local oil companies and retailers also influence prices, the minister added.

(GINA)

.jpg)